Adobe Systems Inc. spent $20 billion on its biggest acquisition ever of design software maker Figma Inc. to win the exact kind of consumers and small businesses the company has struggled to reach in recent years.

(Bloomberg) — Adobe Systems Inc. spent $20 billion on its biggest acquisition ever of design software maker Figma Inc. to win the exact kind of consumers and small businesses the company has struggled to reach in recent years.

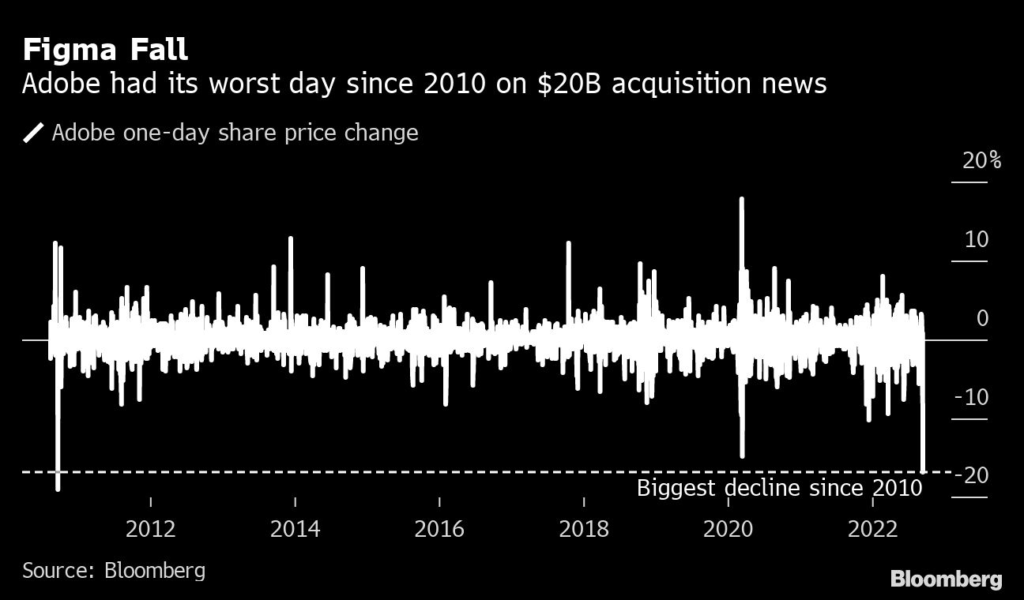

Wall Street panned the half-stock, half-cash purchase as too expensive, and Adobe shares suffered their worst day since 2010. But leaders from both companies said the deal buttressed their plans for the future.

Figma will help accelerate improvements to Adobe’s main flagship applications, bolster its appeal to creative arts professionals and help find new customers, David Wadhwani, president of Adobe’s digital media business, said Thursday in an interview with Bloomberg Television. “The market opportunity here is massive, this was a great time to make that play,” he said.

Investors have been increasingly skeptical about the future sales growth of Adobe’s products for design professionals, which increasingly have been seen as cumbersome, expensive and outdated. Upstarts like Figma, Lightricks Ltd. and Canva Inc., which offer more consumer-friendly services, have dented Adobe’s once-unquestioned dominance. The maker of Photoshop relied on acquisitions as it increased sales an average of about 20% a year since 2015 to an estimated $17 billion, but most of the purchases have been in adjacent business or new sectors such as marketing, e-commerce and analytics.

The fact that Adobe bought one of its creative software competitors suggests a “more competitive urgency, and a significant narrative change in M&A,” Citigroup analyst Tyler Radke wrote in a note.

Adobe’s announcement Thursday confirmed earlier reporting by Bloomberg. Wadhwani said talks between the two companies started a few months ago. The deal is the biggest for a closely held software company, according to data compiled by Bloomberg.

The shares plunged 17% after the deal was announced, sending Adobe’s valuation down to April 2020 levels, and making it the worst-performing company Thursday in the S&P 500.

San Francisco-based Figma was founded about a decade ago by Dylan Field and Evan Wallace. The company, which lets customers collaborate on software as they build it, “pioneered product design on the web,” Adobe and Figma said in announcing the deal. Figma expanded its customer base in recent years from software designers at big companies like Airbnb Inc. and Alphabet Inc.’s Google to individuals building games, maps and presentations, particularly on mobile phones. It has also attracted a loyal student following.

Field, who is chief executive officer, said the company could “choose our own destiny” by staying independent or joining Adobe. “We believe this accelerates the impact we can have,” he said in the joint Bloomberg TV interview with Adobe’s Wadhwani.

The company was valued at $10 billion in its last funding round a year ago. Figma’s backers include venture capital firms Kleiner Perkins, Index Ventures and Greylock Partners.

Field said the more he learned about Adobe, the less he saw them as competitors, adding Adobe is more focused on marketing.

“I grew up using Adobe software,” Field said. “So, the chance to help Adobe think about the next generation of creative tools, and how they are used collaboratively and what they mean in a web browser context — that’s a dream come true.”

The transaction is expected to close in 2023, pending regulatory clearance and other approvals, Adobe said. After closing, Field will continue to lead the Figma team, reporting to Wadhwani. Figma will continue to exist as a stand-alone product.

The deal price was widely criticized by analysts. “We think the company overpaid for Figma, which indicates it was a defensive move,” wrote Oppenheimer’s Brian Schwartz in a note downgrading his price target for Adobe.

Adobe’s leadership was undeterred.

“We’re confident that if you look at this in the long run, it’s going to be a big value for their shareholders and our shareholders as well,” Adobe CEO Shantanu Narayen said in an earlier interview with Bloomberg.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.