(Bloomberg) — The Bank of Korea is poised to raise its key interest rate by a quarter-percentage point on Thursday, resuming normal-sized increments as it seeks to rein in inflation without damaging the economy’s growth prospects.

(Bloomberg) — The Bank of Korea is poised to raise its key interest rate by a quarter-percentage point on Thursday, resuming normal-sized increments as it seeks to rein in inflation without damaging the economy’s growth prospects.

The BOK will lift its seven-day repurchase rate by 25 basis points to 2.5%, according to all but one economist surveyed by Bloomberg. Barclays Plc is the outlier with a 50 basis-point call, after the BOK last month delivered its first ever half-point hike to tackle the fastest consumer-price gains in over two decades.

While inflation accelerated further in July, it came in below economists’ estimates for the first time this year. A cooling of global energy and food prices has also eased some of the pressure on central banks to hike hard, enabling some of them to consider a more flexible approach that protects growth.

Korea’s return to quarter-point rises would contrast with fellow early rate mover New Zealand, which last week hiked by a half point for a fourth-straight meeting.

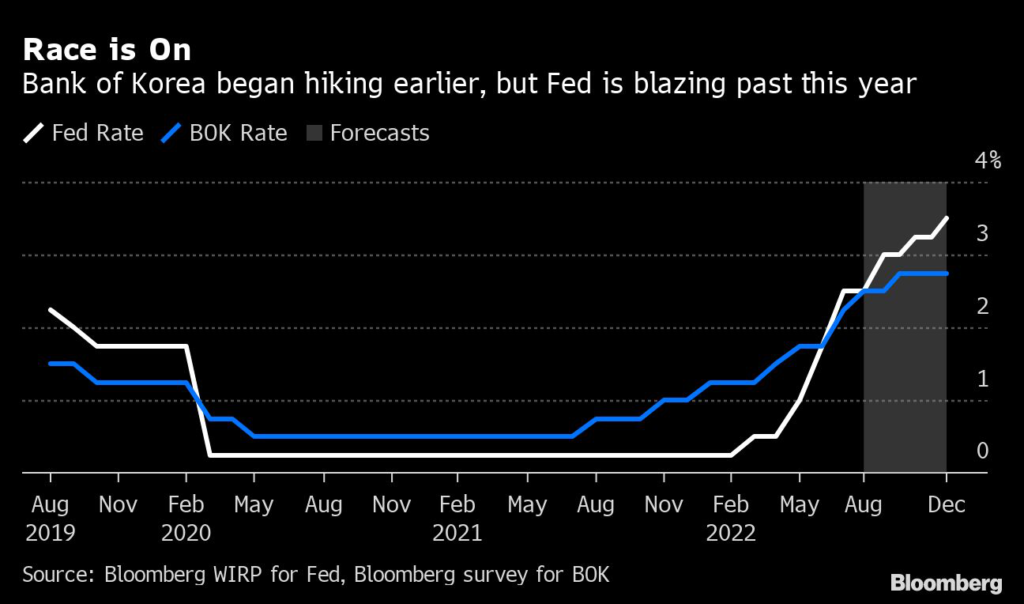

Still, Korea is unlikely to deviate from a path of tightening as consumer prices run at more than three times the central bank’s 2% inflation target. On top of that, capital outflows triggered by the Federal Reserve’s rate increases run the risk of a continued weakening of the currency that further inflates key import prices.

“Inflation is rising and more US Fed rate hikes will come, so I see the BOK doing another rate hike,” said Lloyd Chan, an economist at Oxford Economics. But, he added, “policy makers will be more cautious about the impact of rapid rate hikes on growth.”

The BOK on Thursday will also release its quarterly update of economic forecasts after having in May predicted growth of 2.7% and inflation at 4.5% this year. The median estimate in a Bloomberg survey of economists this month was for inflation of 5%.

Kwon Goohoon, an economist at Goldman Sachs Group Inc, predicted last week that the BOK may raise its inflation forecast to around 5.5%. But the central bank is likely to avoid a hawkish tone given there are signs of inflation cooling while growth fears continue, he said.

A further concern is slowing exports, as global semiconductor forecasts are downgraded and shipments to China decline. A key driver of domestic economic growth this year has been consumption after the relaxation of Covid rules released pent-up demand, but that spending may start to slow just as external demand weakens.

Governor Rhee Chang-yong has made clear since the last meeting that another outsized rate hike is unlikely unless extraordinary circumstances arise. The BOK is also closely watching the impact of higher interest rates on record household debt, amid rising credit concerns.

The rate decision should come before 10 a.m. local time followed by a press briefing by Rhee starting around 11:10 a.m. The governor’s remarks on the likely trajectory of the economy, prices and interest rates will be closely followed.

The central bank’s efforts have been assisted by recent government measures to try to ease the burden of rising living costs on the population. These have included the release of grain supplies and an extension of fuel tax cuts.

In the first extra budget since President Yoon Suk Yeol took office in May, the government provided 3.1 trillion won ($2.3 billion) of support to lower-income households and the stabilization of agricultural prices.

“As both the central bank and the government share a common view on high inflation as a bigger threat to the economy than higher rates, the introduction and implementation of small but frequent measures to cap the price level is likely to help with sentiment,” said Kathleen Oh, an economist at Bank of America Corp.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.