(Bloomberg) — Josh Merkle was shocked when he saw the $6 increase on his AT&T Inc. wireless bill. The 36-year-old new father, already facing soaring prices for everything from gas to baby formula, said it’s “very upsetting” that the carrier would squeeze customers on a service that’s too essential to give up.

Merkle and millions of other wireless customers are opening phone bills this month to find AT&T and Verizon Communications Inc. raised rates on older service plans. Both Verizon, and to a lesser degree T-Mobile US Inc., have also increased monthly fees. While customers aren’t happy about it, they’re not racing for the exits. And that could pay off for the carriers.

“Telcos want to use this inflationary period to reset their pricing models upward,” said Tammy Parker, an analyst with GlobalData. “So far however, many subscribers are sticking with what they have, even if that means paying more than they used to.”

It took a pandemic, kinks in the global supply chain, skyrocketing inflation and the elimination of a fourth competitor, Sprint Corp., but the tables have finally turned for the wireless industry. After years of price battles to attract and keep customers, including phone giveaways and perks like free video streaming, carriers are, for the moment, in a position to take away those treats and raise rates without any immediate backlash.

AT&T and Verizon are scheduled to report earnings this week. And while the price increases didn’t go into effect until the last weeks of the quarter, the results may show slight benefits in the form of a boost to revenue and margins.

Bottomline Padding

As fuel and labor costs rise, industry executives say they need to raise prices to keep up with the additional expenses. Given that 97% of US adults have at least one phone, the incremental increases in service plans, surcharges and fees start to reach big numbers when spread across hundreds of millions of customers.

AT&T expects to book more than $1 billion in new revenue annually by raising rates on older service plans and is already looking at a second increase. For perspective, the $6-a-line increase AT&T is tacking on represents a 12% bump to its $49 average monthly revenue per customer, well outpacing the 9.1% rate of inflation in June.

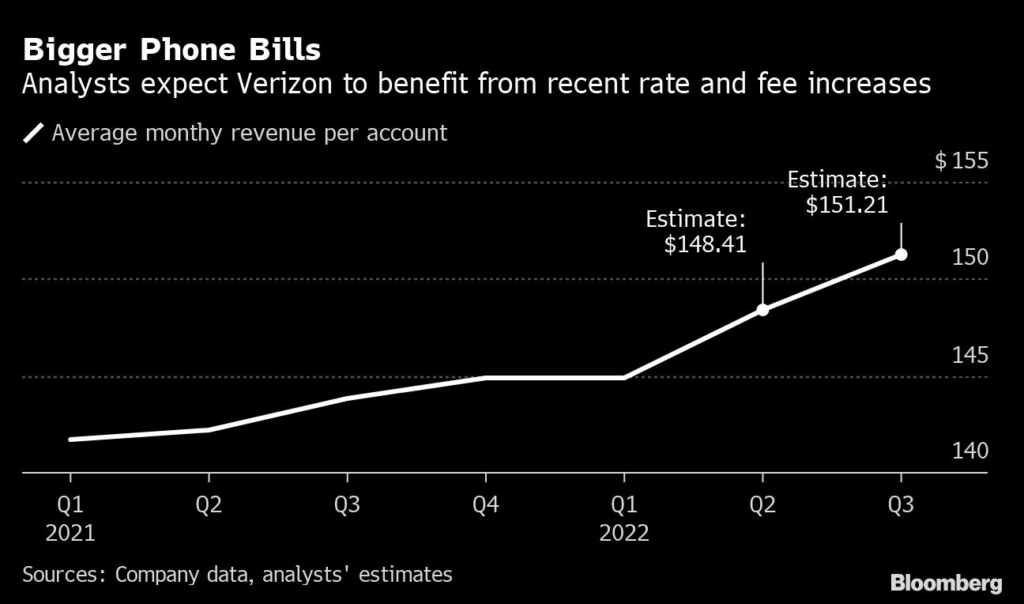

Verizon expects to book an additional $600 million in the second half of this year, just from a new $1.35-per-line increase in administrative fees on consumers and a $2.20-per-line “economic adjustment charge” on business customers. That doesn’t include its own $6-a-line price hike this month, to match AT&T. Collectively, fee and service increases will boost revenue for the large carriers by $3 billion, according to LightShed Partners analyst Walt Piecyk.

As the bigger bills arrive, T-Mobile is ramping up marketing on its service plans and price promises, even staging an event in New York’s Times Square last week that featured Twisted Sister frontman Dee Snider singing his hit “We’re Not Going to Take It” in a shot at the other carriers. T-Mobile became the second-largest US wireless operator through a takeover of Sprint in 2020. As a condition of the deal, T-Mobile agreed not to raise prices for three years. That commitment ends in April.

‘Critical Services’

The industry’s defection rate, or churn of mobile phone subscribers switching service, has been hovering near a record low of 1% a month for the past year. And when it comes to pinching pennies, both mobile-phone and internet service are way down the list of areas where people would cut spending, according to a Recon Analytics Mobile Intender survey.

When asked where they would cut if they were forced to spend less, 56% of respondents said dining out would be the first, followed by credit-card charges, car buying, streaming services, cable bills and gym memberships. Only 12% of those surveyed said they’d reduce mobile spending and internet bills.

“As we’ve learned from the pandemic, mobile and internet are critical services,” says Roger Entner of Recon Analytics. “It helps find a job and it’s the cheapest source of entertainment.”

When Merkle, the AT&T customer, saw the $6 increase he thought it was “ridiculous.” Sure, the price of gas and milk goes up, “those are physical tangible goods, whereas this is a service that’s already up and running,” he said.

He was paying $101 a month for an unlimited plan that includes the HBO Max. His new bill is $107 a month. He called AT&T to complain and was put in touch with a supervisor who told him he could switch to a new cheaper plan that didn’t include the streaming service. So for now, he’s sticking with his current plan.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.