The amount of bearish bets against Hong Kong stocks has risen to levels that could trigger a surge in share prices as traders rush to close out their positions, according to quantitative analysts at Morgan Stanley.

(Bloomberg) — The amount of bearish bets against Hong Kong stocks has risen to levels that could trigger a surge in share prices as traders rush to close out their positions, according to quantitative analysts at Morgan Stanley.

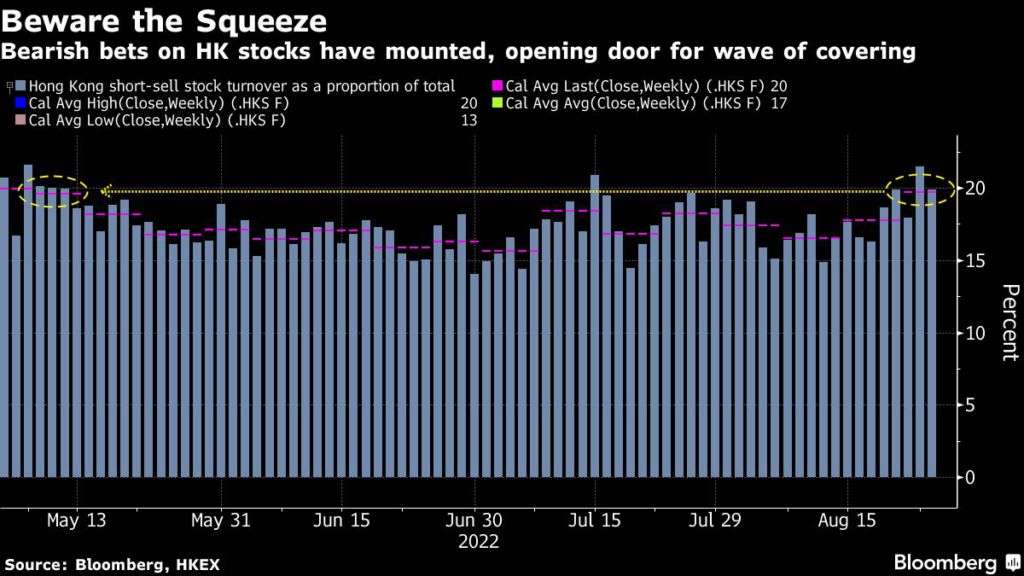

Hedge funds and other short sellers say they’re either covering bearish wagers or planning to do so, strategist Gilbert Wong wrote in emailed comments Wednesday. Short-selling activity was running at just under 20% of total turnover on the city’s stock market this week, a level not seen since May, calculations by Bloomberg based on exchange data showed.

“We believe the risk of short squeeze in China and Hong Kong equities is rising,” Wong said. “Stay alert.”

Betting against Hong Kong’s stock market has proven to be a profitable trade this year, with the Hang Seng Index down over 20% at its low point in March on fears of an economic slowdown and regulatory overreach. Global investors are so underweight Chinese assets that bearish equity bets were considered one of the most-crowded trades in Bank of America Corp.’s investor survey earlier this year.

But it can also be a perilous one — in the middle of that month, a coordinated pledge from China’s top regulators to address investor concerns triggered a two-day, 17% surge in the benchmark.

Theories on what could lead to a rebound this time range from beaten-down valuations, low positioning after August redemptions and signs of increased stimulus from Beijing. The Hang Seng climbed as much as 3.3% Thursday after China announced additional measures to boost infrastructure spending. The Hang Seng Tech index rallied 5.3%, with Alibaba Group Holding Ltd. surging 8.1%.

While short-covering flows may have little to do with fundamental changes in the outlook for Chinese equities, some investors are behaving like the best of the bearish-China trade is behind them.

“They believe further market downside is limited from current levels because positioning is low and very defensive,” said Wong.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.