(Bloomberg) — Municipal bonds are being left behind as other fixed-income sectors move to electronic trading.

Only about 11% of muni bond trading volume was executed electronically in May, a share that hasn’t moved in the past three years, according to an estimate last month from Coalition Greenwich, a financial services industry analytics firm.

By contrast, investment-grade corporate bond e-trading has more than doubled since May 2018 to 41% and more than tripled for high-yield bonds to 28%. Two-thirds of the US Treasury market traded electronically in May 2022.

In large part, the structure of the $4 trillion muni market has hampered the adoption of e-bond trading, according to Kevin McPartland, head of research for market structure and technology at Coalition Greenwich and the report’s author.

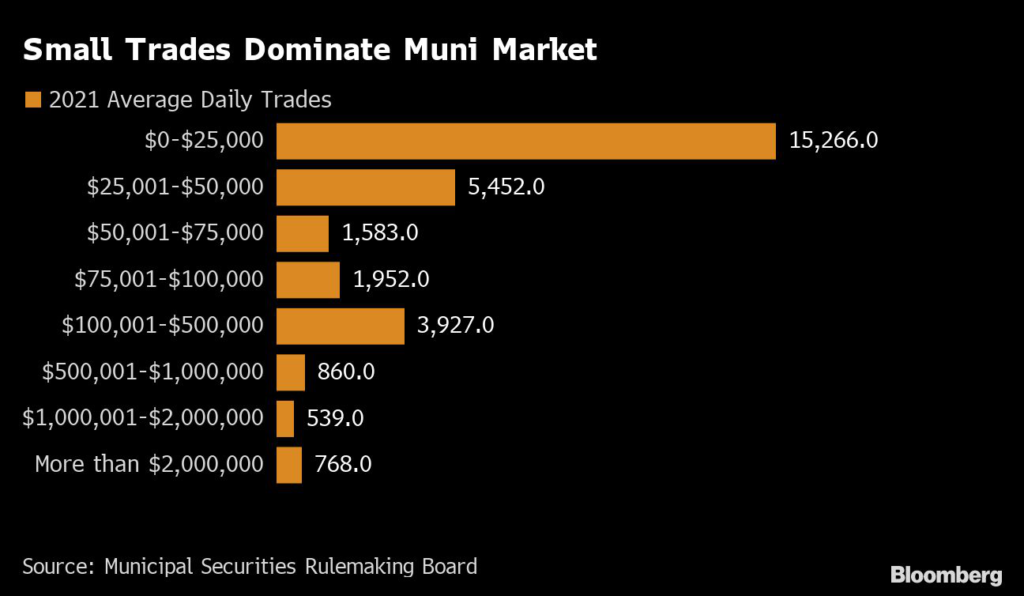

The over-the-counter market has about 950,000 separate securities issued by tens of thousands of state and local government entities, according to data compiled by Bloomberg. “Buy-and-hold” individual investors hold a big chunk of bonds, but in small sizes, with many never trading after they’re issued.

The decentralized nature of the market also means that regional bond dealers often handle an outsized share of trading in certain states.

“The market has such a long tail of participants that unlike in treasuries or corporate bonds, where the big names drive most of the volume, that’s less so the case in munis,” McPartland said in an interview.

Electronic trading platforms typically post bonds for sale and help buyers sort them to identify potential purchases. Quantitative trading firms and institutional investors, using algorithms based on decades of trading data, can hook up to the platforms and respond to thousands of auctions.

Two of the biggest platforms, Tradeweb Markets Inc. and MarketAxess Holdings Inc., each reported about $8 billion of muni trading volume in June. Together, that represents about 5.2% of the muni market’s $307 billion June trading volume. Coalition Greenwich also estimated volumes handled by ICE and Bloomberg LP, which don’t publicly report volumes.

Bloomberg LP, the parent company of Bloomberg News, competes with MarketAxess, Tradeweb and ICE to offer fixed-income trading services.

Despite stagnant electronic trading levels, Coalition Greenwich says the muni market is ripe for electronic venues that match buyers and sellers.

Investors want more liquidity — the ability to easily buy and sell blocks of bonds without causing big price changes — and price transparency.

Dealers, meanwhile, are building or acquiring electronic trading capacity. Last year, TD Bank Group bought Headlands Tech Global Markets LLC, which delivers fully automated electronic market-making in municipal bonds. In March 2022, Raymond James bought SumRidge Partners LLC, an electronic bond trading firm.

On the buy-side, AllianceBernstein Holding LP, has invested heavily in technology enabling the firm to compete against dealers for bonds, rather than pay them a markup to buy securities. The firm uses computers to scan tens of thousands of bond offerings each day, determine whether a bond is priced attractively and fits into an individual investor’s account, and then bid on the security.

Electronic trading also allows AllianceBernstein to build individual portfolios faster — between five and 12 days, instead of a more typical 60 to 90 days — minimizing the amount of time an investor’s funds are held in cash, said Jim Switzer, the firm’s global head of fixed income trading and head of municipal bonds.

AllianceBernstein’s municipal trading volume has jumped to 17,000 trades a month in 2022, from 17,000 a year in 2019, despite having two fewer human traders.

“We can’t go back to a manual process,” Switzer said.

Meanwhile, the growth of municipal bond exchange-traded funds could also spark more electronic trading, just as it has in the corporate market, according to McPartland.

Large corporate bond ETFs, such as the $33 billion iShares iBoxx Investment Grade Corporate Bond ETF, have drawn arbitrage traders seeking to earn a profit by exploiting the discrepancies between an ETF’s share price and the price of its underlying securities.

Because the arbitrage trade involves buying or selling baskets of the ETF’s underlying bonds, electronic market makers began trading the underlying securities, boosting liquidity, said McPartland.

Average daily muni ETF trading volume grew to $1 billion in the second quarter of 2022, from about $200 million per day in 2021, according to Jane Street Group LLC, a trading firm specializing in ETFs. The iShares National Muni Bond ETF, the biggest muni ETF, has $29 billion in assets.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.