(Bloomberg) —

The Bank of England is seeking to preserve the role of traditional banknotes and coins in everyday transactions, keeping it an option for consumers as electronic forms of payment grow in popularity.

Sarah John, the UK central bank’s chief cashier, said it will be “a long time” before society is ready to go cash free, and in the meantime authorities need to keep notes and coins circulating widely.

“It’s important that people have a choice of payment methods and they can choose what works best for them,” John said in an interview.

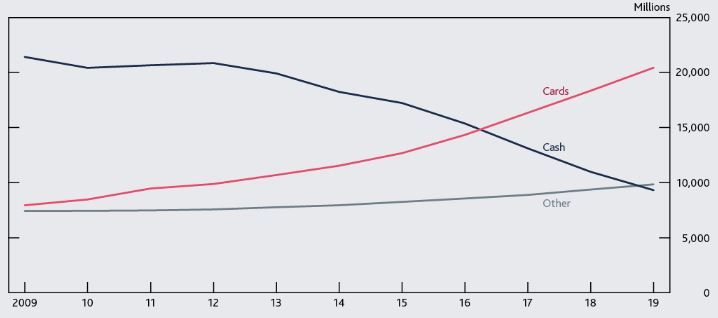

Between 2017 and 2019, the number of people using cash only once a month or less in the UK more than doubled to 7.4 million, a trend accelerated by the Covid-19 pandemic, according to BOE data. Credit and debit cards and other forms of money backed by private companies and not the BOE are gaining ground.

Cards are now the most frequently used form of consumer payment

Maintaining cash is part of a broader effort by the BOE to keep the UK’s payment systems up-to-date with technology and in step with consumer demands. Officials are also considering a “central bank digital currency” that would smooth online payments and give people security they can’t get with cryptocurrencies.

Maintaining the relevance of cash and coins is also a priority. The BOE started issuing new polymer £20 notes in 2020 while phasing out paper £20 and £50 notes. The new notes are more durable and harder to counterfeit.

The old ones will be withdrawn as legal tender from Sept. 30. After that date, people will have to exchange the paper notes in person at the BOE’s London headquarters in Threadneedle Street or through the post. The BOE estimates £14.5 billion of the soon-to-be-worthless paper notes remain in circulation.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.