Bankers are poised to kick off the $15 billion leveraged buyout financing for Citrix Systems Inc. next week, testing investor demand for risky debt just days after the Federal Reserve pledged to keep raising interest rates.

(Bloomberg) — Bankers are poised to kick off the $15 billion leveraged buyout financing for Citrix Systems Inc.

next week, testing investor demand for risky debt just days after the Federal Reserve pledged to keep raising interest rates.

The loan portion of the deal, an expected $4.05 billion offering, will get under way on Tuesday after being reconfigured several times to help banks offload debt that they committed to provide in January, when credit markets were in much better shape.

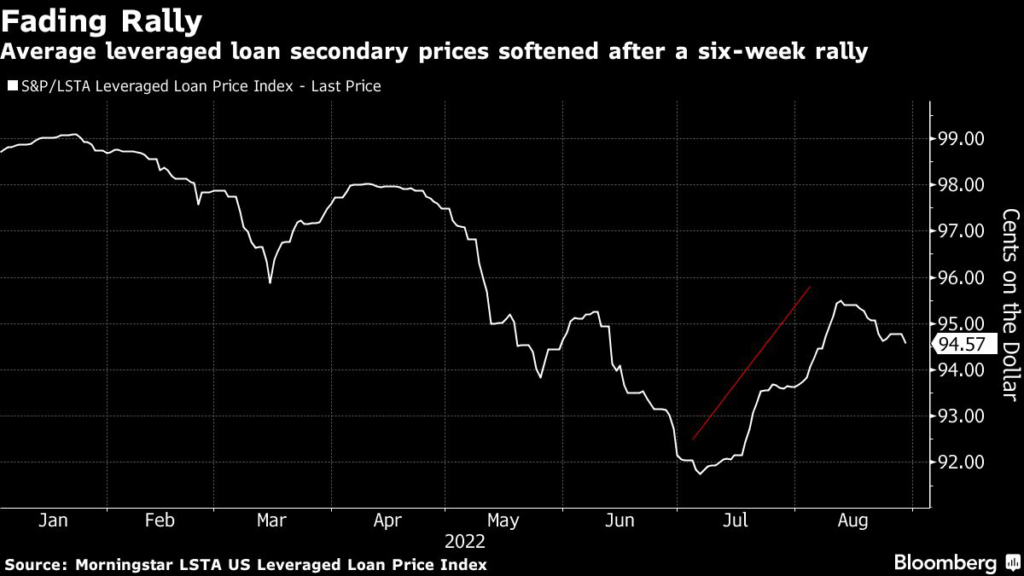

Loans then were trading at around 99 cents on the dollar, and have since fallen to about 94.6 cents on average, according to the Morningstar LSTA US Leveraged Loan Price Index.

Fed Chair Jerome Powell on Friday made the banks’ job harder, saying at a symposium in Jackson Hole, Wyoming, that the US central bank is likely to keep raising interest rates and leave them elevated for a while to stamp out inflation.

This caused a rout in credit markets, a painful double-whammy following the mid-August demise of a six-week rally that had sparked hope the deal might launch in a more-welcoming environment.

Where the Citrix loan prices will indicate any potential losses faced by those banks, led by Bank of America Corp., and how two other large buyout deals for Nielsen Holdings and Tenneco Inc.

may fare.

“The buyout deals will set the tone on what price the market wants to assign to true risk,” said John McClain, a high-yield portfolio manager at Brandywine Global Investment Management.

As a software company, Citrix is more resistant to a downturn, but Nielsen and Tenneco are in media and auto parts, respectively, and therefore more exposed if there is a recession, he said.

The size of the financing is so large that banks have decided to hold onto part of the Citrix debt rather than overload the market with too much supply.

The underwriters plan to hold onto $3.5 billion of a leveraged loan, though they may reduce that amount if there is enough demand for the $4.05 billion broadly syndicated portion, of which about $1 billion has already been placed with private credit firms, Bloomberg reported.

The $4.05 billion loan was floated at a margin of 450 basis points over the Secured Overnight Financing Rate and a discounted price in the low-90 cents range in the latest round of pre-marketing earlier this month, Bloomberg previously reported.

