The JSE slipped into the red briefly this morning, before finding its feet during the afternoon session to stay in the green and ultimately traded flat as investors await the US Federal Reserve monetary policy committee meeting decision due this evening.

Markets expect a 75 basis point interest rate hike from the Fed while corporate earnings from Alphabet, the Google owner, and Microsoft disappointed with Facebook owner Meta due to announce its earnings results after the closing bell on Wednesday.

The All Share Index closed at 68,425 points.

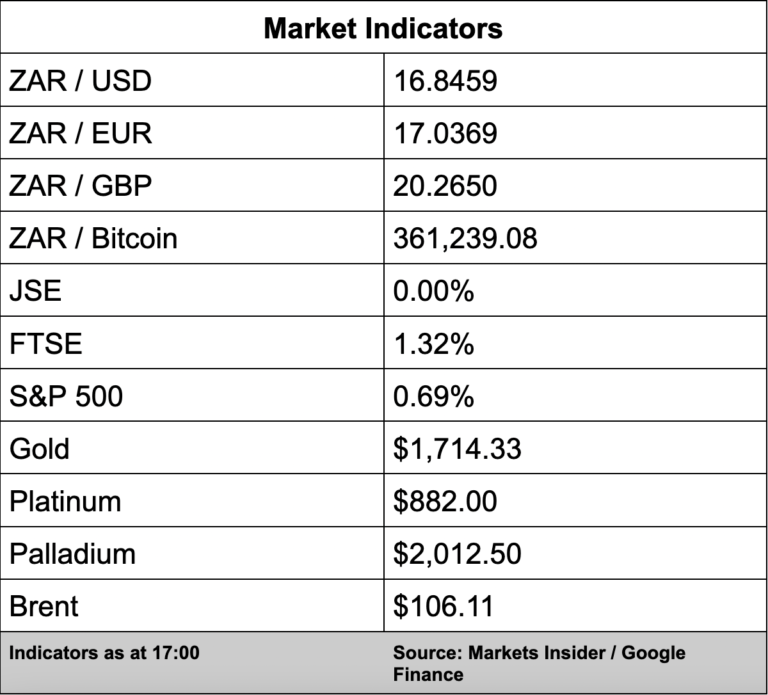

On the currency front, the US dollar is slightly down against the rand with the local unit currently trading at R16.85/$. The rand is currently trading at R17.04 versus the euro.

It’s a mixed bag for commodities today with some up and some down while Brent crude is currently 1.35% up for the day, trading at $106.11 a barrel.

Back on the JSE, Anglo American (-0.20%) said its subsidiary De Beers’ sixth rough diamond sales cycle of 2022, amounted to $630 million (about R10.64 billion), up from $514 million (about R8.68 billion) in the comparative cycle in 2021.

Bruce Cleaver, CEO of De Beers said there was a steady demand for rough diamonds.

“However, the diamond industry continues to adopt a watchful approach in light of the risks to consumer sentiment presented by macroeconomic challenges.”

Chemicals group AECI (-1.31%) has declared a gross interim cash dividend of 194 cents per share and cited better market conditions and recovery from the knock-on effects of covid-19.

The company said its headline earnings per share increased by 8% to 573 cents, up from 529 cents in the 2021 interim period.

Don’t forget to try out our new market data section, which includes stock market indexes, a currency converter and news. If you can’t access the market data make sure you have the latest version of SAccess installed. SAccess is available on App Store, Google Play and Huawei App Store, update today!