Is the streaming giant ready for America’s richest and most popular sport?

(Bloomberg) — When the National Football League’s regular season kicks off Thursday, millions of fans will settle into their easy chairs to watch America’s biggest, richest sport. But a different, multibillion dollar match will unfold a week later.

Starting Sept. 15, viewers who want to watch “Thursday Night Football” will have to log in to Amazon.com Inc.’s Prime Video streaming service. The contest between the Los Angeles Chargers and Kansas City Chiefs is the first regular-season game in an 11-year, $13 billion deal that makes Amazon the exclusive home of “Thursday Night Football.”

It’s the first time a streaming service has obtained exclusive, season-long rights to NFL games in the US, and it presents a big challenge to major networks—like CBS, ESPN, NBC and Fox—that have dominated televised sports for generations. If Amazon can attract the millions of viewers and prestige advertisers that football usually draws, other leagues, like the NBA, may be more willing to offer exclusive packages to online heavyweights.

“This is an inflection point,” said Daniel Cohen, executive vice president of global media rights consulting at Octagon, a division of the ad giant Interpublic Group of Cos. “We’ll look back on this season of Amazon exclusively producing and distributing NFL games as a turning point in sports broadcasting.”

Sponsors flock to the NFL because it’s one of the few places to reach a large live audience—this year’s Super Bowl, for instance, drew an audience of 112 million in the US, about seven times the number who tuned in for soccer’s World Cup final four years earlier.

It’s also the last stronghold of the networks. While films and TV series have shifted to streaming, people still need cable or satellite TV to watch most live sports. Sports accounted for nearly all of the 100 most-watched broadcasts on TV last year, with professional football alone amounting to 75 of them. With an NFL deal in hand, Amazon is positioned to capture a cut of the $66 billion US TV advertising market.

Over the last couple of years, Amazon and Apple Inc. have started to buy their way into this exclusive club, acquiring rights to baseball, soccer, tennis and other sports around the world. But these deals have mostly been for partial packages or in smaller markets.

“Thursday Night Football” provided Amazon with an opportunity to get in the big game. Three of the league’s biggest partners, CBS, NBC and Fox, had all aired Thursday night games and found it hard to make money, in part because the league tended to stick them with less-desirable matchups. Amazon had streamed NFL Thursday games that also aired on the NFL Network and Fox. But it had never had an NFL package to itself.

The company made early headway streaming sports in Europe. Deals there are shorter than in the US, creating more opportunities for newcomers. Amazon snagged rights to stream the US Open tennis tournament in the UK and Ireland and acquired Premier League rights in the UK, as well as the Champions League soccer tournament in the UK, Italy and Germany.

In the US, Amazon started showing some exclusive New York Yankees games and became the streaming home of soccer’s Seattle Sounders. But it had a harder time convincing major sports leagues to entrust a streaming service with multibillion-dollar media rights.

As the NFL prepared to seek a new round of media deals, Marie Donoghue, Amazon’s vice president of global sports video, moved to convince her bosses to make a big offer. A near 20-year ESPN veteran hired by Amazon in 2018, she drafted a document that outlined all the reasons that NFL rights would benefit the company and its customers.

“We said let’s step back and look at it differently,” Donoghue recalled. “Let’s look at it as a once-in-a-decade opportunity to create appointment viewing for tens of millions of fans.”

Amazon has long invested in entertainment to entice customers to its Prime business. Prime members pay $139 a year to get faster, free shipping, as well as access to video and music services. They shop more than people who aren’t Prime customers.

In March 2021, Amazon agreed to pay about $1.2 billion a year for exclusive rights to “Thursday Night Football”— an 80% increase over what Fox Corp. paid under the previous deal, but less than what other networks pay for Sunday and Monday timeslots. Not long after signing, the NFL added another wrinkle: The league was ending its Thursday night deal with Fox after the 2021 season, a year earlier than expected.

