(Bloomberg) — Some of Argentina’s most renowned business leaders including e-commerce billionaire Marcos Galperin and pharmaceutical mogul Hugo Sigman are among investors pledging more capital for biotech accelerator GridX as initial investments begin to pay off.

The Sielecki family, which runs a pharmaceutical business, and Gador SA are other names renewing their commitment to GridX. After a first fund raised $10 million, the second fund expects to hit $50 million by next year.

Read more: Latin America’s unicorns face a reckoning as VCs flee

“Entrepreneurship in Latin America is very difficult,” Miguel Galuccio, GridX’s chairman, said in an interview last month. “We provide a platform to succeed.” Galuccio, an oil veteran, 54, who’s on the board of Schlumberger, has experienced first-hand the struggles of starting a business in the region after building his own shale driller Vista Energy.

The new influx of cash for GridX — including funds from US biotech investor Paul McEwan and family offices in Mexico and Argentina — is a nod to the high regard in which the startup accelerator has come to be held after it began raising money in 2017. It’s already gathered half of the $50 million goal and is widening its investor targets to institutions.

The role wealthy business executives and families are playing to seed the investments is helping to compensate for tighter liquidity from venture capital funds as a rout in the technology sector and rising interest rates globally prompt a pullback.

GridX matches scientists working on biotech projects with entrepreneurs. Take Beeflow, which supercharges pollination to increase crop yields, or Stamm, which makes small-scale machinery in a bid to proliferate access to biologists working on sustainable manufacturing.

“Argentina has a distinguished tradition of science,” said CEO Matias Peire, a 44-year-old business administrator who came up with the GridX concept and found support from Galuccio, referencing the country’s three Nobel winners in medicine and chemistry. “But we need this sophisticated process of transforming the science into something tangible.”

GridX, which is headquartered in Buenos Aires and employs 11 people, has 42 companies in its portfolio worth around $300 million, Peire said. Most of the companies got their break through the first fund, which involved Sigman, one of the first backers, convincing MercadoLibre Inc. founder Galperin to invest as well.

The second, bigger pot of money will try to keep companies better funded as they grow and reach more scientists in other Latin American countries.

GridX’s expansion comes as researchers in the region test solutions for a world grappling with climate change and health crises. But bringing projects to fruition is under threat from both global market volatility and Argentina’s broader credit woes.

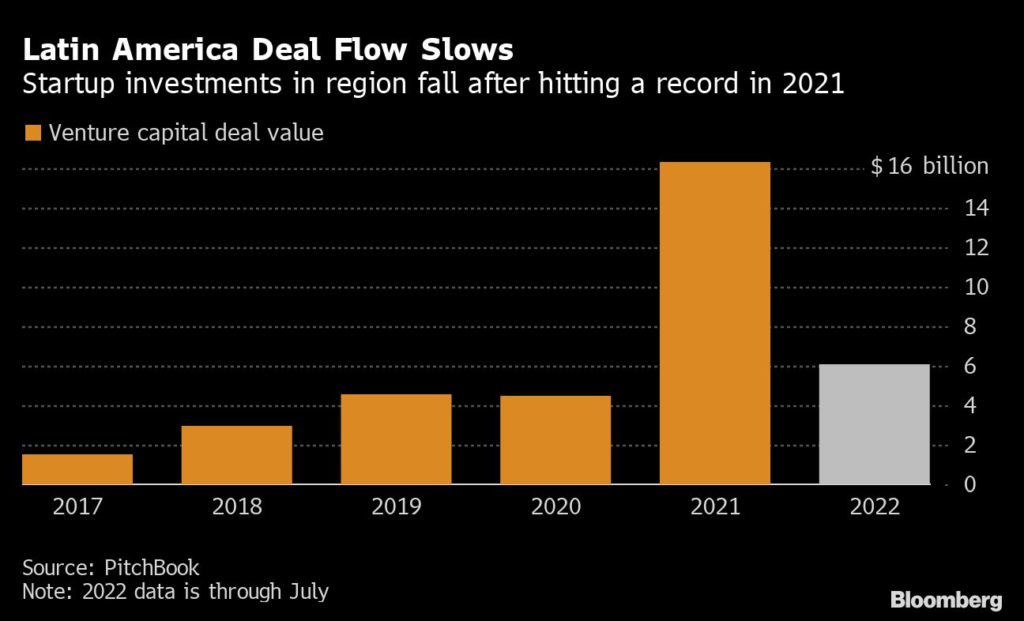

After a record $16.3 billion of venture capital poured into Latin America in 2021, it’s been a different story this year. Investments through July 27 were $6.1 billion, according to financial data firm PitchBook.

GridX is undeterred. “This process of markets falling will end up being an opportunity soon for our sector, rather than a threat,” Peire said. “The appetite of venture capital won’t fall that much.”

Still, there’s a long way to go for biotech, which accounts for less than 1% of the region’s venture capital deals.

“We are building the market” for biotech, Peire said. “There’s no deal flow in Latin America, no company where a big investor can come in and put down $50 million. Creating globally-competitive companies needs this deep process.”

GridX has built a pipeline of startups such as Puna Bio, which uses organisms sourced from the harsh climate of the Andes to make products for crop growth and soil nutrition; and Onco Precision, which develops bespoke cancer treatments.

Around 20 GridX companies now have outside backers, including US venture capitalist Tim Draper’s investment in Stamm.

There’s also a tangible success story. Caspr Biotech, which aims to broaden access to molecular diagnostics for doctors, was recently acquired outright.

GridX’s process involves a search for scientists toiling on groundbreaking projects at universities and laboratories, then teaming them up with entrepreneurs. The subsequent startup then receives $200,000 and, later, global investment connections.

These connections include IndieBio, another biotech startup accelerator but with greater clout and headquartered in San Francisco.

To be sure, other startup accelerators also use matchmaking programs. And there’s competition in Argentina from biotech funds like SF500 and Aceleradora Litoral, as well as broader startup funds like Sancor Seguros Ventures.

Galuccio used a soccer metaphor to describe the success he sees ahead for GridX. “There are a lot of companies that we see becoming goals,” he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.