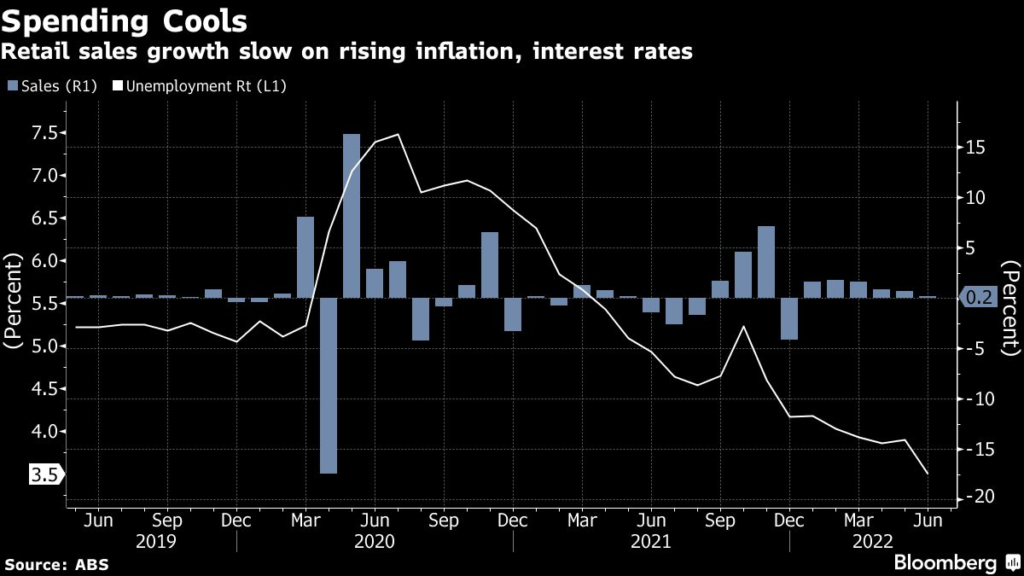

(Bloomberg) — Australian retail sales increased at the slowest pace this year, in a sign that interest-rate increases to contain quickening inflation are beginning to weigh on household spending.

Sales rose 0.2% in June, less than half the 0.5% gain predicted by economists, Australian Bureau of Statistics data showed Thursday. Australian three-year government bond yields slipped following the report.

The figures suggest rising prices of petrol and food, as well as higher borrowing costs, are beginning to impact consumers. The RBA has lifted rates by 125 basis points since May to 1.35% and is widely expected to raise again next week as it tries to bring inflation back to its 2-3% target from 6.1%.

“Results were mixed across the six industries, with turnover rising in three of them and falling in the others, as cost-of-living pressures appear to be slowing the growth in spending,” Ben Dorber, director of Quarterly Economy Wide Statistics at the ABS, said in a statement.

Today’s figures will disappoint RBA policy makers who have expressed confidence in the economy’s ability to withstand further rate hikes. Private consumption accounts for almost 60% of Australia’s A$2.1 trillion annual economic output.

Money market bets imply a cash rate of 3.1% by year’s end.

The latest data showed cafes, restaurants, and takeaway food services posted the largest rise, up 2.7%, followed by a 1.3% gain in clothing, footwear, and personal accessories. Food and household goods declined by 0.3% apiece.

A National Australia Bank Ltd. index of online retail sales showed a contraction in June, suggesting inflationary pressures and rising borrowing costs are beginning to weigh on the consumer.

“Given the increases in prices we’ve seen in the Consumer Price Index, it will also be important to look at changes in the volumes of retail goods, in next week’s release of quarterly data,” Dorber said.

Quarterly data on volumes will be released on Aug. 3.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.