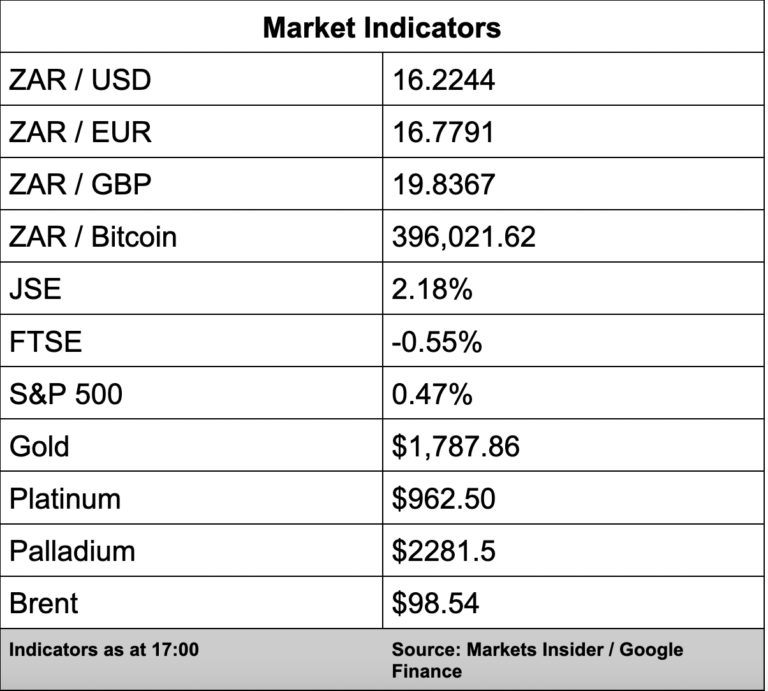

The rand was trading at its best level against the US dollar in six weeks by lunchtime on Thursday but the local unit has since given back some of those gains and is currently trading at R16.25 to the dollar.

The local unit was trading as low as R16.17/$ at midday – its best level since the end of June. This was after traders reined in bets on an aggressive interest rate hike by the US Federal Reserve after better-than-expected US inflation data was released on Wednesday, reports Reuters.

On the stock market, the JSE also traded firmer on the back of the softer-than-expected US CPI data with the All Share Index adding a healthy 2.18% to see it close at 71,265 points.

In company news, mobile operator MTN said profit increased by 47% for the six months to the end of June with subscribers increasing by almost 6% from a year ago to nearly 282 million across its operations.

The positive results come against the backdrop of a clampdown in Nigeria, which saw unverified users disconnected – amounting to millions of users.

The company warned of moderate price increases in certain markets, subject to regulatory approval, while the company’s share price surged by 8.99%.

Meanwhile, earlier this year MTN submitted a bit to purchase competitor Telkom, which would make the MTN group the largest mobile operator in South Africa. But earlier on Thursday data only network operator Rain, said Telkom should ditch MTN and merge with the 4G and 5G pioneers.

However, Rain has been instructed to retract a statement that it wants to merge with Telkom, with the Takeover Regulation Panel (TRP) declaring it unlawful, reports Fin24.

Telkom surged 6.11% while mobile peer Vodacom added 1.50%.