(Bloomberg) — When Christian Sewing took over at Deutsche Bank AG four years ago, he vowed to keep a tight lid on expenses to turn around a lender reeling from years of shrinking revenue.

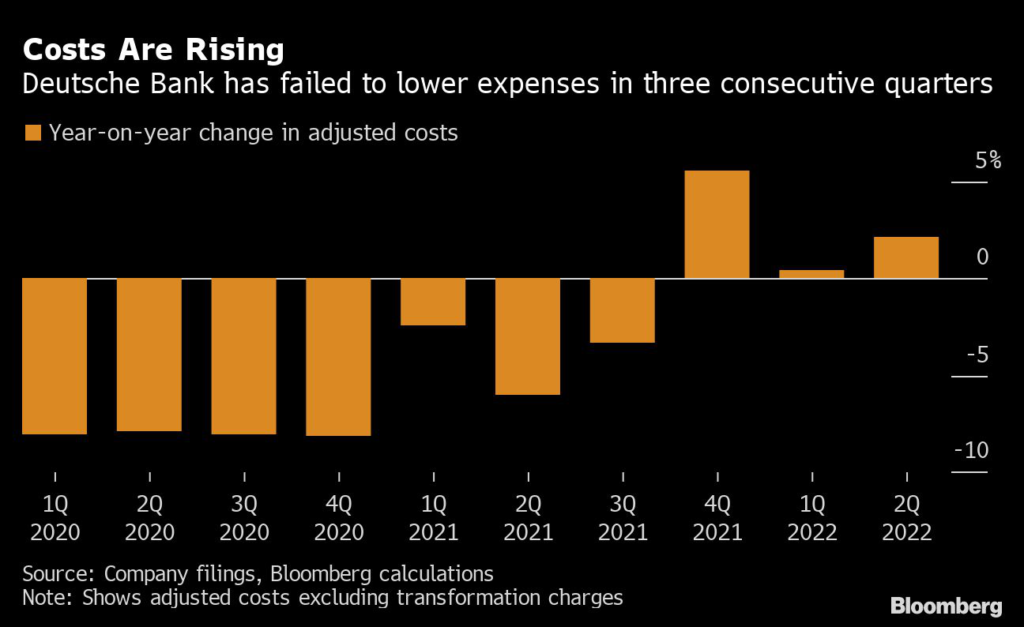

As the chief executive approaches the end of his restructuring, his traders keep gaining market share and revenue is surging even in businesses that struggled for years. But expenses, the one thing under his control in 2018, are threatening to derail his main financial target, an 8% return on tangible equity.

The CEO said on a call Wednesday that his “laser-focus” on costs hasn’t changed and won’t change, while also saying that he made a conscious decision to keep investing. The bank is working on new cuts to offset the unexpected expenses, he said.

Here’s a rundown of some of the things driving up costs at Germany’s largest bank:

Sewing initially pledged to cut Deutsche Bank’s workforce to 74,000 by the end of this year, but headcount stopped declining last year and has been hovering at around 83,000 ever since.

Now, with inflation fueling wage gains across the economy, compensation expenses have been rising of late, increasing by 3% in the first six months of 2022.

Rising bonuses in the investment bank have contributed, too, as Deutsche Bank vowed to pay successful traders. Compensation costs in the investment bank were up 5% in 2021 and rose another 13% between January and June.

In fact, the lender said it’s made higher bonus accruals in the first half of 2022 than last year, even though Chief Financial Officer James von Moltke said pay will reflect market conditions and remains a “lever” to manage costs.

Costs tied to legal and regulatory issues, another area Sewing had successfully focused in his first years as CEO, are also creeping up again. Deutsche Bank has been criticized by regulators for being to slow in improving controls. Starting last year, it stepped up how much it’s spending on those issues.

The firm also had to set aside money for a probe by US regulators into staff use of unapproved personal devices. Several US banks have disclosed they’re expecting to pay about $200 million euros each to settle the matter.

Then there’s a probe of allegations that its investment arm DWS Group overstated its sustainability capabilities, forcing the firm to twice hire external parties to vet the accusations. DWS on Tuesday said it booked costs of about 13 million euros on the matter in the first half, partly resulting from legal fees.

Deutsche Bank has also highlighted higher contributions to the European bank resolution fund and legal risks relating to a portfolio of Polish mortgages.

Streamlining computer systems, a long-running issue at the bank, is adding to expenses. Deutsche Bank is facing new obstacles as it integrates the systems of its retail subsidiary Postbank and recently disclosed another three-month delay, meaning some 150 million euros of additional expenses in the first quarter of next year.

The delays follow several hundred million euros in software writedowns the bank had to take last year after signing a cloud computing contract with Google. It hasn’t yet disclosed if it reaped any cost savings from the Google project.

Russia’s invasion of Ukraine has been another drag, contributing to a substantial increase in the amount Deutsche Bank has to set aside for souring loans. Provisions hit 525 million euros in the first half of 2022, compared with 144 million euros in the same period last year. The bank has warned a gas cutoff to Germany could have even worse consequences.

In addition, Deutsche Bank’s decision to phase out operations in Russia has meant it’s winding down its large technology center there, forcing it to spend about 50 million euros on relocating staff to an expanded unit in Berlin, according to people familiar with the matter. It’s also incurred higher costs from implementing the complex sanctions against Russia.

Finally, the return of business travel on the back of easing pandemic restrictions has also contributed to higher costs, with von Moltke saying the associated expenses have increased substantially this year.

(Adds CEO comment in third paragraph, travel expenses in last.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.