(Bloomberg) — Stocks rose on Thursday as the prospect of a slower pace of Federal Reserve monetary tightening filtered across global markets. Investors are turning their focus to the busiest day of the earnings season along with key economic data.

Mining and energy shares gained in Europe as oil advanced. Solar energy and renewables stocks rallied in Europe and premarket trading after US Senator Joe Manchin and Senate Majority Leader Chuck Schumer struck a deal on a tax and energy policy bill, with Vestas Wind Systems A/S surging more than 12%. Chinese developers jumped after a report said banks may provide support.

A dip in futures suggested the US rally could stall when Wall Street reopens, with technology stocks set to pull back after their biggest jump since November 2020. Big Tech will be a particular focus on Thursday with results from Amazon.com Inc., Apple Inc. and Intel Corp.

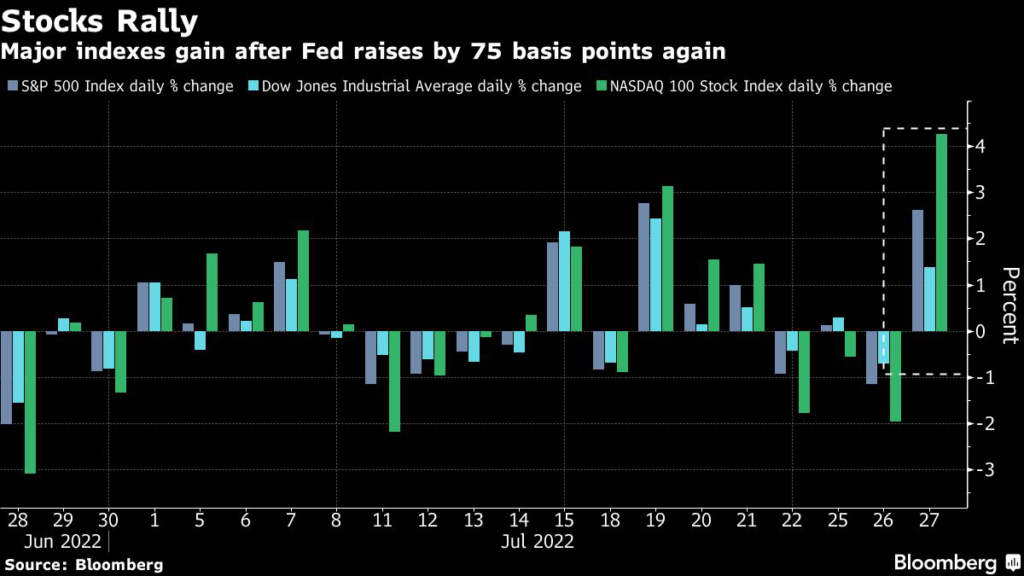

The Fed raised rates by 75 basis points for a second month, saying such a move is possible again and reiterating its desire to curb inflation. Chair Jerome Powell added the pace of hikes will slow at some point and policy will be set meeting-by-meeting. That shift comes amid signs of an economic slowdown.

“As the tug-of-war between inflation and recession fears plays out in the second half of the year, we expect to see highly volatile markets,” Richard Flynn, UK Managing Director at Charles Schwab, wrote in a note.

Treasury yields were little changed and the dollar slipped. Swaps tied to the date of Fed policy meetings imply a 3.3% peak for the fed funds rate around year-end — not much higher than the current range of 2.25% to 2.5%.

US and European firms worth more than $9.4 trillion will report their results on Thursday. The latest US earnings were mixed, with Facebook parent Meta Platforms Inc. posting its first ever quarterly sales decline as Ford Motor Co. beat estimates. Barclays Plc’s earnings fell short of forecasts after the bank booked charges and penalties in the US.

Among individual stock moves, Moncler and Gucci owner Kering advance after the their respective first-half results showed that demand for luxury items is holding up.

Shell Plc gained as it accelerated share buybacks after reporting record profit. Stellantis NV advanced as it expects to overcome supply-chain snarls to extend strong earnings into the second half of the year. Airbus SE fell after cutting its delivery goal and slowing a ramp-up in production of its best-selling narrow-body model.

Meanwhile, confidence in the euro-area economy fell to the weakest in almost 1 1/2 years as fears of energy shortages haunt consumers and businesses, and the European Central Bank’s first interest-rate increase in a more than decade feeds concerns that a recession is nearing.

The knee-jerk relief in markets on possible crumbs of comfort from the Fed outlook echoes a pattern seen after earlier hikes. Those bouts of optimism stumbled on recession risks from a global wave of monetary tightening, Europe’s energy woes and China’s property sector and Covid challenges.

Read more: Specter of Next-Day Losses Haunts Stock Bulls’ Post-Fed Rally

“We do feel the hikes are going to slow from these levels,” Laura Fitzsimmons, JPMorgan Australia’s executive director of macro sales, said on Bloomberg Television. But financial-industry participants are skeptical about the pricing indicating Fed rate cuts in 2023, she added.

Former New York Fed President Bill Dudley said markets are underestimating just how far the Fed will go to tame decades-high inflation. The next key data are US growth and a read on cost pressures. The nation is seen avoiding a technical recession amid a moderation in the core PCE deflator.

The Fed can’t “downshift gears too much” in part because core inflation is poised to decline at a “glacially slow pace,” Seema Shah, chief global strategist at Principal Global Investors, wrote in a note. She expects the Fed to lift borrowing costs above 4% next year.

Elsewhere, traders are awaiting a phone call between President Joe Biden and China’s Xi Jinping, which could touch on US tariffs and other points of tension.

Here are some key events to watch this week:

- Apple, Amazon earnings, Thursday

- US GDP, Thursday

- Euro-area CPI, Friday

- US PCE deflator, personal income, University of Michigan consumer sentiment, Friday

Musk, Tesla and Twitter are this week’s theme of the MLIV Pulse survey. Also share your views on the S&P 500’s biggest stocks. Click here to get involved anonymously.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.2% as of 10:05 a.m. London time

- Futures on the S&P 500 fell 0.4%

- Futures on the Nasdaq 100 fell 0.9%

- Futures on the Dow Jones Industrial Average fell 0.2%

- The MSCI Asia Pacific Index fell 0.2%

- The MSCI Emerging Markets Index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.0204

- The Japanese yen rose 0.9% to 135.33 per dollar

- The offshore yuan was little changed at 6.7454 per dollar

- The British pound rose 0.2% to $1.2178

Bonds

- The yield on 10-year Treasuries was little changed at 2.79%

- Germany’s 10-year yield advanced four basis points to 0.99%

- Britain’s 10-year yield advanced three basis points to 1.99%

Commodities

- Brent crude rose 1.2% to $107.91 a barrel

- Spot gold rose 0.7% to $1,746.41 an ounce

(An earlier version of this story was corrected to show Bill Dudley is a former New York Fed president.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.