A wave of foreign buyers is coming after British technology companies, threatening to rob the UK market of what little exposure it still has to high-growth assets.

(Bloomberg) — A wave of foreign buyers is coming after British technology companies, threatening to rob the UK market of what little exposure it still has to high-growth assets.

Canadian Open Text Corp.’s takeover offer for Micro Focus International Plc follows NortonLifeLock Inc.’s purchase of cybersecurity firm Avast Plc, interest from France’s Schneider Electric SE in industrial software developer Aveva Group Plc and US buyout group Thoma Bravo’s overtures toward Darktrace Plc.

And GTCR said Tuesday it’s considering a bid for identity verification and fraud prevention company GB Group Plc.

These deals may not be the last, as a protracted selloff in growth assets and a weaker pound make the UK fertile ground for bargain hunters.

But the foreign shopping spree is completely at odds with the British government’s efforts to foster a strong domestic tech scene and attract more growth listings in London.

“The swoop on UK targets by overseas buyers will undoubtedly cause unease among politicians,” said Susannah Streeter, senior analyst at Hargreaves Lansdown.

“It’s fresh evidence that UK assets are considered to be cheap, weighed down by the impact of Brexit, the weakening pound, the energy crisis and the looming recession set to hit the economy.”

London has been lobbying hard for the chip designer Arm Ltd.

to list at home, six years after SoftBank Group Corp. took it private. The Japanese group’s founder, Masayoshi Son, has repeatedly said his primary focus is to take Arm public in the US because of its deep investor base and attractive valuations, but is also considering a UK listing in part because of political appeals.

Darktrace was one of several high-profile initial public offerings across 2021 in London and listed less than 18 months ago.

The stock has had a wild ride since, nearly quadrupling before tumbling back to trade at twice the listing price. It’s one of the few tech IPOs from last year that hasn’t plunged since its debut.

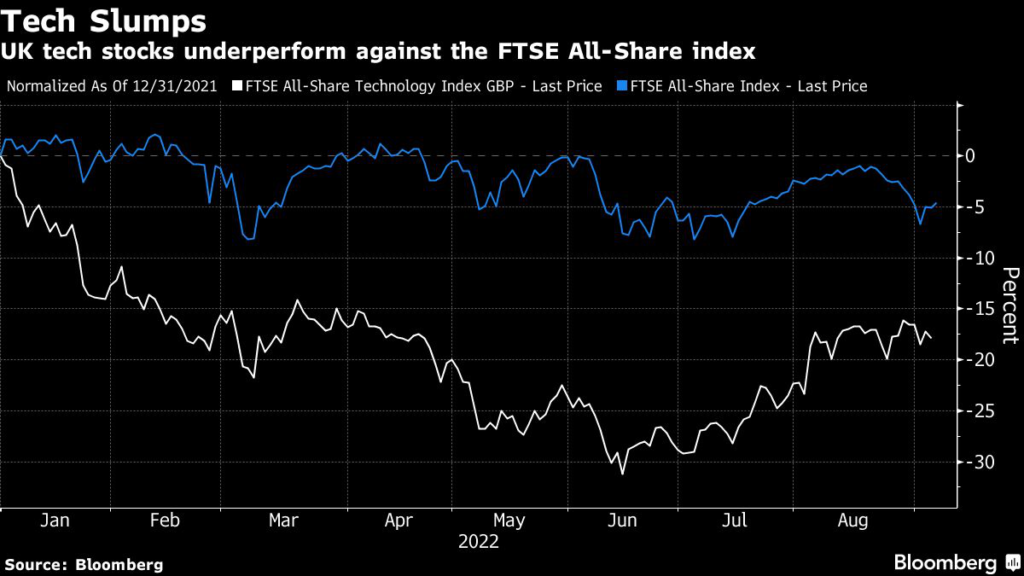

The latest flurry of takeovers will eat into the FTSE All-Share index’s already meager 1.5% exposure to tech, as all the suitors are based outside of the UK.

Analysts also see Kape Technologies Plc, Redcentric Plc, The Sage Group Plc, and Keywords Studios Plc among the most likely takeover candidates in the space.

“The relative cheap valuations of many UK tech companies compared to their US peers, combined with the weakness of sterling are likely to continue to attract suitors,” said Neil Campling, head of TMT research at Mirabaud Securities.

Buyout groups are sitting on tremendous piles of dry powder and firms may conclude that buying is quicker than building, he said.

Still, the UK’s startup scene is the liveliest of any European country.

It’ll take a few years for the effects of the government’s tax incentives and easing of visa rules to attract talent in the sector to come to fruition. But in some areas, like fintech and health tech, Britain is already ahead of other major financial centers like New York, according to Goodbody analyst George O’Connor.

“Once upon a time UK tech companies wanted to list on Nasdaq seeing that venue as the tech mothership.

This is no longer the case,” he said. London is a “superb venue for earlier-stage growth companies with a generation of entrepreneurial fund managers unrivaled on the global stage,” he said.

(Adds news about GTRC’s interest in GB Group in the second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.