(Bloomberg) — US stocks fluctuated in early trading as investors parsed through the latest corporate results while growing concern that Europe may lose access to Russian gas added to recession fears.

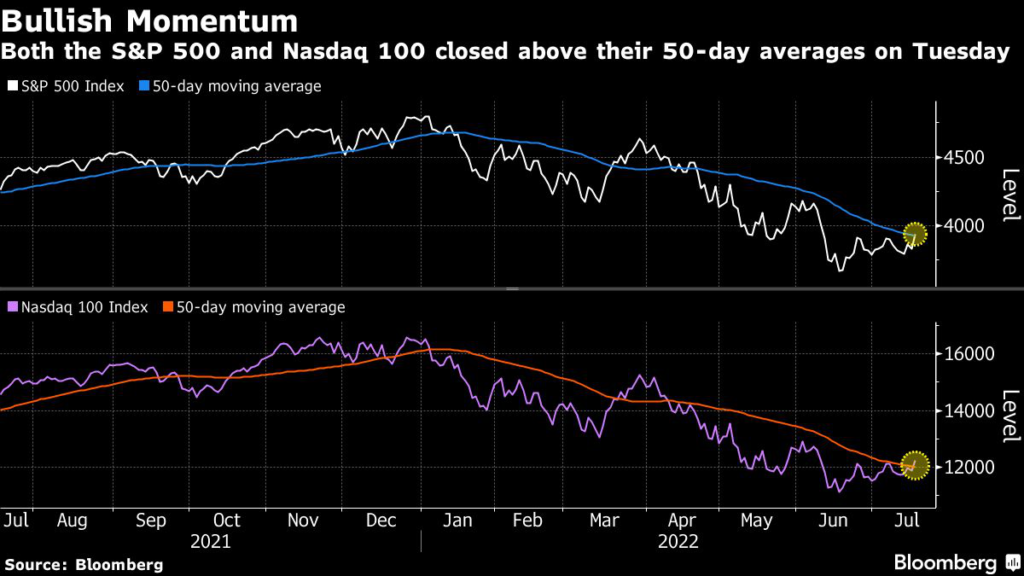

The S&P 500 was little changed, while the tech-heavy Nasdaq 100 posted modest gains. Netflix Inc. rose after it reported better-than-feared earnings late on Tuesday and said it expects to return to subscriber growth before the end of the year.

Risk sentiment took a hit on news the European Union is preparing for a scenario where Russia halts gas exports to retaliate against sanctions over its invasion of Ukraine. That sparked a reversal in haven assets, as Treasuries rose, with the yield on the 10-year benchmark fell back below 3%.

The risk of a global downturn and Europe’s energy crisis doused optimism about the US earnings season and confidence the Federal Reserve will take a more measured approach to tightening.

“Markets are starting to come to a realization that the tail risk of a sustained meaningful drop in European gas imports is rapidly becoming the core risk,” said Seema Shah, chief global strategist at Principal Global Investors. “Global markets have largely assumed they will be immune to European pain. However, Europe is a key trade partner for several major economies and spillover effects are almost unavoidable.”

The EU proposed that the bloc cut its natural gas consumption by 15% over the next eight months to ensure that any full Russian cutoff of natural gas supplies won’t disrupt industries over the winter.

Read more: EU Proposes 15% Cut in Gas Consumption on Russian Supply Concern

West Texas Intermediate crude oil slipped below $103 a barrel. Bitcoin hovered above $23,000 after climbing out of a one-month-old trading range.

How far will the Fed go in this hiking cycle? It takes one minute to participate in the confidential MLIV Pulse survey, so please click here to get involved.

Key events to watch this week:

- Earnings this week include Tesla

- Bank of Japan, European Central Bank rate decisions. Thursday

- Nord Stream 1 pipeline scheduled to reopen following maintenance. Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 9:37 a.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average fell 0.1%

- The Stoxx Europe 600 fell 0.3%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.1% to $1.0238

- The British pound was little changed at $1.2004

- The Japanese yen rose 0.1% to 138.05 per dollar

Bonds

- The yield on 10-year Treasuries declined five basis points to 2.97%

- Germany’s 10-year yield declined four basis points to 1.23%

- Britain’s 10-year yield declined eight basis points to 2.10%

Commodities

- West Texas Intermediate crude fell 1.5% to $102.65 a barrel

- Gold futures were little changed

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.