(Bloomberg) — An Asian stock gauge rebounded Thursday from the lowest level since 2020 but the move trailed a Wall Street rally as the dollar renewed its climb and crude oil edged higher.

(Bloomberg) — An Asian stock gauge rebounded Thursday from the lowest level since 2020 but the move trailed a Wall Street rally as the dollar renewed its climb and crude oil edged higher.

The regional index rose 1%, short of rallies of about 2% in the S&P 500 and Nasdaq 100 overnight. Japan led the advance, while Hong Kong and China slipped and US futures fluctuated. European futures edged higher.

A dollar gauge rose and remains near a record. Greenback strength has rattled currencies like the yen and the pound, which earlier hit the lowest since 1985. In Asia, it’s adding to worries of capital outflows as rate differentials with the rest of the world widen, pressuring the region’s stocks.

Treasuries held a climb, leaving the 10-year yield at 3.23%. Bonds got a boost from an oil plunge that put the spotlight on the possibility of cooling inflation.

Australian yields slumped, with the three-year sinking as much as 23 basis points, after the nation’s central bank governor signaled a potential end to outsized interest-rate hikes. Australia’s dollar extended declines.

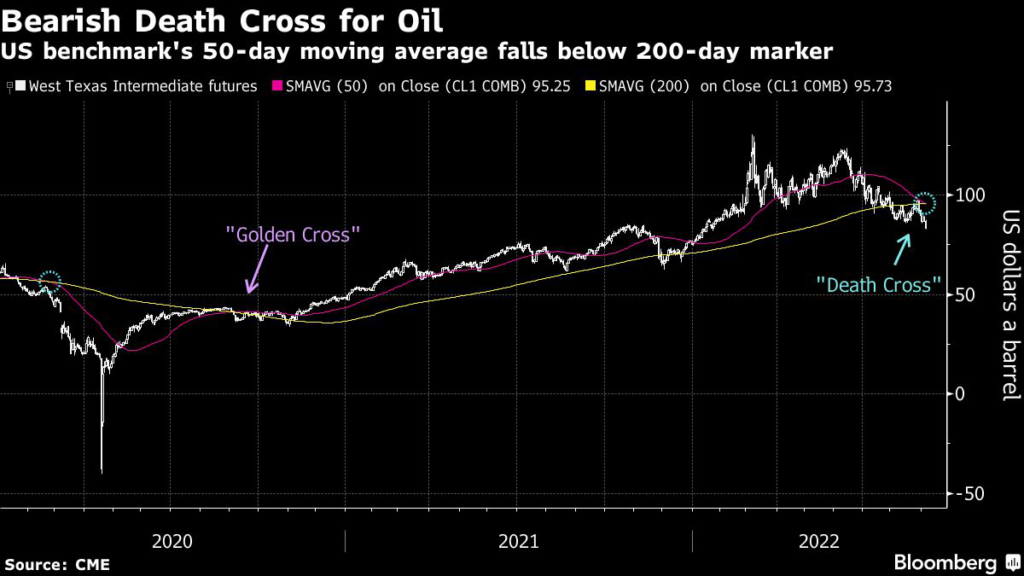

While oil has trimmed some of its retreat, this week’s swoon flags demand risks from a wave of monetary tightening and China’s Covid travails — the megacity of Chengdu extended a weeklong lockdown in most downtown areas.

Central banks are walking a tightrope, raising interest rates sharply to tackle inflation while remaining leery of sparking a damaging economic contraction in the process. The uncertainty is whipsawing markets and has saddled equities and bonds with steep losses this year.

“The stock market has rallied several times even as the bond market has shown lots of negative volatility and the dollar continues to creep up,” Federated Hermes Senior Equity Strategist Linda Duessel said on Bloomberg Television. “You have to wonder when can we expect a sustained rally here or to think we are out of the woods.”

Fed officials reiterated their determination to get inflation under control. Vice Chair Lael Brainard said interest rates will need to rise to restrictive levels, while cautioning risks would become more two-sided in the future. Chair Jerome Powell is due to speak on Thursday.

ECB Center Stage

Monetary policy has tightened further with rate hikes in Canada and Australia this week. The European Central Bank takes center stage later Thursday — Bloomberg Economics predicts a 75 basis points increase to front-load tightening even as the region grapples with an energy crisis.

The Fed’s Beige Book report said US economic expansion prospects were weak and set to slump further over the next year, while adding that price growth showed signs of decelerating.

“What’s clear to us is that the Fed continues to emphasize that they are not done until they see inflation coming back toward that 2% target,” Nadia Lovell, UBS Global Wealth Management’s senior US equity strategist, said on Bloomberg Radio.

What to watch this week:

- European Central Bank rate decision, Thursday

- Fed Chair Jerome Powell due to speak, Thursday

- Chicago Fed President Charles Evans and his Minneapolis counterpart Neel Kashkari due to speak, Thursday

- EU energy ministers extraordinary meeting on emergency intervention in electricity markets, Friday

Are you bullish on energy-related assets? This week’s MLIV Pulse survey focuses on energy and commodities. Please click here to participate anonymously.

Some of the main moves in markets:

Stocks

- S&P 500 futures were steady as of 12:23 p.m. in Tokyo. The S&P 500 rose 1.8%

- Nasdaq 100 futures increased 0.1%. The Nasdaq 100 rose 2.1%

- Japan’s Topix index rose 2%

- Australia’s S&P/ASX 200 index added 1.5%

- South Korea’s Kospi index advanced 0.5%

- Hong Kong’s Hang Seng Index shed 0.4%

- China’s Shanghai Composite Index lose 0.1%

- Euro Stoxx 50 futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index added 0.2%

- The euro was at $0.9988, down 0.2%

- The Japanese yen was at 144.07 per dollar, down 0.2%

- The offshore yuan was at 6.9727 per dollar, down 0.2%

Bonds

- The yield on 10-year Treasuries fell three basis points to 3.23%

- Australia’s 10-year bond yield fell 16 basis points to 3.54%

Commodities

- West Texas Intermediate crude added 1.2% to $82.92 a barrel

- Gold was at $1,715.10 an ounce, down 0.2%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.