(Bloomberg) — Shigenobu Nagamori is back at the top of Nidec Corp., one of Japan’s biggest companies, and doesn’t intend to leave until he’s boosted the company’s share price to a record and captained it onto a path of steady growth.

The 77-year-old, who spent half a century building Nidec into the world’s top supplier of motors for everything from hard drives to power plants, has garnered a reputation for being a sharp deal maker and bellwether for industry trends. At the same time, he’s struggled to find a successor, promoting former Nissan Motor Co. executive Jun Seki to become chief executive officer last year before summarily taking back the reins 10 months later after what he saw as lackluster performance.

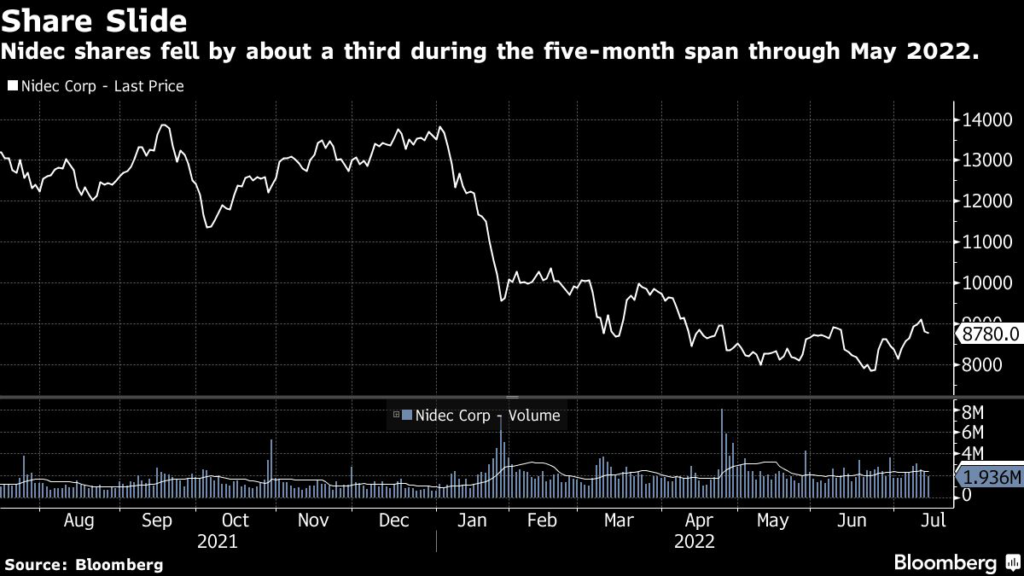

When Nagamori handed over his company to Seki in June 2021, the founder was beginning to think about his next phase of life — writing books and managing a university. But Nidec’s shares, over a five-month span through May, were in the midst of losing roughly a third of their value and over the last year “every day I was in agony,” Nagamori said in an interview. “The company’s performance was getting worse and worse.”

In April, Nidec announced that Nagamori would return to his post as CEO, leaving Seki in the role of chief operating officer, to look after the company’s automotive business. Nidec’s unit supplying motor systems for electric vehicles has continued to struggle, according to Nagamori, but over the recent quarter through June, he’s “tidied up” other businesses. “You’ll see that in the earnings,” he said.

Nidec is set to announce results for the period on July 20. Analysts, on average, are forecasting a 43.5 billion yen ($313 million) operating profit, which would be down slightly from 44.6 billion yen the previous year.

Longer term, Nagamori said his goal is to see Nidec’s share price rise to a level that would beat its 2021 record of 15,175 yen. In two years, at the latest, Nidec’s shares will trade at around 20,000 yen, Nagamori said, “I’m full of confidence.”

Nagamori acknowledges that the performance boost he sees stemming from his return will be temporary. After a record share price is achieved, Nagamori said he’ll look to pass on the CEO post and eventually transition into the role of Nidec’s honorary chairman.

Physical Wound

But at the same time, Nagamori says as long as he’s living, he can’t accept handing off Nidec and seeing it stumble. “I built this company from the ground up and Nidec is like a part of my body,” he said. “If the company were to become a failure it’d be like a physical wound for me.”

Indeed, what comes after Nagamori steps down is of key interest to investors in the company. For years, analysts have been warning that if a transition of power wasn’t smooth, Nidec could lose its “Nagamori premium.”

Nagamori said he’s given up on finding any one individual capable of filling his shoes. He intends to break up his responsibilities between a number of individuals, he said. “At this level, there isn’t a person in Japan who can operate this company as CEO alone,” Nagamori said, “it needs to be managed by a group.”

Recently, Nidec has moved to significantly bolster its recruiting activities, poaching prominent executives including Mitsuya Kishida, the former head of Sony Group Corp.’s mobile communications business, and Shinya Yoshida an executive vice president at Mitsubishi Corp.

Nagamori said those individuals, along with other internal and external hires are all contenders for the top job — a position in which they’ll be tasked with reaching Nidec’s long-standing goal of reaching 10 trillion yen in annual net sales by fiscal 2030.

With regard to Seki, Nagamori said the former CEO has not done enough to learn and embody his methods of management since joining the company. Seki remains the top candidate for next CEO, but unless the businesses he’s in charge of turns around there’s “zero chance” of his return to the top job, Nagamori said.

Seki didn’t immediately respond to a request for comment.

Nidec has a basic policy outlining that the person who contributes most to the company’s profit will claim the top job, Nagamori said. “You may think this is an unsparing company but it’s really the proper way,” he said. “It’s a meritocracy.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.