Banks are also expected to retain $3.95 billion of unsecured bond commitments, which were turned into a second-lien loan, though details could change.

The Citrix transaction also includes a $500 million-equivalent leveraged loan denominated in euros and $3 billion of secured bonds.

The Nielsen deal includes $8.35 billion of bonds and loans, and Tenneco plans to sell $5.4 billion.

Banks typically provide temporary debt commitments for acquisitions and buyouts with the intention of replacing them with junk bonds and leveraged loans sold to institutional investors. The underwriters promised to find investors for the debt at specific maximum interest rates, but then the cost of borrowing increased above those caps over the course of the year, leaving banks on the hook for the difference.

Read more: Debt Losses for Buyouts Top $1 Billion and Banks Brace for More

The floating-rate structure of leveraged loans means that the interest rates will continue to increase for these heavily indebted companies as rates rise.

That could cause defaults to increase, making them the “canary in today’s credit coal mine” for a potential recession, according to a recent report by Morgan Stanley strategist Srikanth Sankaran.

After Citrix

Volatility, high valuations, and choppy debt markets have caused a slowdown in new acquisition and buyout activity.

Refinancing of existing debt often makes up a substantial portion of the leveraged finance markets, but many companies already took advantage of low interest rates in the last two years to push out maturities and can wait out turbulence.

“Once we clear this crop of deals, the calendar will be rather light,” said Peter Toal, global head of fixed income syndicate at Barclays Plc.

If the deals go well, that will give underwriters the confidence to commit to new leveraged buyouts and acquisitions, he said. But if the deals struggle, underwriters might hold off on new commitments.

Investors are still looking to put money to work through leveraged loans and junk bonds as rising rates makes lending more attractive.

“The cost of capital has gone up, there’s no question about it, but there will be need for more financing undoubtedly,” said Toal.

“It’s been a long time since we had a really hawkish Fed but the financing markets will continue and there will be windows where they are more open or less open.”

Elsewhere in credit markets:

Americas

Bonds are sliding toward the first bear market in a generation, burning investors who erred in bets that central banks would pivot away from rapid interest-rate hikes.

- Debt markets have swiftly moved to reprice credit risk, following a duration hit from the higher-for-longer rates outlook.

- Mexican President Andres Manuel Lopez Obrador, pilloried for doling out only the bare minimum of pandemic emergency aid, is getting some pay-off as Mexico has maintained access to international bond markets while other developing nations haven’t.

- While junk-rated bonds have traditionally been the credit market’s first to crack as economic conditions deteriorate, that position may now be filled by the more than $1 trillion worth of floating-rate loans, writes Morgan Stanley strategist Srikanth Sankaran in a new note.

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Eleven issuers across 15 tranches were in the primary market on Tuesday, with a minimum placement volume equivalent to 10.79 billion euros ($10.82 billion).

That’s the highest tranche count since June 23, data compiled by Bloomberg show. On Friday, a euro-denominated senior preferred offering by UK lender Nationwide Building Society capped last week’s issuance activity, which amounted to more than the equivalent of 30 billion euros.

- The European Commission approved a plan to transfer bad loans guaranteed by the Italian government to state-owned asset manager Amco SpA, according to a report in Sole 24 Ore

- Nostrum Oil & Gas Plc got court approval for debt restructuring

Asia

China is set to ask companies planning to sell offshore debt with tenors longer than one year to get approval from the country’s top economic planning body, bringing greater enforcement to parts of longstanding guidance on overseas financing as concern mounts about dollar strength.

- The lowest August volume for dollar-bond deals from Asia in a decade continued on Tuesday, as issuers kept to the sidelines amid rising borrowing costs in the US currency

- Still, Korea Electric Power has sent a request for proposals to banks for a potential issuance of dollar notes, a person familiar with the matter said

- Indian solar utility Azure Power Global Ltd.’s dollar notes slid to record lows on Tuesday after the firm’s chief executive officer Harsh Shah unexpectedly resigned

- Vietnam will tighten rules on bond issuance by property companies to curb speculation and rein in high real-estate prices it says are a threat to the nation’s financial market

- Indonesia’s bid to help the rupiah via “Operation Twist” has pushed the spread between long-dated and shorter corporate notes to the lowest in two years

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.