(Bloomberg) — An Asian stock index rose on Thursday as investors evaluated China’s latest steps to shore up its economy and awaited a key speech by Federal Reserve Chair Jerome Powell about the monetary policy outlook.

(Bloomberg) — An Asian stock index rose on Thursday as investors evaluated China’s latest steps to shore up its economy and awaited a key speech by Federal Reserve Chair Jerome Powell about the monetary policy outlook.

The regional gauge added about 0.5%, helped by gains in Japan. Morning trading in Hong Kong was scrapped due to a storm. US futures pushed higher in the wake of positive closes for the S&P 500 and Nasdaq 100.

China stepped up stimulus with a further 1 trillion yuan ($146 billion) of measures for an economy stricken by property-sector woes, Covid-linked mobility curbs and some power shortages. Mainland shares erased early gains, reflecting uncertainty about whether the efforts are sufficient.

Market angst ahead of Powell’s comments is centered on whether he will rebut expectations that slowing growth will temper monetary tightening in the next phase of the campaign against high inflation.

Treasuries trimmed a slide but the two-year yield remained in sight of 3.40%. A dollar gauge dipped. Crude oil added to a rally that could feed into renewed jitters about whether price pressures have peaked.

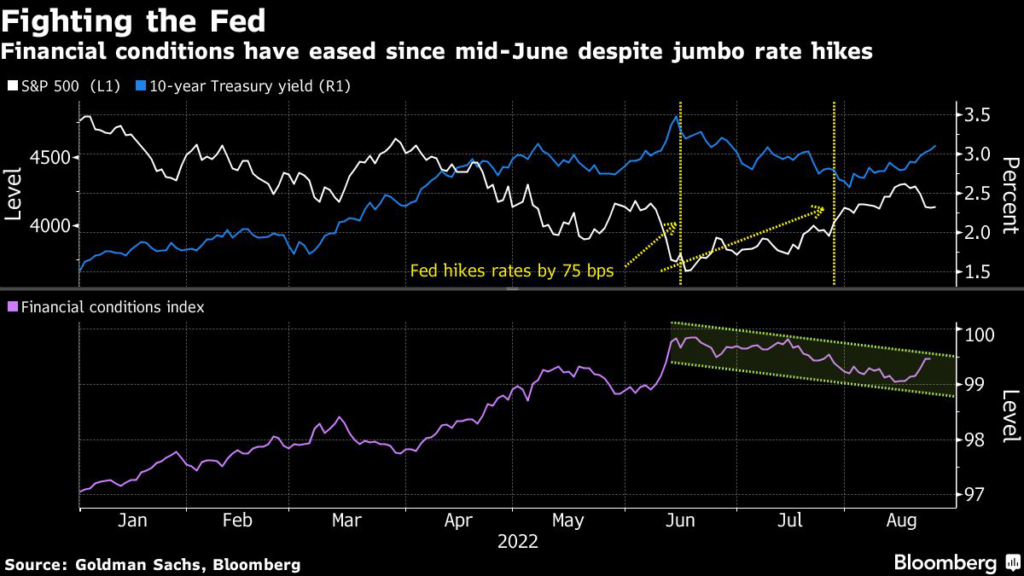

Fed officials in the run-up to Jackson Hole have been clear they see more monetary tightening ahead, a message that’s eroded a bounce in stocks and bonds from mid-June troughs. The tension in markets is whether those assets will continue to head back toward the lows of the year.

Powell on Friday has the opportunity to reset expectations of a pivot and even rate cuts in 2023 and “if there’s anything he’s likely to push back against, it’s that — the fact that rates may have to come down” Anastasia Amoroso, the chief investment strategist at iCapital, said on Bloomberg Television.

South Korea’s central bank raised borrowing costs and projected faster inflation. The won and bond yields advanced. The currency led an Asian basket tracked by Bloomberg.

In Europe, natural gas prices have surged to fresh highs, intensifying an energy crisis that threatens the euro-area economy and hence the global outlook.

Will the meme mania fizzle out? That’s the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

What to watch this week:

- US GDP, initial jobless claims, Thursday

- Kansas City Fed hosts its annual economic policy symposium in Jackson Hole, Wyoming, Thursday

- ECB’s July minutes, Thursday

- Fed Chair Powell speaks at Jackson Hole, Friday

- US personal income, PCE deflator, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 11:50 a.m. in Tokyo. The S&P 500 rose 0.3%

- Nasdaq 100 futures rose 0.3%. The Nasdaq 100 rose 0.3%

- Japan’s Topix index was up 0.4%

- South Korea’s Kospi index added 0.9%

- Australia’s S&P/ASX 200 index gained 0.7%

- China’s Shanghai Composite index added 0.1%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was at $0.9986, up 0.2%

- The Japanese yen traded at 136.75 per dollar, up 0.3%

- The offshore yuan was at 6.8602 per dollar, up 0.2%

Bonds

- The yield on 10-year Treasuries was steady at 3.10%

- Australia’s 10-year yield climbed seven basis points to 3.70%

Commodities

- West Texas Intermediate crude rose 0.6% to $95.46 a barrel

- Gold was at $1,755.86 an ounce, up 0.3%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.