Good morning.

Today we’re covering Eskom’s claims that the standard and quality of maintenance are not what they should be, the owners of the Jagersfontein diamond mine were warned to shut it down years ago, and bond markets slump over growth outlook and inflation.

‘Standard and quality’ of maintenance work not what it should be, says Eskom’s Oberholzer – News24

Eskom’s chief operating officer Jan Oberholzer told the media on Monday that the standard and quality of maintenance at Eskom’s power stations are not up to scratch with a lack of skills and experience among staff and contractors for maintenance as well as funding delays impacting the struggling power utility.

Oberholzer said the power utility will ramp up maintenance during the summer months but it cannot take as many units as it would like to offline because of a lack of generation capacity.

He added that the public will not see the benefits of President Cyril Ramaphosa’s energy plan for at least the next 12 months. Read more here.

Owners of Free State diamond mine ‘were warned to cease operations two years ago’ – Daily Maverick

The Free State government warned the owners of the Jagersfontein diamond mine two years ago that it needed to cease operations and close the mine due to safety concerns over a tailings dam wall that burst over the weekend causing a mudslide and flooding in nearby residential areas, which killed at least one person and displacing 200 more.

“As the province, we find ourselves in a difficult situation as the mine owners were warned to stabilise their wall or cease operation through warning certificates,” said a director-general in the Free State Office of the Premier, Kopung Ralikontsane, adding, “There are ongoing engagements with the mine owners.” Read more here.

Bond market frets over growth outlook and inflation – Business Day (for subscribers)

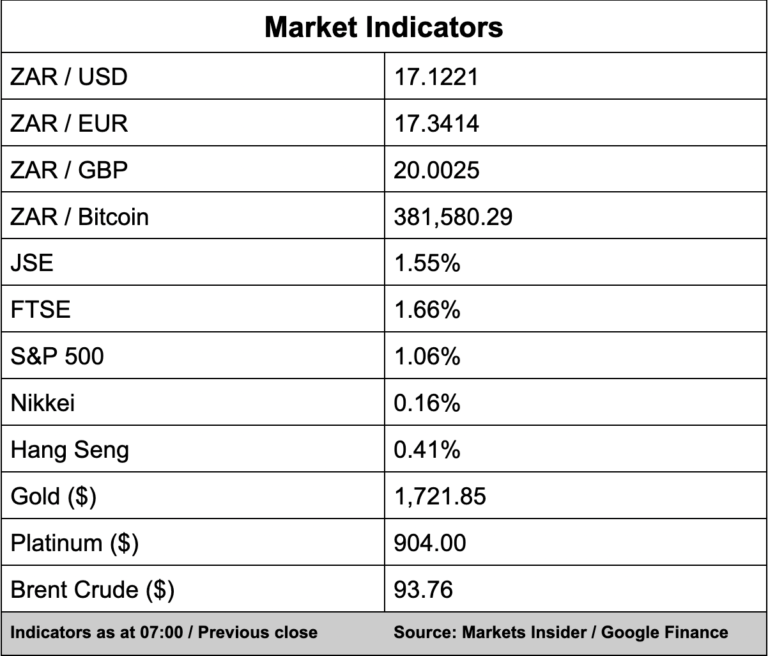

South Africa’s benchmark bond yields fell sharply as market concerns that a possible recession in the United States and Europe might upend the struggling local economy started to outweigh fears of accelerating global inflation.

The drop in yields comes after both the US Federal Reserve and the European Central Bank (ECB) chiefs cut a hawkish tone while the ECB raised the interest rate by 75 bps last week and the South African Reserve Bank also took a hawkish stance.

Here’s what else we’re reading today:

Dollar steadies as eyes turn to US inflation data – SABC

Trail of destruction after Free State diamond mine dam burst leaves destitute residents in shock and searching for relatives – Daily Maverick

There is R47.3bn in unclaimed retirement funds.

Some of it might be yours, but beware of scams. – Business Insider

Most Twitter shareholders vote in favour of sale to Musk – Sources – SABC

Africa’s first hydrogen power plant seen producing electricity in 2024 – Fin24

Apple shares surge on positive iPhone 14 pre-order data – MyBroadband

Image Credit: Wikimedia Commons