(Bloomberg) —

If you listen to Liz Truss’s allies on economic policy, Britain may be about to end the era of cheap money, delivering significant pain for millions of families.

The UK foreign secretary, who is competing with Rishi Sunak to replace Boris Johnson as prime minister, plans immediate tax cuts in a move her own supporters acknowledge would force interest rates higher than investors anticipate.

A key adviser to Truss, the economist Patrick Minford, last week raised the prospect that interest rates could rise as high as 7%, a suggestion he has since reined in.

Many mainstream economists say the proposed stimulus could still see borrowing costs hit 3.25%, closer to the threshold that the Bank of England has identified as troublesome for a number of mortgage payers.

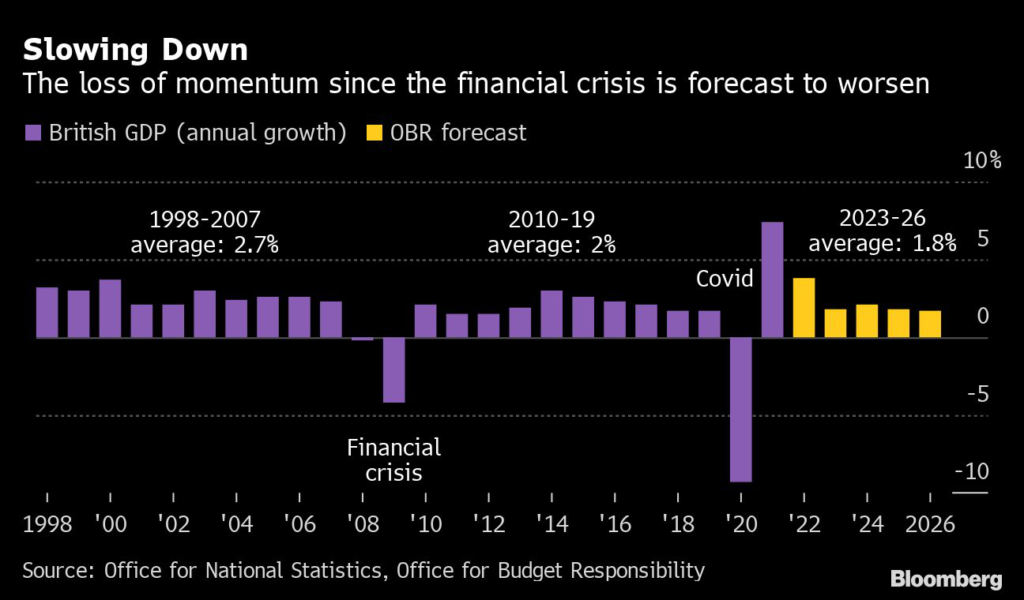

It would lift the cost of money back to levels British borrowers haven’t paid since before the financial crisis.

Sunak drew attention to the views on Truss’s advisers during a debate broadcast by the BBC on Monday.

It represented a new angle of attack by the former chancellor on Truss, who is favored in polls and by bookmakers in the race that concludes on Sept. 5.

For now, newspapers and commentators focused on the growing acrimony of the leadership debate, which some said verged into rudeness by Sunak.

A snap poll by Opinium after the appearance showed Truss and Sunak in a statistical dead heat.

At issue is the desire of Truss and her advisers to deliver a lift to the UK economy through immediate tax cuts — and to pivot sharply away from the historically low level of interest rates prevailing for more than a decade.

Minford, who is helping Truss’s campaign and advised Margaret Thatcher when she was leader in the 1980s, argues that lowering income taxes will draw people into work by letting them keep more of their earnings.

By increasing labor supply, domestic wage pressures would ease.

He also acknowledged in a Times interview last week the inflationary effect of that policy could boost rates to “a normal level” that he defined as 5%-7%, compared with the current 1.25%.

In subsequent comments, he suggested a figure of 4% or less.

Even so, the consensus of mainstream economists is that tax cuts would stimulate the economy and inflation, and for that reason the policy would lead to higher interest rates.

Truss’s policies could force the BOE to raise its benchmark interest rate to 3.25% in the next year, according to Dan Hanson at Bloomberg Economics. That’s 50 basis points above his current forecast of 2.75%.

His analysis doesn’t envision rates nearing 7%, and BOE Governor Andrew Bailey has said rates aren’t headed to levels in previous cycles.

But each tick up in rates reduces the affordability of borrowing, and the BOE has said 5% is the level where homeowneers will tip into distress.

What Bloomberg Economics Says …

“Truss — the favorite — is aiming for big tax cuts.

Using SHOK, our model of the UK economy, we calculate how her plans could add 0.6% to 2023 GDP and 0.4 percentage point to CPI inflation by the start of 2024. Sunak is the economy’s continuity candidate — fiscal prudence will remain paramount as inflation soars.”

–Dan Hanson, Bloomberg Economics.

Click for the ANALYSIS.

Sunak, echoing economists, focused on the inflationary impact of cutting taxes now and the danger of much higher rates on the economy.

“Can you imagine what that’s going to do for everyone here and everyone watching?” Sunak said in the debate.

“It’s going to tip millions of people into misery and it’s going to mean we have absolutely no chance of winning the next election.”

Truss didn’t answer Sunak’s charge on interest rates directly, noting instead the damaging impact the chancellor delivered when he boosted taxes to the highest level since World War II.

“This chancellor has raised taxes to the highest rate in 70 years, and we’re now predicted a recession,” Truss said.

For Minford, higher rates “are badly needed” to reward savers after years of near zero returns.

Tory party members who vote for the next leader have an average age of 57 and are likely to have built up savings.

“One of the great things about being an independent country with your own independent central bank and treasury is that you can borrow to smooth out the bumps in the budget,” Minford said in an interview broadcast Tuesday on BBC Radio 4’s “Today” program.

“It isn’t a license to just spend, spend, spend. A lot of economists agree that you shouldn’t put up taxes because they’ll damage growth, and the Bank of England should tighten money to control inflation.”

Rates have drifted down from more than 7% in the 25 years since the BOE won authority from the Treasury to set monetary policy.

That reflects declining inflation and then rapid cuts to borrowing costs following the financial crisis in 2008 and then the pandemic that started in 2020.

Cheap money helped the UK housing market touch new records through coronavirus lockdowns.

Seven UK economists wrote the Telegraph newspaper last week supporting Truss’s plan, saying tax cuts are needed and won’t spur inflation.

They include Graeme Leach, chief economist at Macronomics; Gerard Lyons, senior fellow at Policy Exchange; and the independent economist Julian Jessop.

Mainstream economists criticize the Truss plan, saying it will fan the inflationary pressures that both the Treasury and BOE are struggling to control.

Citigroup Inc.’s Chief UK Economist Ben Nabarro said she “poses the greatest risk from an economic perspective with an unseemly combination of pro-cyclical tax cuts and institutional disruption.”

Former Brexit secretary David Davis stepped up the attack on Truss’s tax cuts, which “means mortgage rates, commercial rates of eight, nine, 10% — four times as high as they are now.

I’ve got children who have mortgages. I worry about what and how they’ll get by.”

Read more:

- UK Economy at Heart of Debate as Truss and Sunak Trade Blows

- UK’s Outsider Economists Question Radicalism of Trussonomics

- Truss Plan Risks Inflation That Outlasts Growth Lift, Says Model

- UK Economists See Faster Interest Rate Increases Under Liz Truss

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.