Dell Technologies Inc. fell the most since the company returned to the public markets in December 2018 after executives’ pessimistic remarks about the business environment for the second half of the year outweighed solid quarterly results.

(Bloomberg) — Dell Technologies Inc. fell the most since the company returned to the public markets in December 2018 after executives’ pessimistic remarks about the business environment for the second half of the year outweighed solid quarterly results.

Company leadership talked Thursday about a greater sales challenge ahead for the maker of personal computers, servers and information technology. Co-Chief Operating Officer Chuck Whitten said Dell “observed more cautious customer behavior as the quarter progressed.” Whitten’s co-COO Jeff Clarke said the company is operating “in an increasingly challenging environment.”

In a conference call Thursday, Chief Financial Officer Tom Sweet said revenue in the current quarter will be $23.8 billion to $25 billion — a sales decline of about 8% from a year ago at the midpoint of the estimate. Analysts, on average, projected $26.4 billion.

Still, Dell said its long-term financial models project annual revenue growth of 3% to 4% and an increase of more than 6% in earnings per share. For the full year, Sweet said revenue should range from flat to 2% growth.

The long-range forecast wasn’t enough to overcome investors disappointment with the current outlook. The shares declined 14% to $41.43 at the close Friday in New York, the biggest one-day drop on record, which fueled a fall of 26% this year.

Sales climbed 9% to $26.4 billion in the fiscal second quarter, which ended July 29, in line with estimates. Earnings, excluding some items, were $1.68 share, the Round Rock, Texas-based company said Thursday in a statement. Analysts, on average, projected $1.64, according to data compiled by Bloomberg.

While personal computer sales make up about 60% of Dell’s revenue, the company overcame a downturn in consumer spending with gains among its business clients. Commercial PC sales grew 15% to $12.1 billion while consumer sales dropped 9% to $3.3 billion.

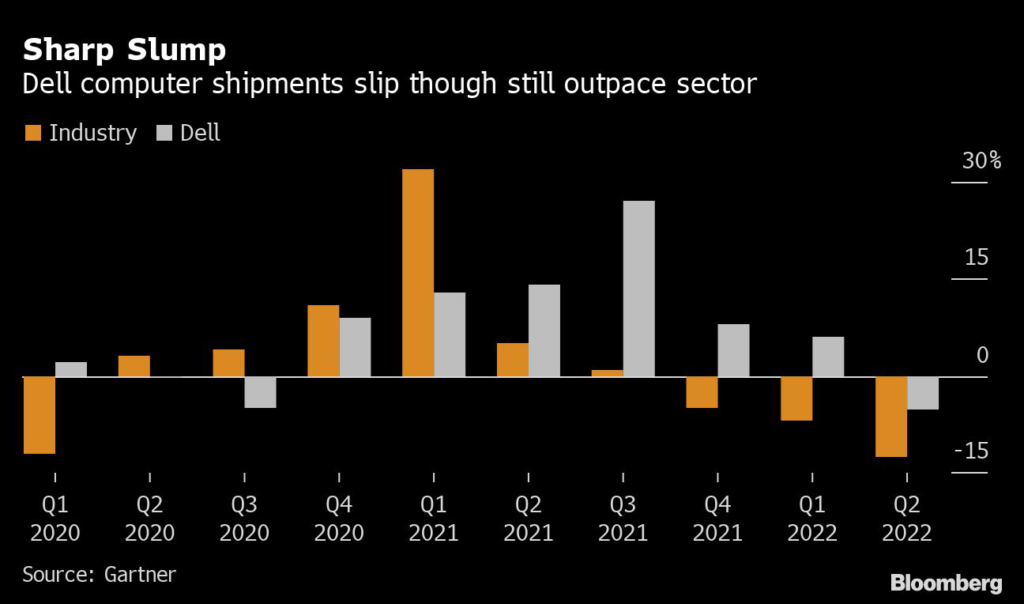

Global PC shipments fell 13% in the three months from April to June — the worst quarter in more than nine years, according to Gartner Inc., an industry analyst. Much of the decline was due to the ongoing downturn in demand for Chromebooks and inflation-squeezed budgets delaying consumer purchases.

Fiscal second-quarter revenue from the Infrastructure Solutions Group, which includes most of Dell’s technology services, increased 12% to $9.5 billion from a year earlier. Server and networking sales climbed 16% to $5.2 billion, while storage revenue gained 6% to $4.2 billion.

Investors may have been expecting Dell’s infrastructure unit to beat estimates, and share gains heading into the results left little room for a rally, said Woo Jin Ho, an analyst at Bloomberg Intelligence.

“We’re somewhat surprised by (Dell’s) more-muted ISG view, given sturdier results from enterprise IT peers,” he said in a note. “Dell notes elongated purchasing decisions and smaller orders and could be a test case for broader weakness.”

To emphasize the continuing slump in the PC market, Sweet said current-quarter sales in Dell’s PC division are expected to decline by a “high teens” percentage from the period a year ago. Revenue will increase “in the low teens” in the infrastructure unit, where executives “see a more challenging” demand environment, he said.

Supply chain backlogs improved during the quarter for Dell, and backlog-clearing PC sales helped offset demand weakness, Clarke said. However, the backlog for its infrastructure unit, particularly for server components, remained elevated, and component cost inflation is expected in the third quarter, he said.

Gross margins decreased 2 percentage points from a year ago to 21.4%, mainly due to expense increases and currency value changes that haven’t yet been factored into product prices, Sweet said. The company slowed down external hiring as part of an effort to control costs, Sweet said.

Dell ended the quarter with remaining performance obligations of $41 billion, up 2% year-over-year. Recurring revenue was $5.2 billion, a gain of 8% from the period a year earlier. The company said annual recurring revenue for APEX, its cloud management service, is now more than $1 billion.

(Updates with Friday closing shares in the fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.