That meant Amazon had to be ready a year early. Both Chief Executive Officer Andy Jassy and Chairman Jeff Bezos signed off.

The show is being shepherded by Fred Gaudelli, who has been producing prime-time football for more than 30 years. Longtime broadcaster Al Michaels will handle play by play and Kirk Herbstreit, best known for his college football analysis, will provide color commentary.

Gaudelli will use most of the standard features of a football broadcast, including a pregame show, sideline reporters and a halftime show. Several former NFL players, including Ryan Fitzpatrick and Richard Sherman, will serve as analysts before, during and after games. But he also knows Amazon needs to do more.

In its main feed, Amazon will overlay stats and game updates using what it calls X-Ray technology. It will offer an alternate stream for younger audiences, hosted by a group of YouTube personalities called Dude Perfect, and will also carry games on Twitch, an Amazon-owned site popular among video-game enthusiasts.

“I know the NFL audience, especially the prime-time audience, extremely well,” Gaudelli said. “If you came out there and just threw stuff up against the wall to see what would stick, I thought it would fail. I had no desire to be a part of that.”

The first challenge for Amazon will be making sure people know where to find “Thursday Night Football.” The company plans to buy ads on cable-TV channel guides to remind fans that the Thursday games aren’t on TV anymore.

Amazon also struck a deal with DirecTV so the games will still be available in bars and restaurants, and home-town fans will be able to see their teams on local stations when they play on Thursday nights. In addition, the company plans to promote the broadcasts atop everything from the Amazon.com homepage to the cardboard boxes that Prime subscribers have delivered to their homes.

Streaming live sports glitch-free is another concern. In 2018, Amazon had problems broadcasting the US Open tennis tournament in the UK, with fans complaining about poor picture quality and functionality. Live-streamed events are more vulnerable to crashes than on-demand films and TV shows, and fans will be angry if any big moments are interrupted.

“Even if Amazon does everything they can, they’re still going to have issues,” said Dan Rayburn, a streaming media analyst.

Amazon has spent months preparing, communicating with internet providers to make sure they are ready for an expected spike in traffic. It will reduce picture quality for fans with low bandwidth to ensure their stream doesn’t crash. And it has hired more customer-service representatives to field the inevitable complaints on social media.

“I don’t think there’s any company more prepared than we are to handle that type of scale and that type of challenge,” said Jay Marine, an Amazon veteran and former technical adviser to Bezos who now oversees Amazon’s sports business. “It’s what we’re good at.”

For Amazon, success this NFL season could take many forms. It could sell more Prime subscriptions, since watching games requires people to sign up. It could also help sell other Amazon products. A recent ad urged fans to “experience each game to the fullest” by purchasing Amazon’s Fire TV Stick, a streaming device. The company’s first preseason game featured several commercials for Amazon products and programs, including “The Lord of the Rings: The Rings of Power,” a highly anticipated series the company produced.

“We’re confident we’ll not only see a lot of people signing up for Prime but also exposed to other parts of the Prime membership,” Marine said. He added: “We have a long-term horizon. While we’re focused on the first game, success is really going to be ‘How are we doing three, five, seven, 11 years from now?’ Half of my brain is focused there.”

Amazon is also eager to see how NFL games benefit its advertising business, which generates about $30 billion a year in revenue and already exceeds competitors in traditional TV.

The company is charging about $600,000 for a 30-second spot, more than the roughly $500,000 that Fox sought last year, according to a person familiar with the matter. Amazon has told advertisers it has an abundance of data on Prime subscribers and could serve up targeted ads that lead to purchases, said the person, who asked not to be identified discussing negotiations with sponsors.

