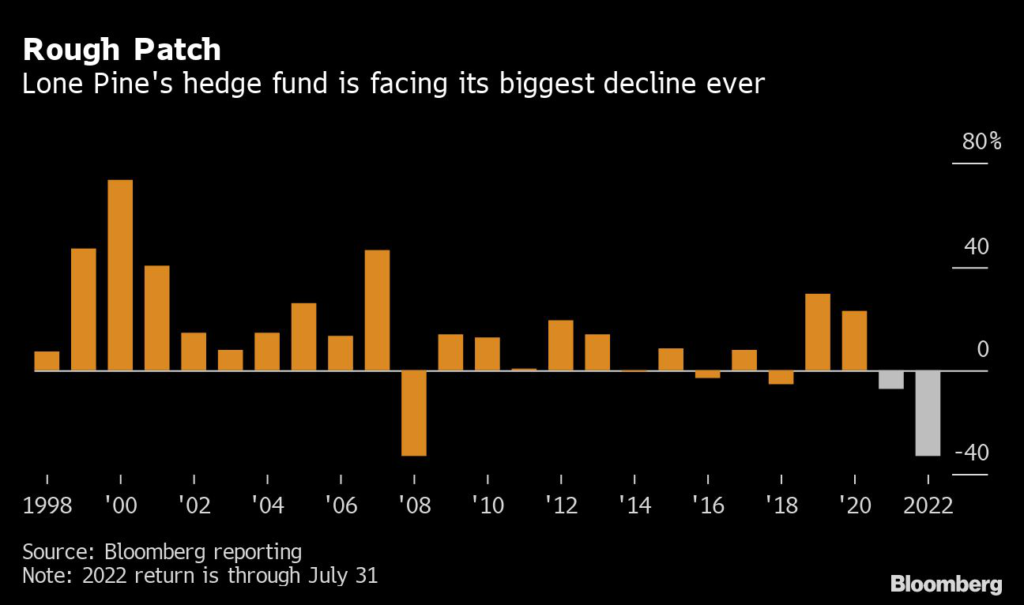

(Bloomberg) — Lone Pine Capital is facing its biggest challenge since Steve Mandel founded the firm a quarter-century ago, with its $5.8 billion hedge fund down the most in its history.

(Bloomberg) — Lone Pine Capital is facing its biggest challenge since Steve Mandel founded the firm a quarter-century ago, with its $5.8 billion hedge fund down the most in its history.

The hedge and long-only funds are both mired in a prolonged slump, each losing more than 30% this year through July on bullish growth-stock wagers that soured. Assets have tumbled 42% to $16.7 billion, driven by the wrong-way bets and client redemptions.

It’s a humbling turn for a firm that long engendered fierce client loyalty with its industry-leading returns and comes just three years after Mandel, 66, stepped back from day-to-day management.

“We recognize that our performance over the past nine months has been deeply disappointing,” Mandel and co-portfolio managers David Craver and Kelly Granat wrote in a letter to clients last month. “While this latest period of underperformance has been difficult, we believe the work we are doing today will set us up to reap the rewards in the months and years to come.”

More withdrawals are coming this quarter, even though performance improved in July, according to investors and other people familiar with the firm. Based on Bloomberg calculations, second-quarter net redemptions totaled about $1 billion, or 6% of assets as of June 30.

A spokesman for Greenwich, Connecticut-based Lone Pine declined to comment.

Growth Stocks

At the start of 2019, Mandel pulled off a rare feat for a hedge fund founder, successfully handing leadership to the next generation.

Instead of managing the portfolio, he spent days researching companies and advising younger colleagues, leaving stock-picking to Craver, Granat and Mala Gaonkar. Lone Pine flourished, posting some of its strongest returns in 2019 and 2020.

Then the bottom fell out for growth stocks.

The hedge fund tumbled 47.1% from September through June, according to the letter. The long-only fund, which managed $10.9 billion, was down 51.6% in the same span, rivaling losses it incurred during a 16-month swoon around the 2008 financial crisis.

While other founders might have jumped back in to protect their wealth and legacies, Mandel hasn’t announced any intention of reasserting his influence on the portfolio, according to some investors. He has, however, participated in recent fundraising conversations with clients, they said.

That’s happening just as Gaonkar, who announced in late 2021 that she was leaving Lone Pine, is raising money for her own firm, SurgoCap Partners, which plans to open next year with at least $1 billion.

Read more: Gaonkar Hires From Third Point, Maverick for Fund Launch

Mandel worked for legendary investor Julian Robertson’s Tiger Management for seven years before launching Lone Pine. Performance was strong from the outset, and even with the recent losses the hedge fund has posted annualized returns of 11.8% since inception through June 30, beating the S&P 500 by 4.1 percentage points.

Those returns have made Mandel a billionaire. He and other insiders account for about 25% of the hedge fund’s assets, according to a March regulatory filing.

‘Steady Compounders’

The firm has been shifting toward investments that it describes as “steady compounders,” while trimming growth stocks, according to the July letter. It also reduced leverage, added to its short bets and increased stakes in some beaten-down equities, including high-end retailer RH, Taiwan Semiconductor Manufacturing Co. and Workday Inc.

Those changes helped Lone Pine benefit from the recent market rebound, with the hedge fund jumping 7% in July and the long-only fund gaining 12%. That still leaves those funds down 33% and 38%, respectively, for the year.

While Lone Pine looks to attract more money, another fundraising project is on hold: a vehicle with a $1 billion target that would invest in later-stage private companies, according to people familiar with the matter. The firm currently has investments in more than two dozen privates, including Outreach Corp., a Seattle-based provider of enterprise software solutions, and Australian payments firm Airwallex.

Still, it might be a while before Lone Pine manages to climb out of the hole. After 2008, it took about three years before the funds returned to breakeven.

“Remaining focused during previous drawdowns,” the firm told investors in July, “has helped drive strong outperformance when the markets eventually recover.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.