By Vuyani Ndaba

JOHANNESBURG (Reuters) – South Africa’s Reserve Bank will deliver another two 50 basis points interest rate hikes this year, as risks to the country’s inflation outlook remain skewed to the upside, a Reuters poll found on Thursday.

Inflation globally has been racing higher and locally it remains uncomfortably high as food and fuel prices worsen a cost of living crisis.

A median forecast of 29 economists surveyed between Aug.

10 and 17 suggested consumer price inflation would average 6.7% this year and 5.3% next, but 11 of 14 respondents to an extra question said the risk to their forecasts over the coming year was to the upside.

South Africa’s central bank delivered its biggest interest rate hike of 50 basis points in two decades last month to try to curb inflation, and the poll predicted half-percent hikes at the September and November meetings, taking the key rate to 6.50%.

Inflation surged to a 13-year high of 7.4% in June and was expected to peak at an average of 7.5% this quarter, above the Bank’s comfort level of between 3% and 6%.

Still, the Reserve Bank was expected to have raised its repo rate by a cumulative 150 basis points to 7.00% by the end of May 2023, before easing the rate back to 6.50% by the end of the year.

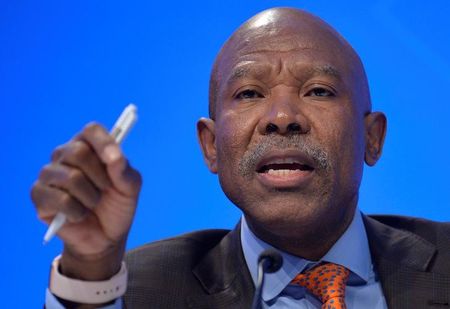

Governor Lesetja Kganyago has said the South African Reserve Bank (SARB) is determined to act on rising inflation while being cognisant of the risks.

Analysts at Capital Economics wrote in a note: “While tackling inflation head-on appears to be the current priority at the Reserve Bank, concerns about the economy may increasingly come into view and the tightening cycle is likely to slow.” They added that economic activity would remain sluggish.

The poll suggested the South African economy would expand 2.0% this year after growing 4.9% in 2021.

Next year growth was expected to slow to 1.5%.

(For other stories from the Reuters global economic poll:)

(Reporting by Vuyani Ndaba; Editing by David Holmes)