Global markets were mixed on Thursday as investors searched for direction and braced for a possible 100 basis point interest rate hike from the US Federal Reserve next week.

A 75 basis point hike has been fully priced in while on the local front a Reuters poll indicated that the South African Reserve Bank will likely raise the repo rate by 75 basis points when it meets next week.

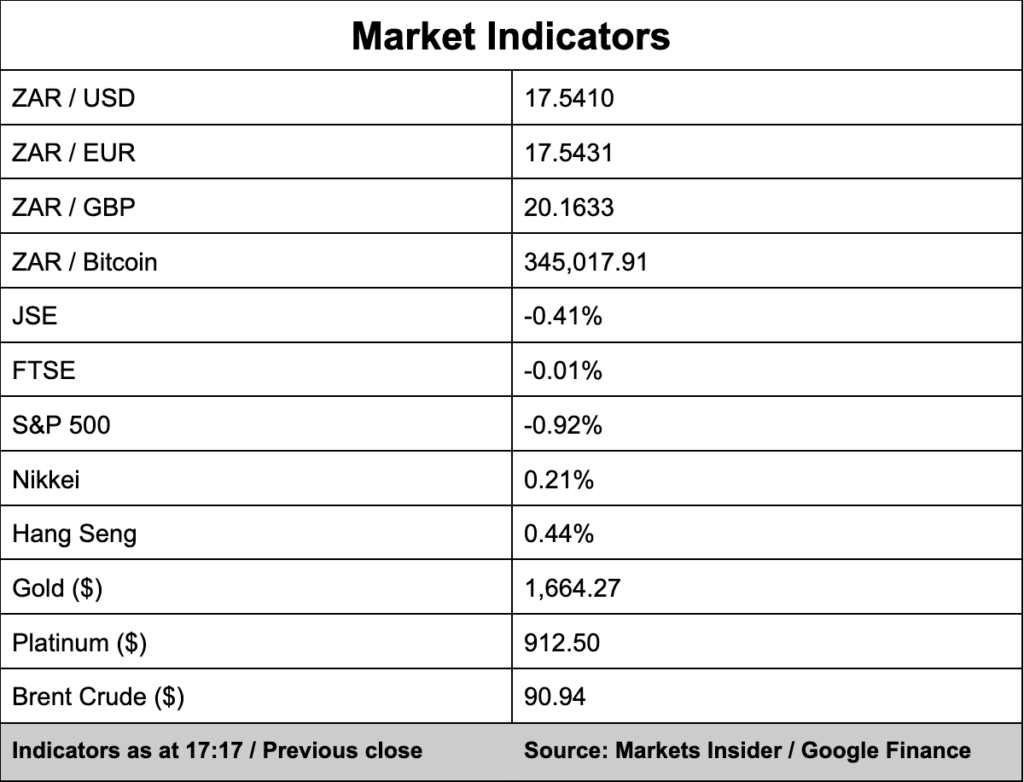

Asian markets were mixed with the Nikkei and Hang Seng ticking higher while the Shanghai Stock Exchange closed 1.16% lower.

The JSE lost 0.41% to see the All Share Index close on 67,685 points.

In the currency markets, the dollar continues to shuffle higher against the rand with the local unit currently trading at R17.54 against the greenback.

In company news, FirstRand (0.98%) reported a 22% rise in full-year profit posting headline earnings per share of 585.3 cents, up from 480.5 cents a year ago.

Banking peers, Absa (2.20%), Nedbank (0.80%), and Standard Bank (1.46%) all closed in the green while Capitec bucked the trend closing 1.21% down.