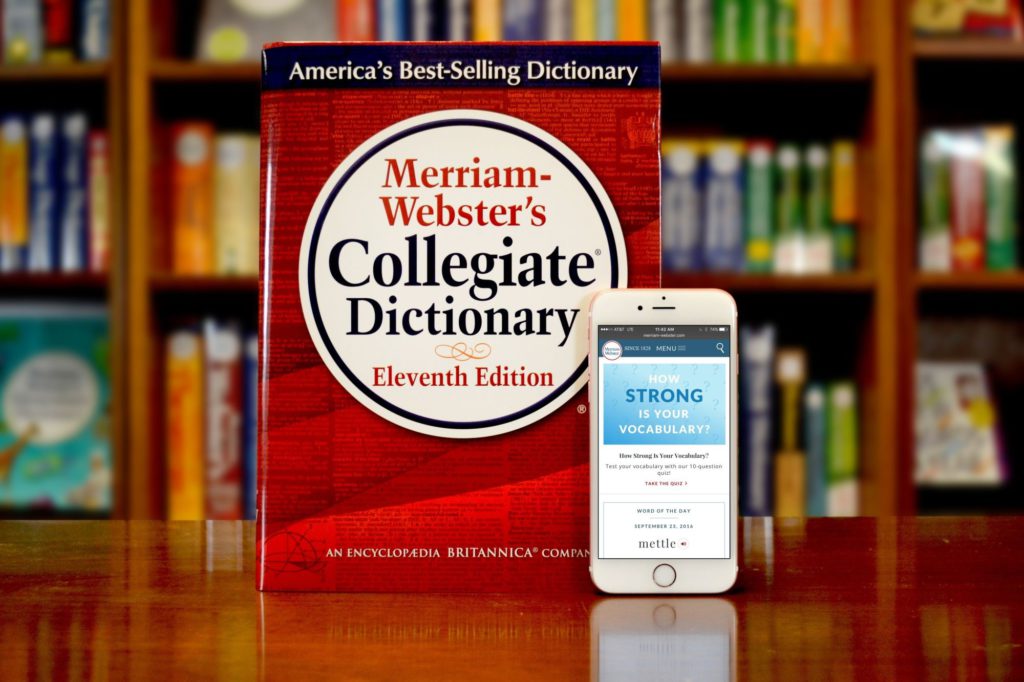

Britannica Group, the publisher of the Merriam-Webster dictionary as well as its historic namesake encyclopedia, is weighing an initial public offering as soon as next year, according to people with knowledge of the matter.

(Bloomberg) — Britannica Group, the publisher of the Merriam-Webster dictionary as well as its historic namesake encyclopedia, is weighing an initial public offering as soon as next year, according to people with knowledge of the matter.

The company, now an education-technology business with mostly digital products, could be valued at more than $1 billion in an IPO, the people said, asking not to be identified discussing private matters. It’s also considering raising private capital ahead of the listing, the people said.

The timing of a listing will depend on market conditions and Britannica could decide to remain private, they added.

Britannica, founded more than 250 years ago, will have revenue approaching $100 million in 2022, Chief Executive Officer Jorge Cauz said in an interview. The majority of that came from sales of online materials after the company retired most of its print operations a decade ago. Britannica has a combined growth rate and profit margin of about 50%, he said.

“We are seeing significant increases in revenue and increases in margin. So we want to continue to grow obviously,” Cauz said. “But since the market changes so rapidly, especially after Covid, we do want to tap into the public markets to accelerate that growth.”

Digital Curriculum

The Chicago-based company has focused on building digital curriculum on so-called foundational skills — basic literacy, numeracy, and transferable skills. It also develops English language courses for international markets such as Latin America and Asia, Cauz said.

School closures during the coronavirus pandemic put a spotlight on education technology, estimated to be a $45 billion market globally for K-12 instruction. The boom benefited edtech startups such as Byju’s, an Indian rival to Britannica that is seeking new funding that would value it at $23 billion, according to reports.

Cauz said the market for edtech is very fragmented and no single player has a share exceeding 2%.

He added that market conditions will determine when an IPO would happen. “We really want to time it in a way so that our current shareholders and future shareholders would be able to benefit from what we’re going to be doing,” he said.

‘Adorkable’

Merriam-Webster continues to hold sway over language in the English-speaking world, updating its dictionaries to reflect newly coined words and usage. This week, it announced 370 additions, including “video doorbell” and “side hustle,” as well as “sus” (for suspicious), “adorkable” (a combination of adorable and dorky).

(Updates with plan to raise capital in second paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.