Federal Reserve Chair Jerome Powell’s signal of higher-for-longer interest rates coursed through markets Monday, sinking stocks and equity futures and lifting two-year Treasury yields to levels last seen in 2007.

(Bloomberg) — Federal Reserve Chair Jerome Powell’s signal of higher-for-longer interest rates coursed through markets Monday, sinking stocks and equity futures and lifting two-year Treasury yields to levels last seen in 2007.

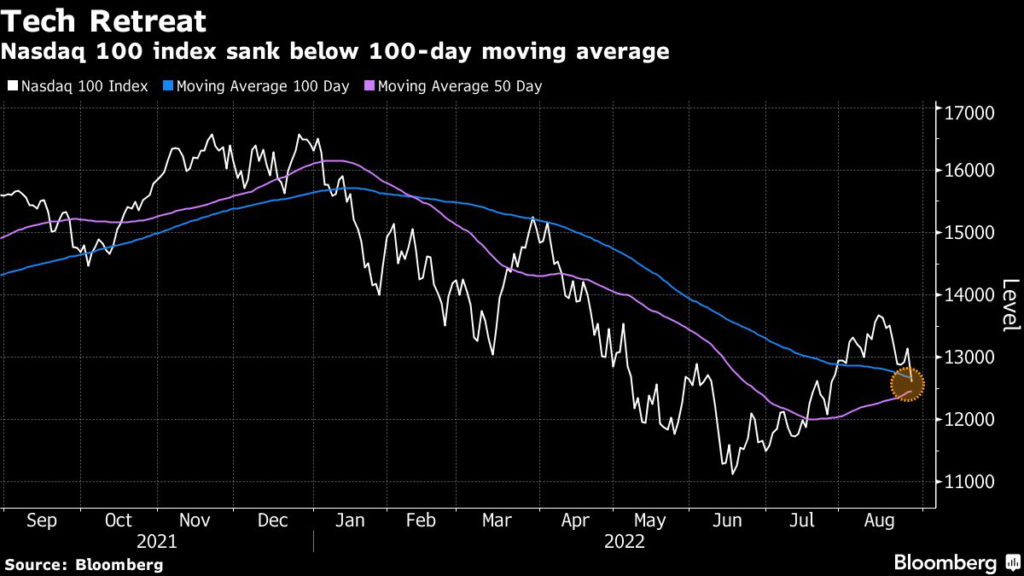

A global share index fell to a one-month low as Asian equities shed over 2%, hurt by tech firms. Losses on Nasdaq 100 and European futures were at least 1%. Progress in the US-China delisting spat helped to cushion Chinese stocks.

The Bloomberg Dollar Spot Index pushed toward the record hit last month as investors sought a haven from spiking volatility. Commodity-linked currencies as well as the yen, the pound and the offshore yuan were under pressure.

Bonds sold off and a deepening inversion of the Treasury yield curve underscored expectations of a recession as monetary policy tightens. The US two-year yield, sensitive to expectations around Fed policy, hit 3.47%

Powell in his address last week at the Fed’s Jackson Hole symposium flagged the likely need for restrictive monetary policy for some time to curb high inflation and cautioned against loosening monetary conditions prematurely. He also warned of the potential for economic pain for households and businesses.

Those comments contrast with bets for reductions in US borrowing costs next year as growth slows. The locus for much of the investor angst is the equities market, further undoing a bounce in global shares from the bear-market lows of mid-June. Other risks include China’s slowdown and Europe’s energy crisis.

Powell signaled “once they get to whatever the final hike is, they’re going to stay there for a while,” Charles Schwab & Co. Chief Investment Strategist Liz Ann Sonders said on Bloomberg Television. “The market had trouble digesting that.”

Bitcoin broke below the $20,000 level some view as a marker of a deeper slide in investor sentiment. Gold retreated but oil made gains on supply risks.

Delisting Progress

The relative resilience in China’s bourses may reflect optimism about a preliminary deal between Beijing and Washington to ease a dispute over reviewing audits of Chinese firms. An agreement is needed to avert the delisting of about 200 Chinese companies from US exchanges.

The mood in global markets overall remains downbeat against the backdrop of a slowing world economy struggling with the highest inflation in a generation, stoked by disruptions from Russia’s war in Ukraine and China’s Covid curbs.

“We’re going to go back down below 4,000 here in short order,” Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, said on Bloomberg Television, referring to the S&P 500. Markets must absorb the fact that “the Fed is going to remain aggressive until inflation’s back is broken,” he said.

Here are some key events to watch this week:

- US consumer confidence, Tuesday

- New York Fed President John Williams due to speak, Tuesday

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- China PMI, Wednesday

- Euro-area CPI, Wednesday

- Russia’s Gazprom set to halt Nord Stream pipeline gas flows for three days of maintenance, Wednesday

- Cleveland Fed President Loretta Mester due to speak, Wednesday

- China Caixin manufacturing PMI, Thursday

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.9% as of 7:21 a.m. in London. The S&P 500 fell 3.4%

- Nasdaq 100 futures dropped 1.2%. The Nasdaq 100 shed 4.1%

- Japan’s Topix index fell 1.8%

- Australia’s S&P/ASX 200 index lost 2%

- South Korea’s Kospi dropped 2.1%

- Hong Kong’s Hang Seng index retreated 0.9%

- China’s Shanghai Composite index was little changed

- Euro Stoxx 50 futures fell 1.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.6%

- The euro was at $0.9928, down 0.4%

- The Japanese yen was at 138.83 per dollar, down 0.9%

- The offshore yuan was at 6.9282 per dollar, down 0.5%

Bonds

- The yield on 10-year Treasuries rose about seven basis points to 3.11%

- Australia’s 10-year yield added 12 basis points to 3.69%

Commodities

- West Texas Intermediate crude was at $93.67 a barrel, up 0.6%

- Gold was at $1,723.20 an ounce, down 0.9%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.