Stocks were mixed Friday and global bonds slumped into their first bear market in a generation ahead of key US jobs data that could stir expectations for another sharp Federal Reserve interest-rate hike.

(Bloomberg) — Stocks were mixed Friday and global bonds slumped into their first bear market in a generation ahead of key US jobs data that could stir expectations for another sharp Federal Reserve interest-rate hike.

Europe’s Stoxx 600 index climbed, ending a five-day losing streak, while US futures were little changed and Asian shares fell.

The jobs update Friday is expected to show healthy payrolls growth and follows a stronger-than-expected US manufacturing report. Traders increasingly anticipate another large 75 basis points Fed rate rise to cool inflation.

Concern that rising rates will hurt growth has weighed on markets, pushing the Bloomberg Global Aggregate Total Return Index of government and investment-grade corporate bonds down more than 20% from a 2021 peak.

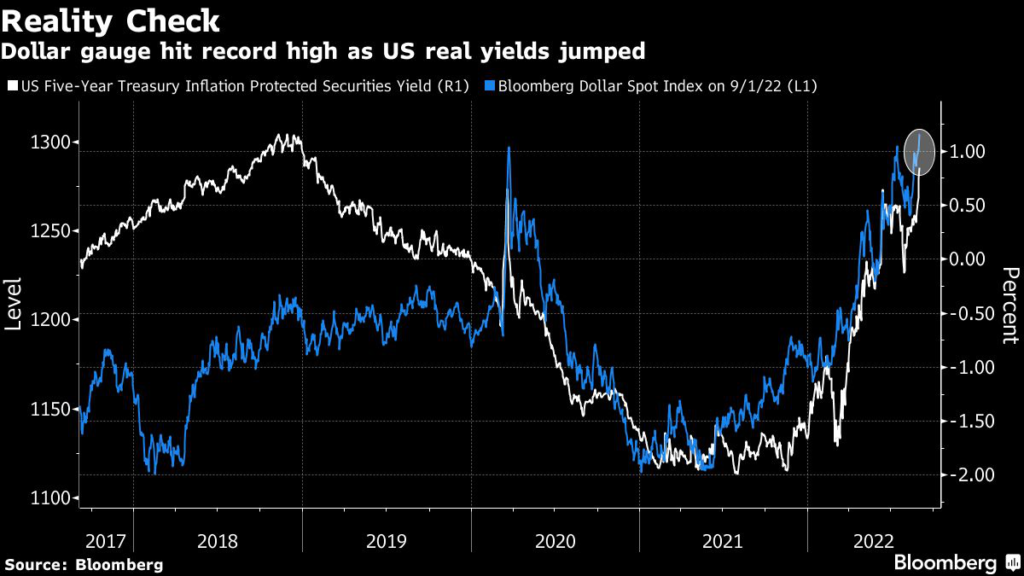

A dollar gauge held near a record high and the euro strengthened.

Energy companies outperformed in Europe as oil rose to pare a hefty weekly decline before an OPEC+ meeting on supply. Russia looks set to resume gas supplies through its key pipeline, a relief for investors even as fears persist about more halts this winter.

Among individual movers, JD Sports Fashion Plc, Puma SE and Adidas AG edged higher after Canadian peer Lululemon Athletica Inc. raised its full-year outlook. Lululemon jumped in premarket trading.

But traders remain cautious. A gauge of world shares is set for its worst week since June, roiled by ebbing bets on tempered Fed tightening after US central bank officials made it clear that they see the need for restrictive monetary settings for some time.

Investors are also exiting global stock funds at a fast pace, with the fourth-largest weekly outflows of the year in the week through Aug. 31, according to BofA citing EPFR Global data.

“We don’t have a lot of reasons to be bullish in this type of environment for the next couple of weeks and months,” Meera Pandit, global market strategist at JPMorgan Asset Management, said on Bloomberg Television. “Yet when we think about the longer term perspective and the longer term investor, these are the types of level that can be fruitful in the long run.”

The payrolls report later Friday is projected to show a 298,000 gain and solid wage growth. Federal Reserve Bank of Atlanta President Raphael Bostic said there’s still some work to do to contain price pressures.

Gold and Bitcoin rose.

Here are some key events to watch this week:

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Will Chinese sovereign bonds outperform Treasuries? China is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.7% as of 10:15 a.m. London time

- Futures on the S&P 500 were little changed

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 2.2%

- The MSCI Emerging Markets Index fell 1.8%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.3% to $0.9972

- The Japanese yen fell 0.1% to 140.36 per dollar

- The offshore yuan was little changed at 6.9175 per dollar

- The British pound was little changed at $1.1549

Bonds

- The yield on 10-year Treasuries was little changed at 3.26%

- Germany’s 10-year yield advanced two basis points to 1.59%

- Britain’s 10-year yield advanced three basis points to 2.91%

Commodities

- Brent crude rose 2.7% to $94.88 a barrel

- Spot gold rose 0.4% to $1,704.73 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.