The JSE traded stronger on Tuesday along with global peers while central banks prepare to raise interest rates this week.

The local bourse briefly traded weaker this morning while global stocks also fell during the morning session after investors worry about a possible economic slump after US tech behemoth Apple said it planned to slow its hiring.

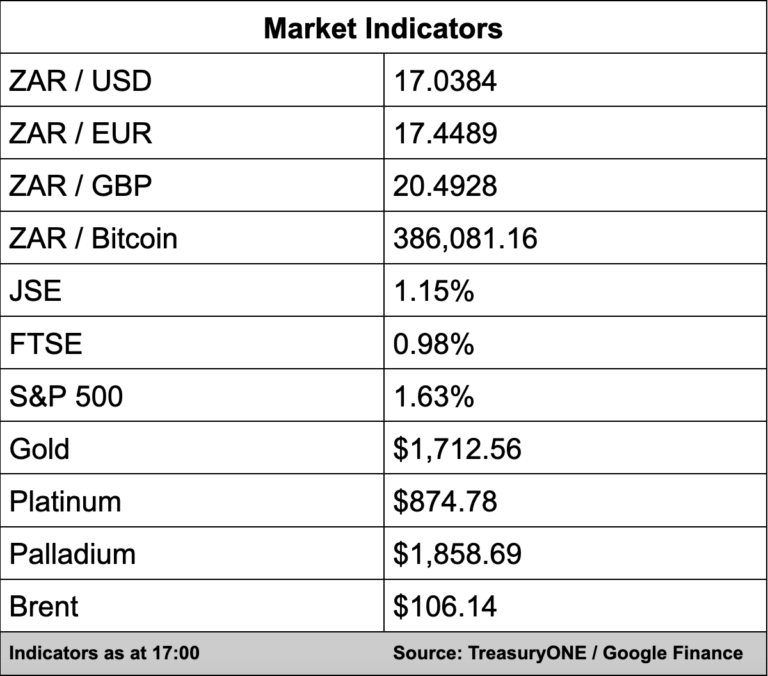

The All Share Index added 1.15% to close at 67,785 points.

With the European Central Bank expected to raise interest rates this week, there has been some US dollar retreat with the greenback moving from 1.0120 to 1.0270 against the euro.

“The expectation is that the ECB will hike by 25 basis points as they attempt to arrest the surge in inflation in the Eurozone. The strength in the euro has not translated to significant moves in the EM space,” comments TreasuryONE.

The rand has not responded to the weaker dollar and has traded within a 15-cent range for most of the day. The local unit did trade as low as R16.97/$ but is currently trading around R17.03 to the dollar.

With the SA Reserve Bank monetary policy committee decision due this week, TreasuryONE says the sluggish trading in the rand is due to the interest in the rate hike announcement with some volatility expected on Thursday afternoon when the decision is announced.

In company news, Aveng’s share price jumped 2.08% after the company said that its Australian subsidiary McConnel Dowell had been awarded a R6.9 billion contract to deliver Tasmania’s largest ever transport infrastructure project. The new one-kilometre-long Bridgewater Bridge will replace an existing bridge.

The top gainers on the bourse were Bytes Technology (7.41%), Textainer Group (6.75%), and Alphamin Resources (5.32%). The biggest losers on Tuesday were Vivo Energy (-6.29%), Telkom (-1.88%), and BHP Group (-1.78%).