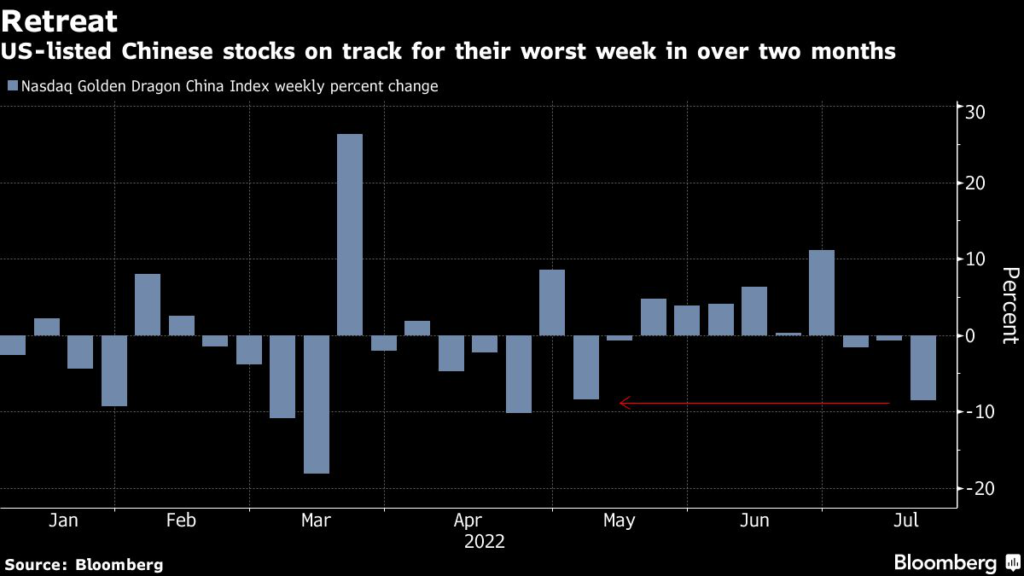

(Bloomberg) — US-listed China stocks tumbled on Thursday, leaving them poised for their steepest weekly losses since May, as a report that Alibaba Group Holding Ltd. faces an inquiry in China in connection with a data theft case renewed regulatory concerns broadly.

The Nasdaq Golden Dragon China Index fell about 2%, led by Alibaba, which dropped as much as 7.7% in a five-day losing streak. Technology peers Baidu Inc. and JD.com Inc. declined 2.5% and 0.5%, respectively, while electric vehicle stock Nio Inc. lost 0.3%.

Executives from Alibaba Group’s cloud division have been summoned for talks by authorities in Shanghai in connection with the theft of a vast police database, one of the nation’s largest cybersecurity breaches, according to the Wall Street Journal.

The news, coupled with reports Monday that China hit tech giants with regulatory fines, is denting investors sentiment on the group after a rally in June.

Alibaba, China Stocks in US Tumble Amid Fines, Covid Risks

In June, the Golden Dragon Index soared 16%, its best month since 2019, with a string of analysts calling a bottom in the group, as the government appeared to step back from regulatory crackdowns on the tech industry and continued to roll out supportive measures. The rally then paused amid jitters over regulatory uncertainty and fresh Covid-19 lockdown risks. The Golden Dragon Index is still about 17% lower this year.

This week, the Hang Seng Tech Index entered a technical correction, with analysts questioning if fresh probes on internet giants would trigger another downturn in the sector.

(Corrects first paragraph to say steepest weekly loss since May)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.