Stock markets resumed their downward trend on Wednesday as traders keep an eye on the US Federal Reserve’s resolve to beat down inflation with sharp interest rate rises, reports AFP.

Investors fear higher interest rates will force the world’s largest economy into a recession and following Fed chair Jerome Powell’s comments last week that the bank would need to tighten its policy much more to succeed in its battle, global stocks have borne the brunt.

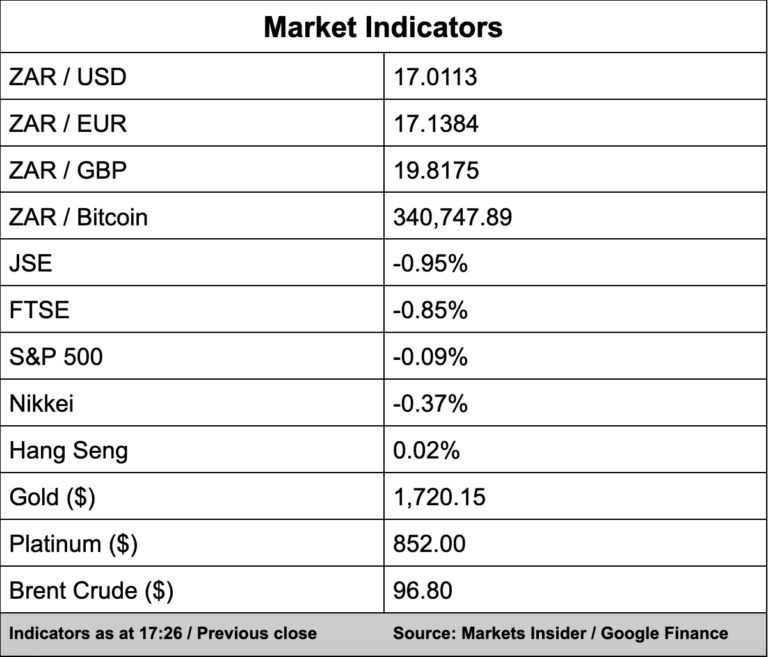

On the local front, the JSE slipped 0.95% in what is its fourth straight day of losses with the bourse unable to shield itself from global sentiment around rate hikes. The All Share Index closed at 67,257 points.

In company news, Discovery (-4.18%) said via a trading statement that its headline earnings for the year to end June are expected to increase by between 70% and 80%.

Its South African business saw a 38% to 43% increase in normalised operating profit and this is despite Discovery Insure’s profit falling by more than 160% following the claims made after the flooding in KwaZulu-Natal earlier this year.

Retailer Woolworths (4.77%) said it would hike its dividend to 229.5 cents per share, which represents an increase of almost 250% more than its dividend of last year at 66 cents per share.

Woolies said it has seen a strong recovery in its Australian operations in recent months following a severe lockdown in the first half of its financial year while the South African clothing business is also showing signs of life. Woolies total turnover grew by 1.4% to R87 billion.

Aspen Pharmacare’s share price jumped nearly 6% following the release of good financial results. Annual revenue increased by 2% to R38.6 billion with headline earnings per share up 31% while a dividend of 326 cents a share was declared – an increase of 24%.