The JSE snapped a four-day losing streak while global peers also traded in the green after two Fed policymakers calmed nerves that a 100 basis point rate hike was on the horizon for later in July.

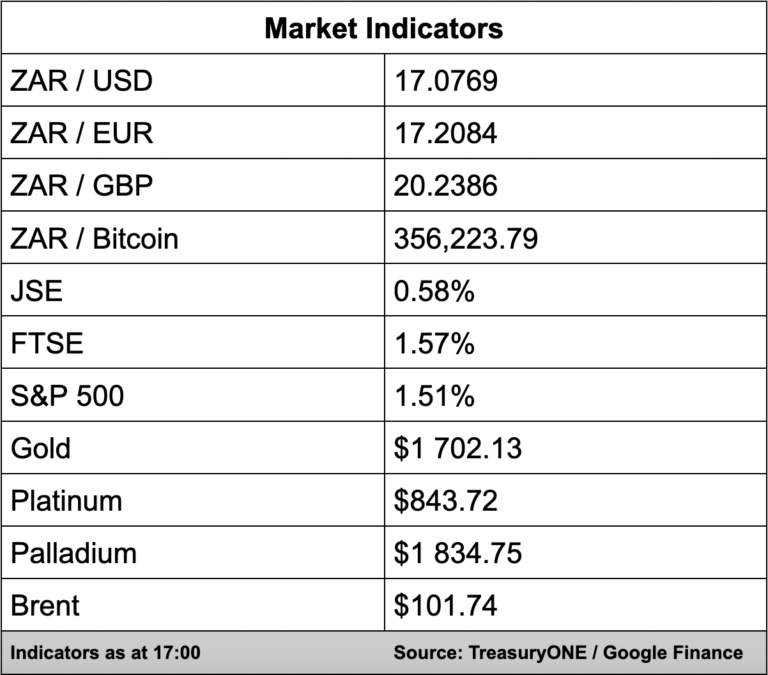

The All Share Index added 0.58% to close at 65,089 points on Friday.

Even with water poured over the 100 bps hike, recension fears were compounded further with data showing a sharp second-quarter slowdown in China. The Chinese economy expanded 0.4% and narrowly missed a contraction as aggressive covid-19 lockdowns take their toll on the country.

In the currency market, the news of an unlikely 100 bps hike at the next Fed meeting saw the euro bouncing back from breaking parity and has traded above the figure for the day.

“Across the board, the dollar is seen quoted softer and has given the market some sort of breathing room,” says TreasuryONE.

“Locally we have seen the rand trade in a wide range of roughly 20 cents, closing the day on the front foot. The rand has sustained immense pressure this week, but we could expect another volatile week as the focus turns to central bank meetings,” comments the forex trading house.

All eyes will be on the dollar next week as the European Central Bank’s rate decision is due on Thursday with the market speculating the hike will be 25 bps.

The South African Reserve Bank will also hold its bi-monthly meeting where the expectation is the SARB will hike the interest rate by 50 bps.

“It is safe to say that both events could be market-changing and would be the main drivers for the rand in the week to come,” says TreasuryONE.

It was a mixed bag in the commodity sector with gold, copper, and palladium all down for the day while platinum snuck into the green but is still down for the week.