(Bloomberg) — Stocks rose in Asia on Thursday, bonds climbed and the dollar fell as the prospect of a slower pace of Federal Reserve monetary tightening filtered across global markets.

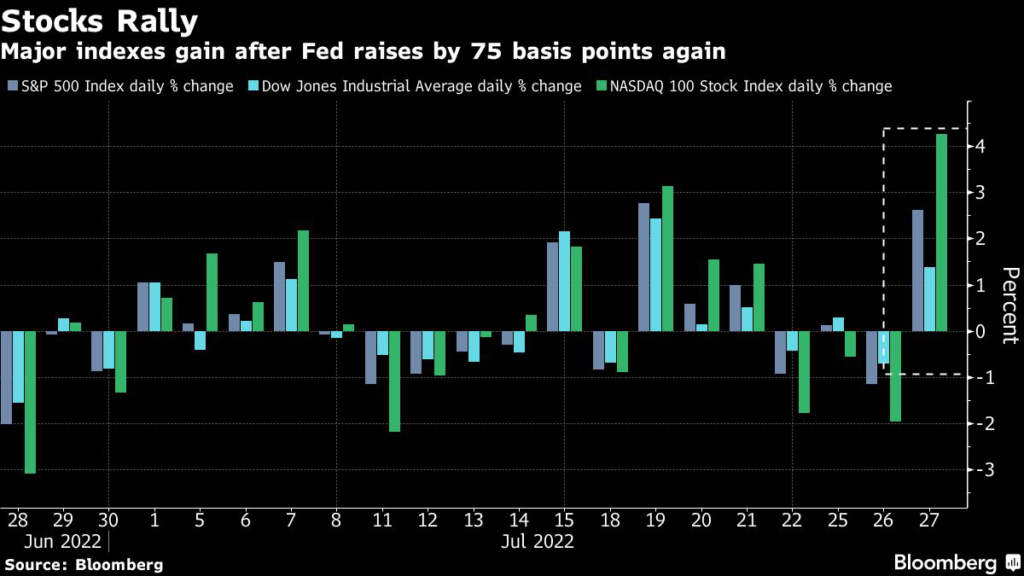

An Asian share gauge added about 1%, bolstered by gains in the Chinese technology sector. That followed Wednesday’s 2.6% surge in the S&P 500 and 4.3% jump in the Nasdaq 100 — though futures suggested the US rally may cool.

The Fed raised rates by 75 basis points for a second month, said such a move is possible again and reiterated its desire to fight inflation. Chair Jerome Powell added the pace of hikes will slow at some point and policy will be set meeting-by-meeting. That shift comes amid signs of an economic slowdown.

Treasuries advanced, lowering the 10-year yield to 2.77%. Swaps tied to the date of Fed policy meetings imply a 3.3% peak for the fed funds rate around year-end — not much higher than the current range of 2.25% to 2.5%.

The yen strengthened 1% against the dollar in the fallout from the Fed decision. Oil advanced toward $99 a barrel, gold edged up and Bitcoin was steady.

The knee-jerk relief in markets on possible crumbs of comfort from the Fed outlook echoes a pattern seen after earlier hikes. Those bouts of optimism stumbled on recession risks from a global wave of monetary tightening, Europe’s energy woes and China’s property sector and Covid challenges.

Read more: Specter of Next-Day Losses Haunts Stock Bulls’ Post-Fed Rally

“We do feel the hikes are going to slow from these levels,” Laura Fitzsimmons, JPMorgan Australia’s executive director of macro sales, said on Bloomberg Television. But financial-industry participants are skeptical about the pricing indicating Fed rate cuts in 2023, she added.

Former New York Fed President Bill Dudley said markets are underestimating just how far the Fed will go to tame decades-high inflation. The next key data are US growth and a read on cost pressures. The nation is seen avoiding a technical recession amid a moderation in the core PCE deflator.

Terminal Rate

The Fed can’t “downshift gears too much” given that core inflation is poised to decline at a “glacially slow pace,” Seema Shah, chief global strategist at Principal Global Investors, wrote in a note. She expects the Fed to lift borrowing costs above 4% next year.

The latest US earnings were mixed. Facebook parent Meta Platforms Inc. posted its first ever quarterly sales decline. Chip firm Qualcomm Inc. gave a lackluster forecast. Ford Motor Co.’s performance beat estimates. Best Buy Co. cut its profit forecast, saying inflation is hitting consumer demand.

Elsewhere, traders are awaiting a phone call between President Joe Biden and China’s Xi Jinping, which could touch on US tariffs and other points of tension.

Separately, Securities and Exchange Commission Chair Gary Gensler said the US and China must reach an agreement “very soon” over access to audit work papers for Chinese firms. Otherwise they face being kicked off US exchanges.

Here are some key events to watch this week:

- Apple, Amazon earnings, Thursday

- US GDP, Thursday

- Euro-area CPI, Friday

- US PCE deflator, personal income, University of Michigan consumer sentiment, Friday

Musk, Tesla and Twitter are this week’s theme of the MLIV Pulse survey. Also share your views on the S&P 500’s biggest stocks. Click here to get involved anonymously.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 11:48 a.m. in Tokyo. The S&P 500 rose 2.6%

- Nasdaq 100 futures fell 0.3%. The Nasdaq 100 advanced 4.3%

- Japan’s Topix index rose 0.1%

- Australia’s S&P/ASX 200 index climbed 0.7%

- South Korea’s Kospi index added 0.9%

- China’s Shanghai Composite index rose 0.9%

- Hong Kong’s Hang Seng index was up 0.2%

- Euro Stoxx 50 futures increased 0.6%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was at $1.0203

- The Japanese yen was at 135.36 per dollar, up 0.9%

- The offshore yuan was at 6.7485 per dollar, down 0.1%

Bonds

- The yield on 10-year Treasuries declined one basis point to 2.77%

- Australia’s 10-year bond yield dropped seven basis points to 3.18%

Commodities

- West Texas Intermediate crude was at $98.72 a barrel, up 1.5%

- Gold was at $1,737.20 an ounce, up 0.2%

(Corrects eighth paragraph to show Bill Dudley is a former New York Fed president.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.