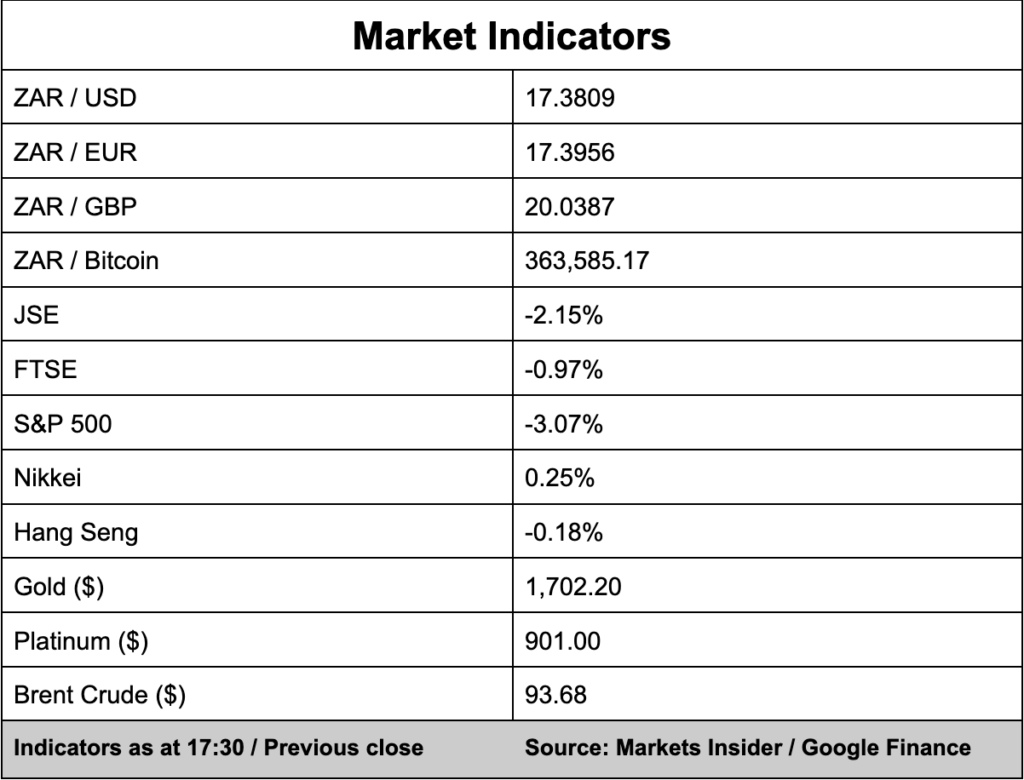

The JSE dropped off sharply in the afternoon session following the release of the US inflation numbers, which rose by 0.1% in August to 8.3% – more than what was expected.

Wall Street’s S&P 500 index dropped 3% following the CPI print while experts had expected US inflation to drop by 0.1%.

After CPI held flat in July, a disappointing result amid widespread expectations that inflation would fall this month has seen global markets drop into the red while a hawkish Federal Reserve will likely hike interest rates again.

The All Share Index closed 2.15% down at 68,274 points.

In the currency markets, the rand strengthened to R17.00 versus the US dollar during morning trade but following the release of the inflation numbers the greenback has jumped firmly onto the front foot.

The local unit is currently trading 1.56% down against the dollar and is trading at R17.38/$.

In company news, landlords Attacq (0.60%), whose portfolio includes the Mall of Africa and Waterfall City, resumed paying dividends for 2022, paying out R352.6 million to shareholders while decreasing its debt and improving rental collections.

Attacq reported on Tuesday that it would declare a 50 cents per share dividend having last paid a 45 cents interim dividend for 2020 while the business also benefited from a R68.6 million dividend from the JSE-listed MAS Real Estate, which it has a 6.5% stake in.

In a trading update, RFG Foods (8.36%) said revenue for the 11 months to August 2022 increased by 21.2% after the group reported growth of 20.9% in the first six months of the 2022 financial year.

The group attributed the growth to “ongoing strong international demand for the group’s canned fruit and fruit puree products and a resilient performance in the regional segment against the background of the deteriorating consumer spending environment.”