(Bloomberg) — US stocks fell and Treasuries rallied as investors digested fresh comments from Federal Reserve officials and data showing slower growth in the manufacturing sector.

The S&P 500 pushed lower while the tech-heavy Nasdaq 100 fell after rising as much as 1.1% earlier in the session. Treasury yields declined, with the 10-year rate around 2.61%, the lowest since April.

After hinting at a possible pivot last week, Fed officials suggested that the central bank will need to raise rates further to bring inflation under control. A purchasing managers index of manufacturing was the latest data point to show that aggressive Fed tightening is starting to slow economic growth.

Stocks had powered higher in July on speculation the central bank was close to the end of its rate-hiking cycle on signs that runaway inflation may have peaked. Investors are now scrutinizing data, where any above-expectation reading could upend bets on a Fed pivot. At the same time corporate earnings have largely shown that companies are able to deliver profit growth.

“July delivered a nice relief rally on a dovish interpretation of Fed comments and tech earnings that were not as dismal as expected, but it’s not surprising that we would see a retrenchment after that sort of performance,” said Dana D’Auria, co-CIO at Envestnet Inc. “We are still facing a rising rate environment and an economy that is probably technically in recession.”

Geopolitical tensions also kept markets on edge, with China again warning that its military would take action if House Speaker Nancy Pelosi makes a landmark visit to Taiwan. The offshore renminbi was down as much as 0.6% on the day in the wake of the report, while non-deliverable forwards on the Taiwanese dollar indicated a weakening of the island’s currency.

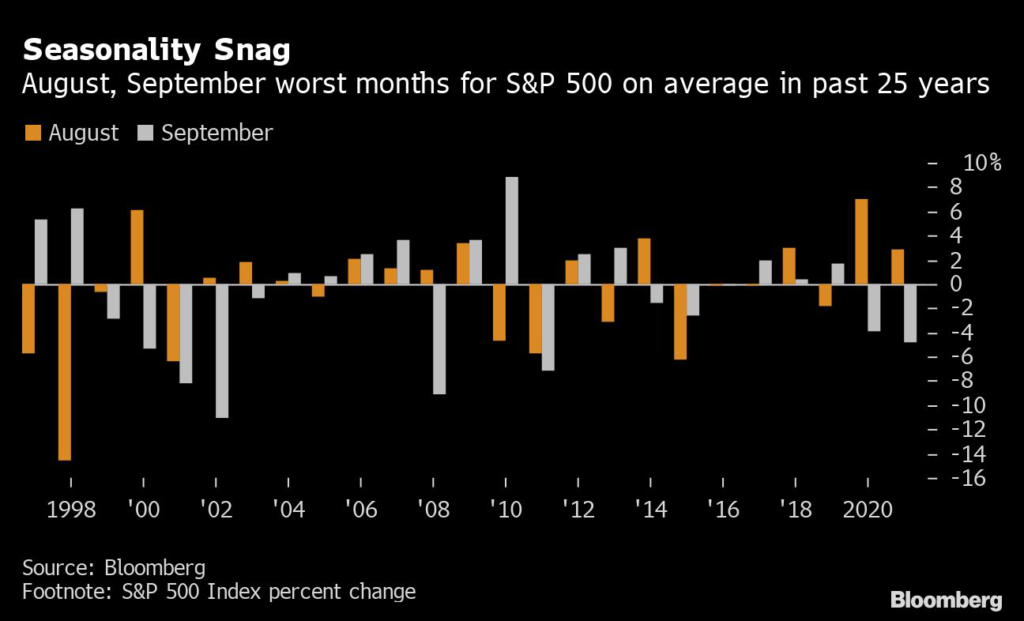

Despite a 12.6% advance from a low on June 16, the S&P 500 could face an ugly stretch. Wall Street lore says October is the most dangerous month for the stock market because of crashes in 1929, 1987 and 2008. But August and September are actually worse, with the S&P 500 averaging declines of 0.6% and 0.7%, respectively, over the past 25 years.

Read More: Surging Stock Market Is Heading Into Riskiest Months of the Year

While more than half of the S&P 500 companies that reported earnings so far have beat analyst estimates, the rate of earnings beats is still trailing the 62% average pace set in the last five quarters. And companies are worried about the economy, with executives and analysts on track to use phrases related to an economic slowdown three times more on second-quarter calls than they did during first-quarter results.

“The Fed does not want to trigger a recession, but their first and much stronger priority is to get inflation under control. If that means driving risk assets lower, that is what they will do,” wrote Dennis DeBusschere, the founder of 22V Research.

Oil declined after poor Chinese economic data added to concerns that a global slowdown may sap demand. West Texas Intermediate dropped below $96 a barrel after sinking almost 7% in July in the first back-to-back monthly loss since late 2020.

The dollar fell. Bitcoin dropped after reaching the highest levels since mid-June on Saturday, fueled by optimism that the market may have recovered from its worst levels.

Read More: Here’s What the Six Key Official Indicators of US Recession Show

What to watch this week:

- Airbnb, Alibaba and BP are among earnings reports

- Reserve Bank of Australia rate decision, Tuesday

- US JOLTS job openings, Tuesday

- Chicago Fed President Charles Evans, St. Louis Fed President James Bullard due to speak at separate events, Tuesday

- OPEC+ meeting on output, Wednesday

- US factory orders, durable goods, ISM services, Wednesday

- BOE rate decision, Thursday

- US initial jobless claims, trade, Thursday

- Cleveland Fed President Loretta Mester due to speak, Thursday

- US employment report for July, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 2:04 p.m. New York time

- The Nasdaq 100 fell 0.3%

- The Dow Jones Industrial Average fell 0.3%

- The MSCI World index rose 1.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.4% to $1.0258

- The British pound rose 0.7% to $1.2254

- The Japanese yen rose 1% to 131.97 per dollar

Bonds

- The yield on 10-year Treasuries declined four basis points to 2.61%

- Germany’s 10-year yield declined four basis points to 0.78%

- Britain’s 10-year yield declined six basis points to 1.81%

Commodities

- West Texas Intermediate crude fell 5% to $93.65 a barrel

- Gold futures rose 0.3% to $1,786.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.