(Bloomberg) — European stocks pared early gains, with investors cautious before a potential jumbo interest rate hike by the region’s central bank later Thursday.

(Bloomberg) — European stocks pared early gains, with investors cautious before a potential jumbo interest rate hike by the region’s central bank later Thursday.

The Stoxx 600 Index surrendered an initial 0.6% advance as retailers slumped after a profit warning from Primark-owner Associated British Foods Plc. US equity futures were little changed following a near-2% advance in the S&P 500 and Nasdaq 100 on Wednesday.

The pound weakened after sliding to its lowest level against the greenback since 1985 on Wednesday. UK bond traders prepared to hear details of Prime Minister Liz Truss’s economic aid plan, amid widespread speculation of further debt sales to fund it that could drive up yields.

A dollar gauge rose as traders assessed comments from Federal Reserve officials on their commitment to fighting inflation. Treasuries steadied after rallying as Australia’s central bank chief signaled a potential end to outsized policy moves.

Central banks are walking a tightrope, moving sharply to tackle price pressures while remaining leery of sparking a damaging economic contraction in the process. The European Central Bank takes center stage later, with Bloomberg Economics predicting a 75 basis points rate increase to front-load tightening even as the region grapples with an energy crisis.

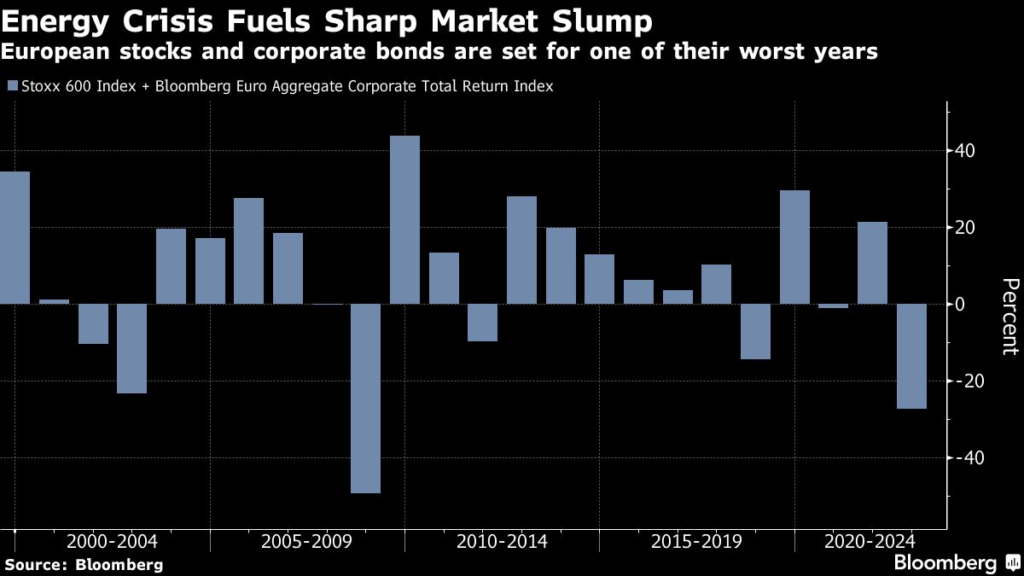

“What we are seeing in Europe is very, very concerning, what is happening there is the worst energy crisis we have seen since the oil embargo in 70s,” Ryan Lemand, Securrency capital advisor to the board, said on Bloomberg Television. “Europe will face a recession, one of the worst recessions it will have faced and I don’t think risky assets are pricing this in correctly.”

Fed officials reiterated their determination to get inflation under control. Vice Chair Lael Brainard said interest rates will need to rise to restrictive levels, while cautioning risks would become more two-sided in the future. Chair Jerome Powell is due to speak later on Thursday.

“What’s clear to us is the Fed continues to emphasize they are not done until they see inflation coming back toward that 2% target,” Nadia Lovell, UBS Global Wealth Management’s senior US equity strategist, said on Bloomberg Radio.

Goldman Sachs Group Inc. economists lifted their forecast for the pace of Fed interest rate increases, expecting the Fed to hike by 75 basis points this month and 50 basis points in November, up from previous forecasts of 50 basis points and 25 basis points respectively. They are tipping a 25 basis points move in December.

The Fed’s Beige Book report said US economic expansion prospects were weak, while adding that price growth showed signs of decelerating.

In Asia, a gauge of the region’s stocks rebounded from the lowest level since 2020. The yen slid for a fourth day after a meeting of senior Japanese officials to discuss the currency’s slide failed to generate a change in sentiment from traders.

Elsewhere, oil held a sharp slide this week sparked by demand risks from monetary tightening and China’s Covid travails — the megacity of Chengdu extended a weeklong lockdown in most downtown areas.

Gold wavered, while Bitcoin held above the $19,000 level.

What to watch this week:

- European Central Bank rate decision, Thursday

- Fed Chair Jerome Powell due to speak, Thursday

- Chicago Fed President Charles Evans and his Minneapolis counterpart Neel Kashkari due to speak, Thursday

- EU energy ministers extraordinary meeting on emergency intervention in electricity markets, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 was little changed as of 10:29 a.m. London time

- Futures on the S&P 500 were little changed

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index rose 1%

- The MSCI Emerging Markets Index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0000

- The Japanese yen fell 0.2% to 144.05 per dollar

- The offshore yuan was little changed at 6.9640 per dollar

- The British pound fell 0.4% to $1.1484

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.25%

- Germany’s 10-year yield was little changed at 1.59%

- Britain’s 10-year yield was little changed at 3.04%

Commodities

- Brent crude fell 0.4% to $87.65 a barrel

- Spot gold rose 0.1% to $1,720.21 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.