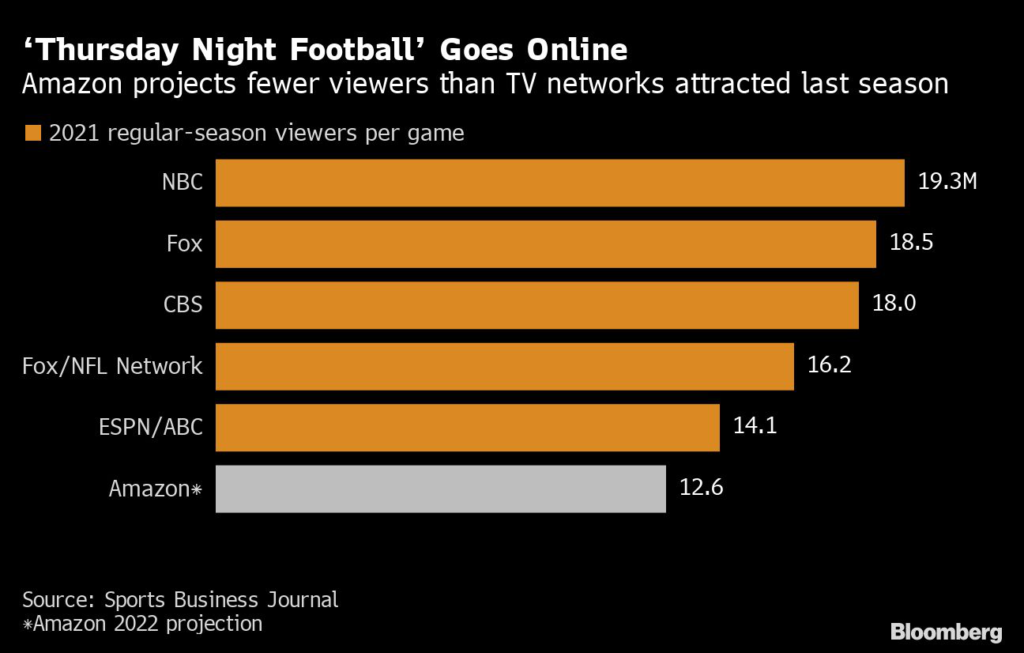

Amazon is guaranteeing advertisers it will reach more than 12 million viewers per game, down from about 16.4 million last year, the person said. Those projections were reported earlier by the Wall Street Journal. About 80 million households have watched Amazon Prime Video at least once in the past year, according to the company, about the same number who subscribe to a pay-TV service.

The arrival of Amazon and Apple on the sports media landscape has been celebrated by leagues whose media rights become more valuable when there are more bidders. It has worried media companies that now must compete with tech giants that have more money and other business goals.

Amazon had over $60 billion in cash and marketable securities on its books at midyear, more than double the combined sums of ABC/ESPN owner Walt Disney Co., CBS parent Paramount Global, NBC parent Comcast Corp. and Fox. Tech titans like Amazon and Apple may be willing to lose billions of dollars on sports if they sell more iPhones and diapers.

Recent negotiations show that most sports leagues aren’t yet ready to go all-in with streaming services. Amazon lost a bidding war for Champions League soccer in the US to CBS and failed to win rights to the Big Ten conference despite reportedly offering more than CBS and NBC. ESPN beat Amazon for the rights to Formula 1 racing, a deal that Netflix Inc. also sought. Industry observers say that Amazon might have won at least one of those deals if it had already proven its NFL broadcasts were a success.

Amazon still has a few chances to add to its sports portfolio. It’s competing with Apple and Google for the NFL Sunday Ticket, a package of out-of-market games that DirecTV has long offered. And it could go after the next big sports rights on the horizon: the NBA. The league will want large increases in fees from its partners, ESPN and Warner Bros. Discovery Inc., which may result in a third package for a streaming service.

“The NBA is interesting to anyone who is in the sports world,” Marine said.Amazon is different than other companies, he added. When it spends billions on sports, it’s willing to wait years for the payoff.

“There’s a misconception that if you’re a company of a certain size that you’ll necessarily be irrational,” Marine said. “We’re actually very rational. But we’re willing to make bets and willing to bet on invention and the future.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.