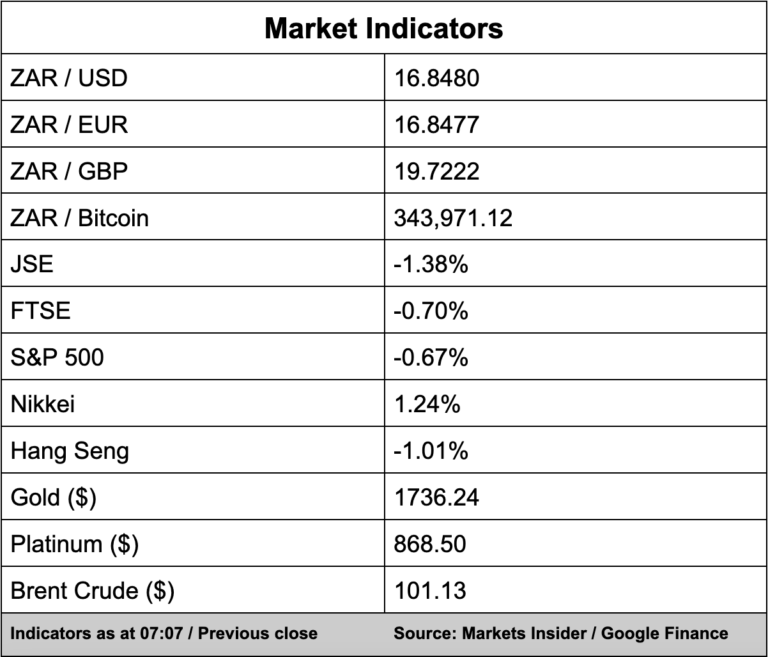

Good morning. Today we’re covering the arrest of former Transnet and Eskom chief executive Brian Molefe, nearly a third of South Africans are still reliant on using cash, and central banks will push us into a recession if it means taming inflation.

Life of Brian: Molefe’s fall from executive darling to court room 9 – News24 (for subscribers)

Former Transnet and Eskom chief executive Brian Molefe was once seen as a rising star within government and became somewhat of an intergovernmental finance expert. But that was before he rose to his high-ranking roles with the two state-owned enterprises.

Once there, he became a key cog in the Gupta family’s plunder of state coffers and was more than willing to loot both Transnet and Eskom. Judge Raymond Zondo recommended that he and other former executives be further investigated by the national prosecuting authority in his report on State Capture.

Yesterday, Molefe and three others, including former Transnet chief financial officer Anoj Singh appeared in the Specialised Commercial Crimes Court in Palm Ridge on the East Rand. The four men were released on R50,000 bail each but the wheels of justice have begun to turn and state capturers have a lot to answer for. Read more here.

A third of South Africans are not yet ready to ditch cash – Tech Central

A new survey shows that while 86% of South Africans already use digital banking, nearly a third of respondents say they still draw cash at least once a month to meet their needs.

The survey conducted by Discovery Bank and Boston Consulting Group indicates that if a significant portion of the population is still reliant on cash, the country cannot transition to a fully cashless system as yet.

High costs for digital banking and a lack of infrastructure are cited as some of the reasons for poorer people and those living in a rural settings to still rely on cash, which is estimated to be as many as 11 million people. Read more here.

Pain of breaking inflation will reverberate around the globe – SABC News

It’s clear that soaring inflation is here to stay and taming it will take an immense effort by the world’s central banks, which will almost certainly result in job losses and a spiral into a recession.

World banks have built a reputation on fighting inflation and if they cannot get a grip on the current rise, it will shake modern monetary policy to its core.

European Central Bank board member Isabel Schnabel said “the longer inflation stays high, the greater the risk that the public will lose confidence.” She added that even if markets do enter a recession there is little choice but to continue with a hawkish policy path. Read more here.

Here’s what else we’re reading today:

Discovery Health clients ‘forced’ to join Discovery Bank to receive flight and travel discounts – Business Insider

Half a million security guards may go on strike soon, unions warn – Fin24

French govt warns businesses that electricity may be rationed – Fin24

Walmart makes offer to buy out rest of Massmart – Sowetan LIVE

‘Hopeless’ – drivers slam Uber, Bolt after meetings – Fin24

Search for new SABC Board members to start on Tuesday – SABC News

The world’s best consumer digital banks named for 2022 – Bizcommunity

Fuel prices still on track for a cut next week – but margin is shrinking – Fin24

Image Credit: Brian Molefe briefs the media with former president Jacob Zuma in the background, GCIS