FedEx Corp.’s warning has rattled markets in the US and Europe as a realization sinks in for investors — it’s probably the first of many.

(Bloomberg) — FedEx Corp.’s warning has rattled markets in the US and Europe as a realization sinks in for investors — it’s probably the first of many.

Shares in the package-delivery giant plunged 20% in premarket trading, dragging US index futures lower, after the company withdrew its earnings forecast, saying macroeconomic trends have “significantly worsened,” both internationally and in the US.

Conditions could deteriorate further in the current period, FedEx said, fueling fears of a broad-based earnings decline.

FedEx Pulls Outlook on Macro Worries in Ominous Sign for Economy

“The FedEx warning came as a slap.

It’s a solid sign that the economy started slowing,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “This is certainly the first in a series of warnings that we may see for the quarters to come.” The bleak outlook also hit shares of rival United Parcel Service Inc., e-commerce giant Amazon.com Inc.

and European delivery companies.

Some strategists were already cautious on the earnings outlook before FedEx’s warning. Bank of America Corp.’s Michael Hartnett said today that an earnings recession will likely drive US stocks to new lows, while Deutsche Bank AG strategists have said that company profits are set to drop, putting the S&P 500 at risk of a much deeper selloff.

Aside from FedEx, some other firms have also warned that the macroeconomic backdrop is likely to impact earnings.

General Electric Co.’s finance chief said on Thursday that supply-chain challenges are weighing on its third-quarter performance, while some of Wall Street’s biggest banks expect deep declines in investment-banking fees for the current quarter with investors still spooked by inflation, rate hikes and possible recession.

In Europe, the profit warnings have already begun to trickle in.

UK conglomerate Associated British Foods Plc warned that profit in the next fiscal year will be lower as rising energy costs and a stronger dollar weigh on its Primark clothing business, while Swedish appliance maker Electrolux AB said earnings would decline “significantly” in the third quarter amid rapidly accelerating inflation and low consumer confidence.

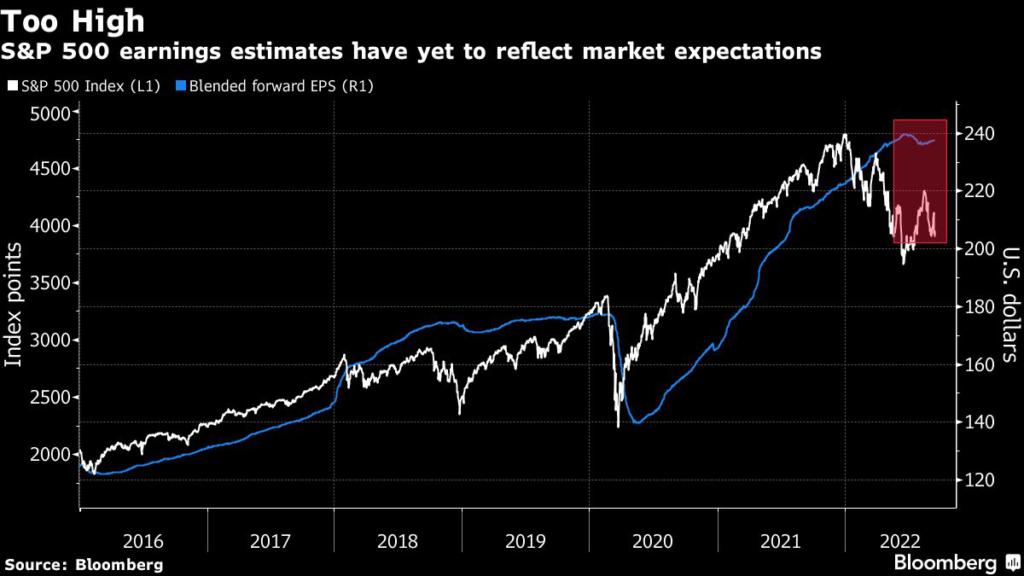

These ominous signs have already prompted analysts to moderate expectations, with weekly earnings downgrades outpacing upgrades for about four months in the US, according to a Citigroup Inc.

index. But there may still be a long way to go to reset expectations — analysts’ earnings estimates for US companies are near record highs, despite an 18% slump for the S&P 500 benchmark this year.

To hedge against the myriad headwinds facing companies, some strategists suggest being selective about regional exposures heading into the earnings season.

“The weakness in FedEx earnings is centered in Asia and Europe, where indeed we are seeing the biggest economic challenges, while US activity is reasonably strong,” said Marija Veitmane, a senior strategist at State Street Global Markets.

“This fits with our broader assessment of the macro conditions at the moment. Indeed, the US is our favorite market.”

Goldman Sachs Group Inc. strategists agree, saying US firms that do most of their business at home will fare better than those exposed to Europe, where a recession is all but guaranteed.

In dollar terms, the Stoxx Europe 600 has lagged the S&P 500 this year, while a Goldman basket of US firms with 100% domestic sales has outperformed one tracking those with high exposure to Europe.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.