A sobering tone took over Wall Street after a rally that added $7 trillion to the stock market, with traders bracing for hawkish rhetoric from Federal Reserve officials at the Jackson Hole retreat later this week.

(Bloomberg) — A sobering tone took over Wall Street after a rally that added $7 trillion to the stock market, with traders bracing for hawkish rhetoric from Federal Reserve officials at the Jackson Hole retreat later this week.

Equities saw their worst rout in two months, following a surge that drove the S&P 500 to its best start to a third quarter since 1932. The Nasdaq 100 underperformed as Treasury 10-year yields topped 3%. The meme-stock frenzy continued to unravel, with other speculative corners of the market like Bitcoin and profitless tech firms also getting clobbered. The Cboe Volatility Index, or VIX, soared. As the dollar gained, the euro sank to an almost two-decade low.

The furious runup in US shares from June lows showed signs of fatigue as the earnings season wrapped up, with the threat of an economic recession still looming large amid warnings from Fed officials that the fight against inflation is far from over. That stance will likely be reinforced by Jerome Powell Friday at the prestigious event in Wyoming’s Grand Teton mountains, which has been used by Fed chairs as a venue for making key policy announcements.

“He may try to send a clear message that even if they have a slower pace of rate hikes, that won’t signal a lower peak rate or that they will be quick to cut rates,” wrote Ed Moya, senior market analyst at Oanda. “After this week, Wall Street should not be surprised if Fed fund futures start pricing in rate hikes for next year. This could be the week many return from vacation and double-down on their bear-market rally calls.”

In fact, while the recent surge in stocks has triggered chatter about a new bull run, history shows there may be more turbulence ahead. Looking back to the last six bear markets since the 1970s, four of them have experienced an average of six or seven short-lived up trends, according to Glenmede. The study also showed that the 17% surge from June lows was consistent with historical bear-market rallies.

“There may be further downside to the ongoing bear market, justifying an underweight to risk assets,” wrote Jason Pride, the firm’s chief investment officer of private wealth.

Investors are also waking up to the imminent acceleration of the Fed’s balance-sheet reduction. So-called quantitative tightening kicks into top gear next month, and will add to pressure on riskier assets which have benefited from ample liquidity. Strategists at Bank of America Corp. last week said that the winding down of the central bank’s balance sheet poses a risk to equity prices.

Read: Morgan Stanley’s Sheets Favors Cash as Bears Circle Equities

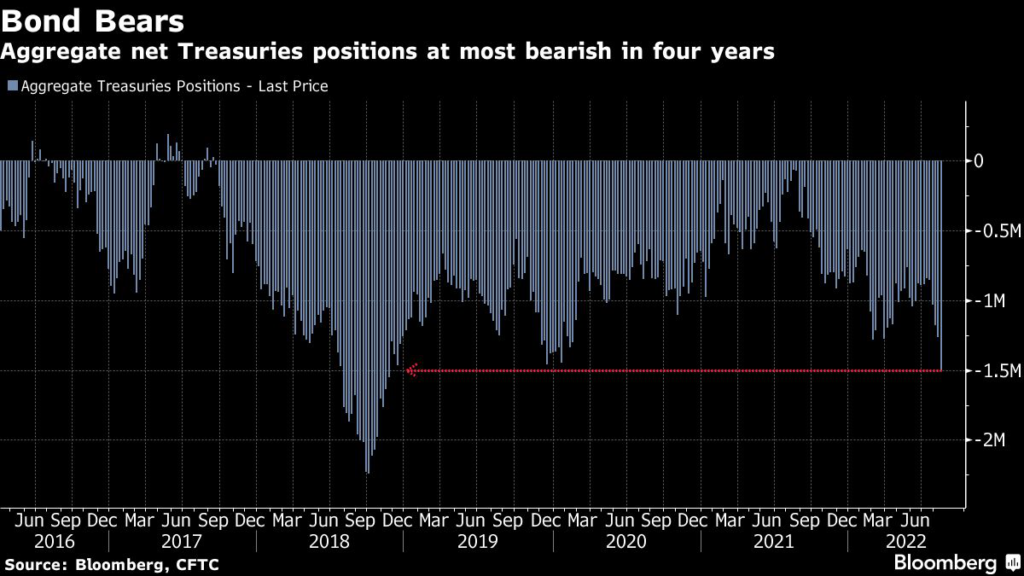

Meantime, hedge funds are rapidly positioning for higher rates in a key corner of the derivatives market. The group has collectively placed a big short across futures referencing the official successor to London interbank offered rate known as the Secured Overnight Financing Rate. This wager stands to benefit should Powell effectively rule out a dovish pivot this week.

The debate for most investors has shifted from a focus on the odds of a recession to how the Fed will impact markets, according to Lindsey Bell, chief money and markets strategist at Ally, who bets volatility will likely increase as investors look for catalysts.

“With real rates still rising and prospects for 2023 rate cuts fading in the bond market, stock valuations look extremely stretched, especially if as we suspect, policy-driven economic slowing will prove an obstacle to currently optimistic 2023 earnings estimates,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said in a note. “Stocks are overbought. Sit it out for now.”

Stocks and bonds are set to tumble once more even though inflation has likely peaked, according to the latest MLIV Pulse survey, as rate hikes reawaken the great 2022 selloff. Ahead of the Jackson Hole symposium, 68% of respondents see the most destabilizing era of price pressures in decades eroding corporate margins and sending equities lower.

As investors wonder whether the selloff will get worse from here, Lori Calvasina at RBC Capital Markets says “it seems premature to call an end to the rebound just yet” even with stocks set up for “some choppiness” in the second half of 2022.

“Deeply depressed levels of investor sentiment, which continue to show signs of healing, have kept us out of the bearish camp,” she added.

Elsewhere, gold dropped for a sixth day as a stronger dollar and higher bond yields are bad for bullion as it pays no interest and is priced in the US currency. Oil clung to $90 at the conclusion of a volatile session after Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said “extreme” volatility and lack of liquidity mean the futures market is increasingly disconnected from fundamentals and OPEC+ may be forced to cut production.

What to watch this week:

- US new home sales, S&P Global PMIs, Tuesday

- Minneapolis Fed President Neel Kashkari speaks at a Q&A session, Tuesday

- US durable goods, MBA mortgage applications, pending home sales, Wednesday

- US GDP, initial jobless claims, Thursday

- Kansas City Fed hosts its annual economic policy symposium in Jackson Hole, Wyoming, Thursday

- ECB’s July minutes, Thursday

- Fed Chair Powell speaks at Jackson Hole, Friday

- US personal income, PCE deflator, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 2.1% as of 4 p.m. New York time

- The Nasdaq 100 fell 2.7%

- The Dow Jones Industrial Average fell 1.9%

- The MSCI World index fell 1.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.6%

- The euro fell 0.9% to $0.9943

- The British pound fell 0.5% to $1.1766

- The Japanese yen fell 0.4% to 137.45 per dollar

Bonds

- The yield on 10-year Treasuries advanced six basis points to 3.03%

- Germany’s 10-year yield advanced eight basis points to 1.31%

- Britain’s 10-year yield advanced 10 basis points to 2.51%

Commodities

- West Texas Intermediate crude fell 0.6% to $90.23 a barrel

- Gold futures fell 0.8% to $1,748.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.