Global markets dropped again on Tuesday as investors fret over further interest rate hikes, looming inflation data, an oncoming recession, the European energy crisis, and the health of China’s economy.

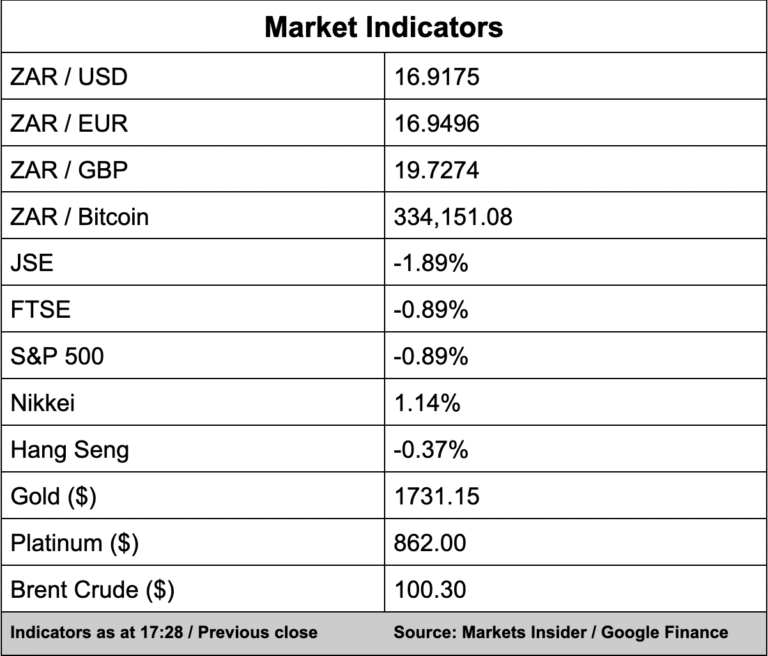

On the local front, the JSE dropped 1.89% with the All Share Index closing on 67,900 points.

In company news, Harmony Gold slumped 11.07% after reporting a R1 billion loss for the first half of the year while profits dropped by 120% in comparison with the previous year when Harmony posted a R5.12 billion profit.

The gold counter operates mainly old and deep gold mines in South Africa and reported a 2% increase in revenue to R42 billion for the first six months of the year.

Super Group (4.88%) reported headline earnings per share increased by 33.4% to 380.7 cents for the first half of the year while group revenue rose by 17% to R46.2 billion and earnings before interest, taxes, depreciation, and amortisation increased by 70% to R7 billion.

The group said the strong results were despite extreme market volatility due to factors such as the war in Ukraine, global logistics and supply chain disruptions, and extreme weather.

Brimstone (0.84%) has been impacted by higher fuel prices and supply chain disruptions, which has led to weak financials for the six months to the end of June.

Headline earnings per share dropped to 10 cents from 100 cents in the corresponding period while no interim dividends were declared.

Brimstone’s subsidiary, JSE-listed Sea Harvest Group (-0.89%), delivered a 29% increase in revenue to R2.7 billion, up from R2.1 billion in the prior period.

Private higher education group Stadio (6.95%), which owns brands like STADIO Higher Education, Milpark and AFDA said headline earnings per share are up 18% and revenue increased by 13% to R617 million for the six months to the end of June.