(Bloomberg) — American equity futures edged higher Wednesday in cautious trading dominated by a dimming economic outlook and an anxious wait for data that may show US inflation at a fresh four-decade high.

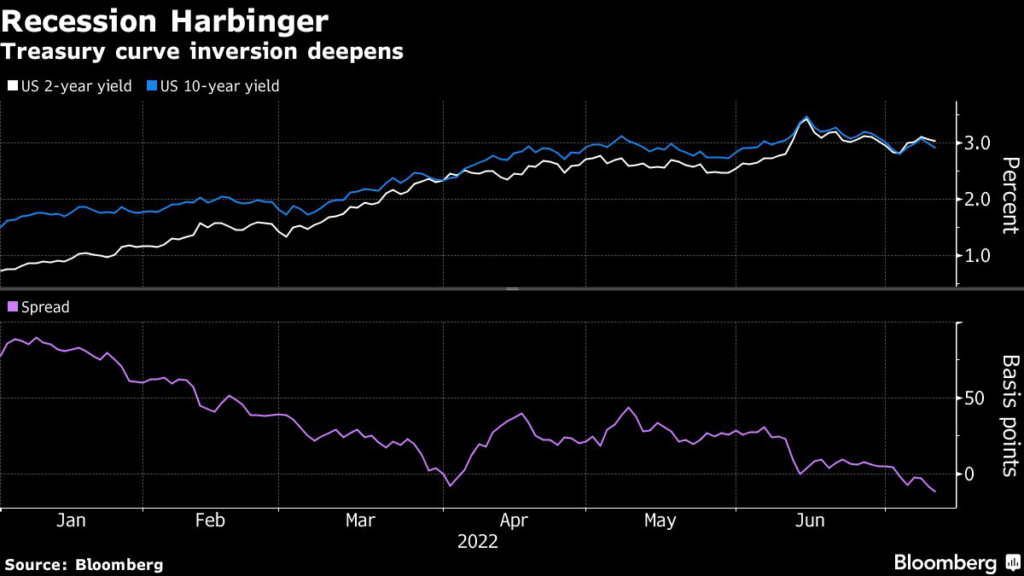

S&P 500 and Nasdaq 100 futures posted modest gains after yet another volatile session Tuesday that ended with both gauges solidly in the red. Treasuries were steady and a key part of the yield curve remains inverted, a potential signal of recession ahead. The 10-year yield at one point Tuesday was 12.4 basis points below the 2-year rate, a level unseen since 2007.

Insurance, healthcare and travel shares led a decline in the Stoxx Europe 600 index. The UK benchmark underperformed after Bank of England Governor Andrew Bailey said policy makers are prepared to move borrowing costs higher in bigger steps to control inflation. MSCI Inc.’s Asia-Pacific share gauge added less than 0.5%, bolstered by a rebound in Chinese technology shares. Most European bonds fell.

WTI crude oil stabilized at about $96 a barrel after a tumble. The dollar hovered near the highest levels since March 2020. The euro remained in sight of parity with the greenback. Bitcoin held below $20,000.

Rapidly tightening monetary policy in the US and elsewhere to fight price pressures is fueling worries about growth and leaving markets nervous. South Korea and New Zealand became the latest to hike interest rates further.

Economists project US inflation likely hit a fresh pandemic peak in June, keeping the Federal Reserve geared for another big rate increase. The consumer-price index probably rose 8.8% from a year earlier, the largest jump since 1981, according to a Bloomberg survey ahead of the release Wednesday.

“This is widely expected to be a really strong print,” Lauren Goodwin, economist and portfolio strategist at New York Life Investments, said on Bloomberg Television. “Even if it is not, I don’t think that changes the Fed’s perspective in a couple of weeks. We won’t have enough evidence that inflation is convincingly turning over.”

The International Monetary Fund cut its growth projections for the US economy and warned that a broad-based surge in inflation poses “systemic risks” to both the country and the global economy.

Traders are also on tenterhooks for the latest corporate earnings getting underway this week and monitoring for a brewing energy crisis in Europe if Russia cuts off gas supplies in the fallout from its invasion of Ukraine.

What to watch this week:

- Earnings due from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- US CPI data, Wednesday

- Federal Reserve Beige Book, Wednesday

- US PPI, jobless claims, Thursday

- China GDP, Friday

- US business inventories, industrial production, University of Michigan consumer sentiment, Empire manufacturing, retail sales, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Atlanta Fed President Raphael Bostic speaks, Friday

Will the eurozone avoid a recession or a debt crisis? How will the euro and stocks perform in the next six months? Share your views and participate in the latest MLIV Pulse survey. It only takes a minute, so please click here anonymously.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.2% as of 6:03 a.m. New York time

- Futures on the Nasdaq 100 rose 0.3%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The Stoxx Europe 600 fell 0.7%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0038

- The British pound was little changed at $1.1897

- The Japanese yen fell 0.2% to 137.09 per dollar

Bonds

- The yield on 10-year Treasuries declined one basis point to 2.96%

- Germany’s 10-year yield advanced two basis points to 1.15%

- Britain’s 10-year yield advanced two basis points to 2.09%

Commodities

- West Texas Intermediate crude rose 0.8% to $96.57 a barrel

- Gold futures rose 0.1% to $1,726.70 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.