Cathie Wood’s flagship ETF, Bitcoin, meme stocks, profitless tech firms. The risk assets that powered this quarter’s $7 trillion rally all took a pounding Monday.

(Bloomberg) — Cathie Wood’s flagship ETF, Bitcoin, meme stocks, profitless tech firms.

The risk assets that powered this quarter’s $7 trillion rally all took a pounding Monday.

The beat-down was part of a concerted stock and bond rout that saw the S&P 500 Index sink more than 2% to clinch its worst two-day rout since mid-June.

The 10-year Treasury selloff pushed yields past 3% for the first time in a month. Volatility spiked higher, with Cboe’s VIX measure pushing toward 24, a level not seen in three weeks.

The proximate cause was a chorus of hawkish Federal Reserve officials days before Chair Jerome Powell is widely expected to reiterate the central bank’s intention to throttle the economy until inflation is under control.

As analysts start advising investors to favor cash, the pullback in risk assets may cool concern that rallying stocks would prompt the Fed to be even more aggressive in its campaign.

“We had a risk-on, momentum-driven market from the middle of June to the end of July, and speculative assets do well in those types of environments,” said David Spika, president and chief investment officer of GuideStone Capital Management.

“It doesn’t mean that there’s legitimate value there — it just means that money was chasing momentum.”

Innovation Ditched

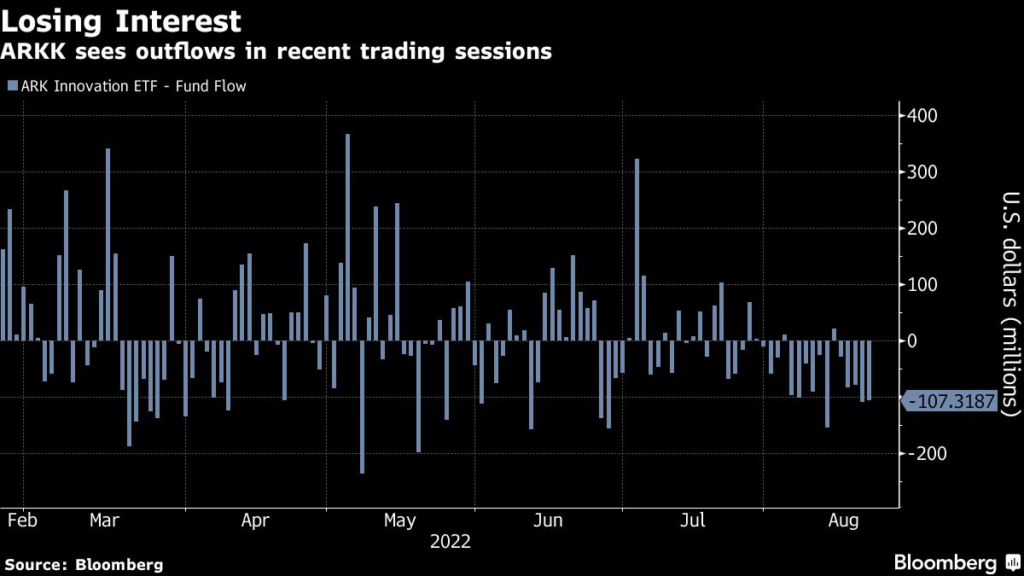

Cathie Wood’s Innovation exchange-traded fund (ticker ARKK) has seen outflows in five straight sessions, including 11 of the last 12.

So far this year, the flagship ETF has seen inflows every month, except in June, though it has lost around half its value since 2022 started. ARKK slumped 2.4% Monday.

Crypto Selloff

Digital assets are being punished as investors unwind bets that the Fed might raise interest rates less than initially feared.

Bitcoin broke above the $25,000 mark last week, but has since dropped toward $21,000. Meanwhile, an index of the 100 largest cryptocurrencies dropped as much as 3.1% on Monday, after losing nearly 12% last week.

Meme Frenzy Falls Flat

Bed Bath & Beyond Inc.

tumbled 16%, adding to three-day rout of 60%, after a report some suppliers were restricting or halting shipments altogether after the company fell behind on payments. The pessimism rippled through other meme stocks, including GameStop Corp., which fell 5.5% Monday, and AMC Entertainment Holdings Inc., which sank 6.4%.

Tech Tumbles

A Goldman Sachs basket of non-profitable tech companies dropped 2.6% Monday and is trading at its lowest level since August 2.

Tech companies with sky-high valuations based on the expectation of future profits suffer when investors expect higher rates and inflation to erode the value of those future earnings.

IPO Slowdown

Newly public companies have been particularly hard-hit by the Fed’s aggressive policy stance.

The Renaissance IPO ETF (IPO) lost 8.9% last week, its largest weekly decline since May. The fund has dropped roughly 44% since the start of the year.

The rout in speculative assets may vindicate bears who have been warning for six weeks that a sustained rally in stocks had no chance of persisting.

They have long pointed to threats from China’s shutdowns, spiking energy prices in Europe and the potential for an overly aggressive Fed.

“Global bond markets started selling off last week.

Then there is today’s spike in European energy and power prices and concerns they will drive inflation through the winter,” Michael O’Rourke, chief market strategist at Jonestrading. “Despite the risk-off environment, inflation fears are prompting bond selling and pushing yields higher.

As such, long-duration growth equities are under pressure.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.