(Bloomberg) — US futures rose Thursday as China’s massive stimulus steadied some nerves in the anxious wait for a key speech by Federal Reserve Chair Jerome Powell. Treasury yields and a dollar gauge dipped.

(Bloomberg) — US futures rose Thursday as China’s massive stimulus steadied some nerves in the anxious wait for a key speech by Federal Reserve Chair Jerome Powell.

Treasury yields and a dollar gauge dipped.

Contracts on the S&P 500 and Nasdaq 100 pushed higher in the wake of positive closes for both gauges, though they came off session highs. Sentiment was boosted after China stepped up stimulus with a further 1 trillion yuan ($146 billion) of measures.

Traders expect markets to remain volatile as they look to Powell’s comments due Friday at the Jackson Hole meeting for clues on the pace of US monetary tightening.

Europe’s stock benchmark erased gains amid mixed economic data from the region’s biggest economy.

Energy and healthcare stocks were the biggest gainers, with retailers underperforming. Germany’s economy proved more resilient than initially thought in the second quarter, though worsening business confidence pointed to a still-cloudy outlook.

Crude oil held around $95 a barrel, with elevated energy prices feeding into renewed jitters about whether price pressures have peaked.

Natural gas prices have surged to fresh highs, intensifying an energy crisis that threatens the euro-area economy and hence the global outlook.

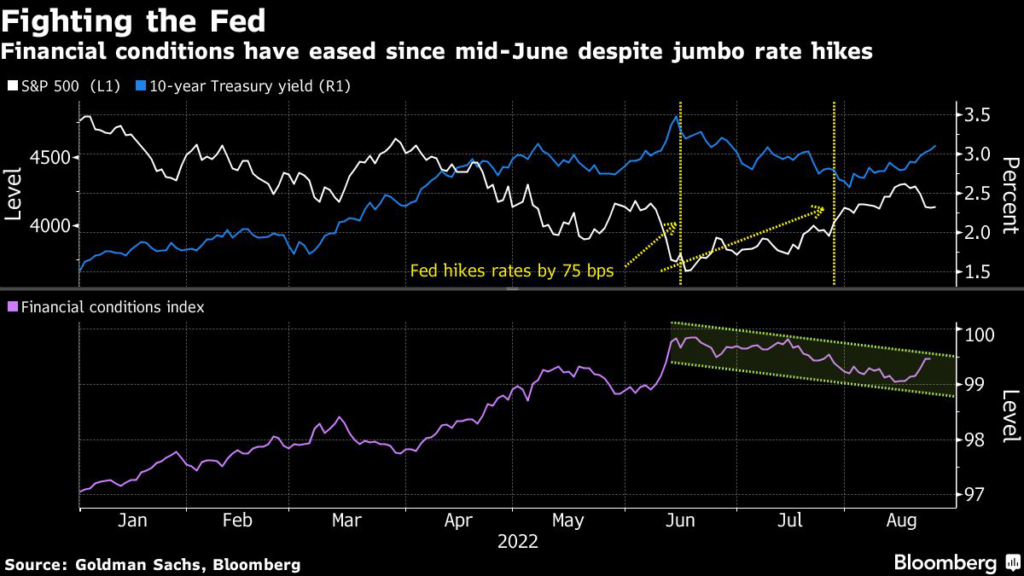

Fed officials in the run-up to Jackson Hole have been clear they see more monetary tightening ahead, a message that’s eroded a bounce in stocks and bonds from mid-June troughs.

The tension in markets is whether those assets will continue to head back toward the lows of the year.

“Powell is likely to push back on premature expectations of a dovish pivot, reiterating the focus on the fight against high inflation,” said Silvia Dall’Angelo, a senior economist at Federated Hermes Ltd.

“Whether markets take him seriously amid an increasingly gloomy outlook for the global economy is yet to be seen.”

Will the meme mania fizzle out? That’s the theme of this week’s MLIV Pulse survey.

Click here to participate anonymously.

What to watch this week:

- US GDP, initial jobless claims, Thursday

- Kansas City Fed hosts its annual economic policy symposium in Jackson Hole, Wyoming, Thursday

- ECB’s July minutes, Thursday

- Fed Chair Powell speaks at Jackson Hole, Friday

- US personal income, PCE deflator, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.5% as of 5:53 a.m.

New York time

- Futures on the Nasdaq 100 rose 0.6%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.3% to $1.0000

- The British pound rose 0.4% to $1.1844

- The Japanese yen rose 0.5% to 136.40 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 3.08%

- Germany’s 10-year yield declined four basis points to 1.33%

- Britain’s 10-year yield declined seven basis points to 2.63%

Commodities

- West Texas Intermediate crude was little changed

- Gold futures rose 0.9% to $1,778.10 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.