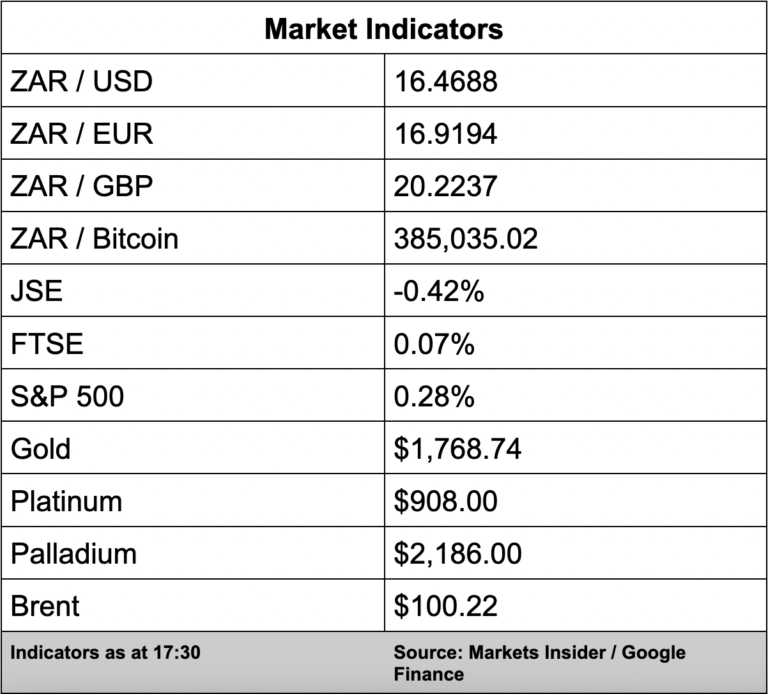

The JSE slipped a small 0.42% while global peers were mixed with oil also trading lower as investors assessed data showing further weakness in China’s economy.

Weak manufacturing numbers from China and Japan on Monday weighed on demand outlook as oil prices dropped while investors brace for a meeting of officials from OPEC and other crude oil producing nations this week, reports Business Day.

Brent crude is currently trading nearly 9% down for the day at $100 a barrel.

Covid-19 restrictions extinguished whatever tiny flames there may have been for recovery of factory activity in China.

Meanwhile, comments from Federal Reserve officials signal the US central bank is committed to its campaign to bring down inflation via interest rate hikes.

Back on the JSE, the All Share Index closed at 68,643 points.

In company news, telecom giant MTN (2.28%), said it expected headline earnings to jump by nearly 50% for the six months ending June 2022.

“Considering the HEPS of 387 cents for the corresponding six-month period ended 30 June 2021, this translates to a range of 542 cents to 581 cents for the six-month period ended 30 June 2022,” MTN said in a trading statement.

Mobile network operator peers Telkom added 1.33% while Vodacom dropped 0.49%.

Thanks to strong local coal prices, Thungela Resources (0.25%) expects a massive increase in earnings for the six months to the end of June 2022.

The coal mining company said headline earnings per share are expected to be between R66.85 and R67.45 – compared to R3.05 for the prior period.

Don’t forget to try out our new market data section, which includes stock market indexes, a currency converter and news. If you can’t access the market data make sure you have the latest version of SAccess installed. SAccess is available on App Store, Google Play and Huawei App Store, update today!