(Bloomberg) — Stocks in Europe gained, US futures wavered and bonds gained at the end of a week in which markets have been whipsawed by shifting expectations for monetary tightening by the Federal Reserve and other major central banks.

S&P 500, Nasdaq 100 contracts fluctuated after Wall Street came off Thursday lows to close with a small drop as investors dialed back expectations of how aggressively the Fed will hike interest rates to combat inflation.

Traders are awaiting earnings from CitiGroup Inc. and Wells Fargo & Co. Friday after disappointing results yesterday from JPMorgan Chase & Co. and Morgan Stanley.

The Stoxx Europe 600 index was led higher by the construction and healthcare sectors.

Italy’s benchmark index rallied after the country’s president rejected an offer from Mario Draghi to resign as prime minister as his coalition government teeters on the brink of collapse. A slide in China tech shares on renewed worries about regulatory obstacles sapped an Asian stock index.

Treasuries rose and the the yield curve between two-year and 10-year maturities remained inverted, something viewed as recession signal.

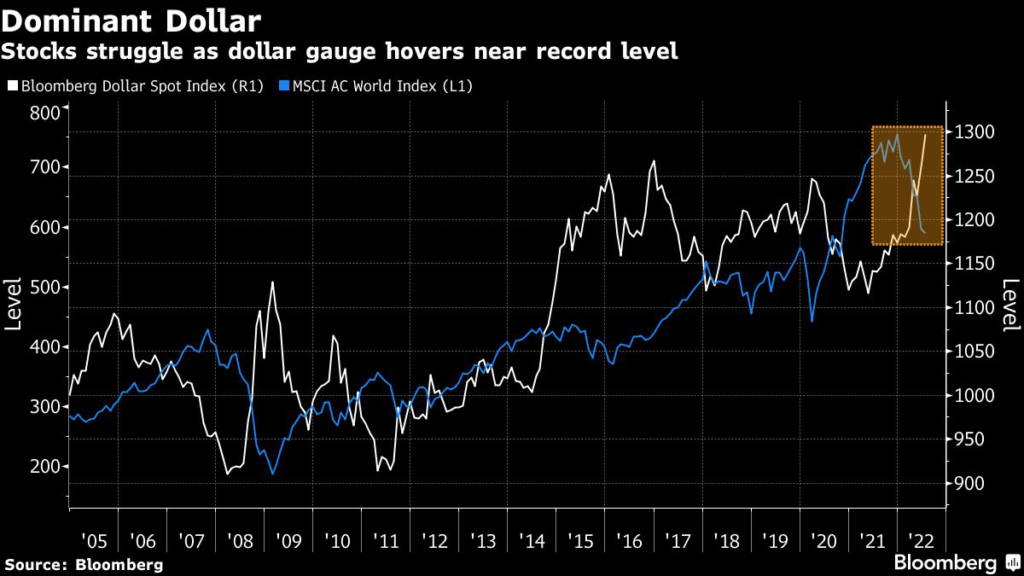

The Bloomberg Dollar Spot Index hovered around a record high. Brent crude oil is poised to end the week below $100 a barrel for the first time since April.

Investors are weighing up how hawkish the Fed must be to curb inflation and the likely toll on the economy.

Bets on a one-percentage-point July rate hike have been scaled back after the latest commentary pointed toward 75 basis points. The pace of monetary tightening along with ebbing liquidity still threatens to stir more market volatility after steep losses for stocks and bonds in 2022.

“We need liquidity to dry up in order to reduce inflation,” Erin Gibbs, chief investment officer at Main Street Asset Management, said on Bloomberg Radio.

“It’s a challenge, it’s a difficult situation, transition. I don’t envy the Federal Reserve, but we’ve known there has been too much money out there and that’s why we’re here in this position.”

In the latest Fed comments, Governor Christopher Waller backed raising rates by 75 basis points this month, though he said he could go bigger if warranted by the data.

St. Louis Fed President James Bullard echoed some of those comments, saying he favored hiking by the same amount.

Elsewhere, China’s second-quarter growth slowed on Covid lockdowns but consumption rallied in June as curbs eased.

Officials refrained from injecting funds into the banking system and left borrowing costs unchanged.

Meanwhile, about $1.9 trillion of options are set to expire Friday, a event that could bring some volatility to markets.

Investors are also awaiting the next batch of US bank profit reports as the earnings season intensifies.

What to watch this week:

- US business inventories, industrial production, University of Michigan consumer sentiment, Empire manufacturing, retail sales, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Atlanta Fed President Raphael Bostic speaks, Friday

Will the eurozone avoid a recession or a debt crisis?

How will the euro and stocks perform in the next six months? Share your views and participate in the latest MLIV Pulse survey. It only takes a minute, so please click here anonymously.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.8% as of 8:26 a.m.

London time

- Futures on the S&P 500 rose 0.2%

- Futures on the Nasdaq 100 rose 0.2%

- Futures on the Dow Jones Industrial Average rose 0.1%

- The MSCI Asia Pacific Index fell 0.4%

- The MSCI Emerging Markets Index fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0024

- The Japanese yen rose 0.2% to 138.74 per dollar

- The offshore yuan fell 0.2% to 6.7762 per dollar

- The British pound was little changed at $1.1826

Bonds

- The yield on 10-year Treasuries declined four basis points to 2.92%

- Germany’s 10-year yield declined nine basis points to 1.09%

- Britain’s 10-year yield declined six basis points to 2.05%

Commodities

- Brent crude fell 0.3% to $98.80 a barrel

- Spot gold fell 0.3% to $1,704.34 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.