The JSE traded just under 1% lower on Tuesday amid global tension between the United States and China over US House Speaker Nancy Pelosi’s proposed visit to Taiwan, which saw Asian markets place the local bourse under pressure.

The All Share Index closed 0.93% down at 68,002 points.

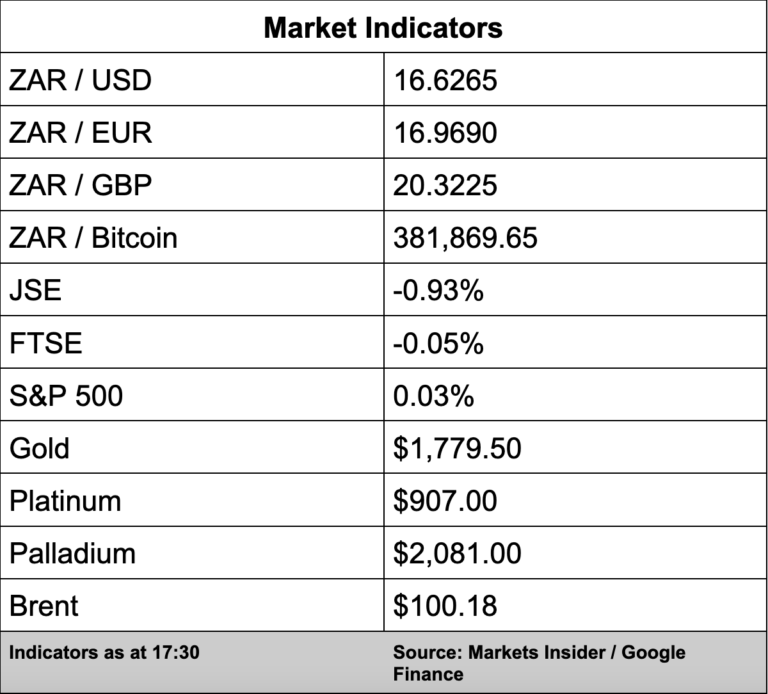

Oil slipped early on but has since recovered its losses with brent crude currently trading at $100.18 a barrel. Investors have a bleak outlook for fuel demand with surveys showing a global manufacturing downturn just as Opec+ producers meet this week to discuss whether to increase supply.

Back on the local bourse, the JSE reported strong performance for the first half of 2022 and good revenue growth.

Headline earnings per share (HEPS) increased by 29% year-on-year (YoY) to 542.7 cents per share, while operating revenue was up 10% to R1.35 billion.

In a trading update for the quarter ended June 2022, Telkom said its revenue had declined by 3.2% to just R10.28 billion despite sustained growth in its mobile division and solid fibre internet numbers while the share price dropped 5.46%.

Bloomberg has reported that MTN (-0.65%) are currently in talks to buy Telkom with the combined company set to be the largest mobile operator in South Africa by number of subscribers, topping that of rival Vodacom (0.12%)

Massmart recorded a drop in profits and flat sales for the first half of 2022 as the Makro and Game owner continues to feel the effects of the July 2021 unrest.

The retailer’s share price slumped 6.42% on the back of the news.

Don’t forget to try out our new market data section, which includes stock market indexes, a currency converter and news. If you can’t access the market data make sure you have the latest version of SAccess installed. SAccess is available on App Store, Google Play and Huawei App Store, update today!