Baidu Inc.’s profit beat expectations, helped by the Chinese search leader’s efforts to expand into new businesses and shield itself from an economic downturn.

(Bloomberg) — Baidu Inc.’s profit beat expectations, helped by the Chinese search leader’s efforts to expand into new businesses and shield itself from an economic downturn.

Sales dropped to 29.6 billion yuan ($4.3 billion) in the April-June period, just above the average analysts’ forecast. But net income came to 3.6 billion yuan, surpassing the 2.2 billion yuan expected.

Baidu’s Netflix-like video service iQiyi Inc. reported revenue a shade weaker than estimates. But it also unveiled improving margins and a deal to place $500 million of convertible notes with Hong Kong private equity firm PAG. Baidu’s and iQiyi’s shares climbed about 3% in pre-market trading in New York.

China’s largest tech giants have made peace with a new reality of low growth and cautious expansion, more than a year after Beijing’s crackdown on internet businesses from e-commerce to edtech and social media. A deepening economic malaise, coupled with strict Covid Zero measures, has crippled consumer demand in the world’s largest mobile app arena.

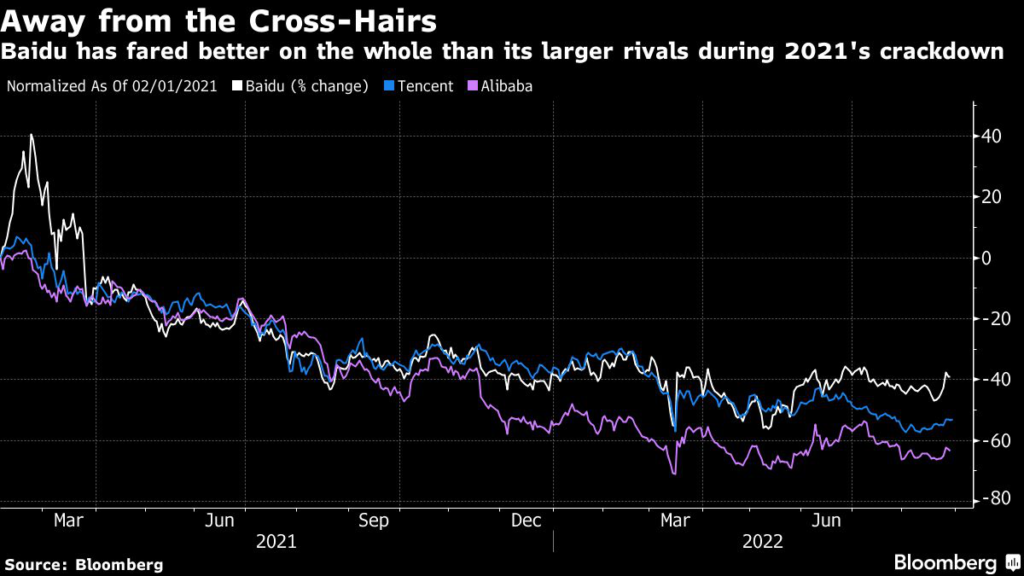

Baidu’s reliance on digital marketing leaves the Beijing-based company vulnerable to the same economic shocks that’ve laid low its bigger rivals. Alibaba Group Holding Ltd. and Tencent Holdings Ltd. both reported their first-ever sales contractions for the June quarter. Online marketing sales declined a better-than-feared 12% while Baidu’s AI cloud revenue grew 31%, down from 45% in the prior quarter.

Baidu’s shares have nonetheless fared better than many of its rivals, staying largely unchanged since the start of the year despite growing economic uncertainty. Beijing and Washington last week reached a preliminary deal allowing American officials to review audit documents of US-listed Chinese stocks including Baidu, in a move toward keeping the companies listed on US exchanges. Its shares surged after news of the agreement emerged.

Baidu is trying to reinvent itself as a supplier of deep technology by expanding into self-driving systems, cloud computing and chips. This month, it won approval to deploy the first fully autonomous taxis on Chinese roads. It also unveiled a self-made quantum computer, saying its resources will be open to the public.

Baidu’s nascent AI cloud division is now its fastest growth engine, but it faces an uphill battle against market leaders including Alibaba and Huawei Technologies Co.

While waiting for these efforts to evolve into meaningful revenue, Baidu depends on its flagship news-search app to win advertising dollars and users from online entertainment platforms operated by Tencent and TikTok-owner ByteDance Ltd.

(Updates with iQiyi’s numbers and PAG deal from the third paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.