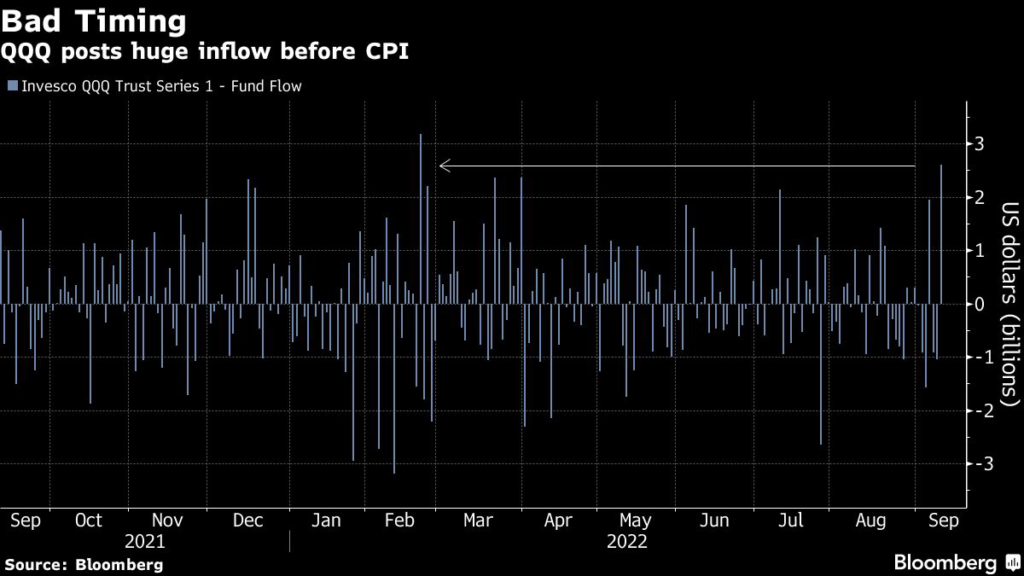

(Bloomberg) — Economists weren’t the only ones caught off-guard by Tuesday’s hotter-than-expected inflation reading: A day earlier, investors were piling into the world’s biggest tech ETF at the fastest rate since February.

(Bloomberg) — Economists weren’t the only ones caught off-guard by Tuesday’s hotter-than-expected inflation reading: A day earlier, investors were piling into the world’s biggest tech ETF at the fastest rate since February.

The $2.6 billion poured into the Invesco QQQ Trust Series 1 ETF (ticker QQQ) on Monday is now set to take an immediate hit after data showed US consumer prices jumped 8.3% from a year earlier, coming in above forecasts. The report triggered a stock slump that looks set to end a four-day rally as traders prepare for more aggressive Federal Reserve tightening.

Read more: ‘It’s a Reality Check’: Wall Street Reacts to CPI Data

Tech shares bore the brunt of the selling, with the Nasdaq 100 Index sliding 3.3% as of 10:14 a.m. in New York. The $171 billion QQQ, which follows the gauge, was down 3.3%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.