The JSE snapped a five-day losing streak on Tuesday after it was helped along via gains from the Asian markets.

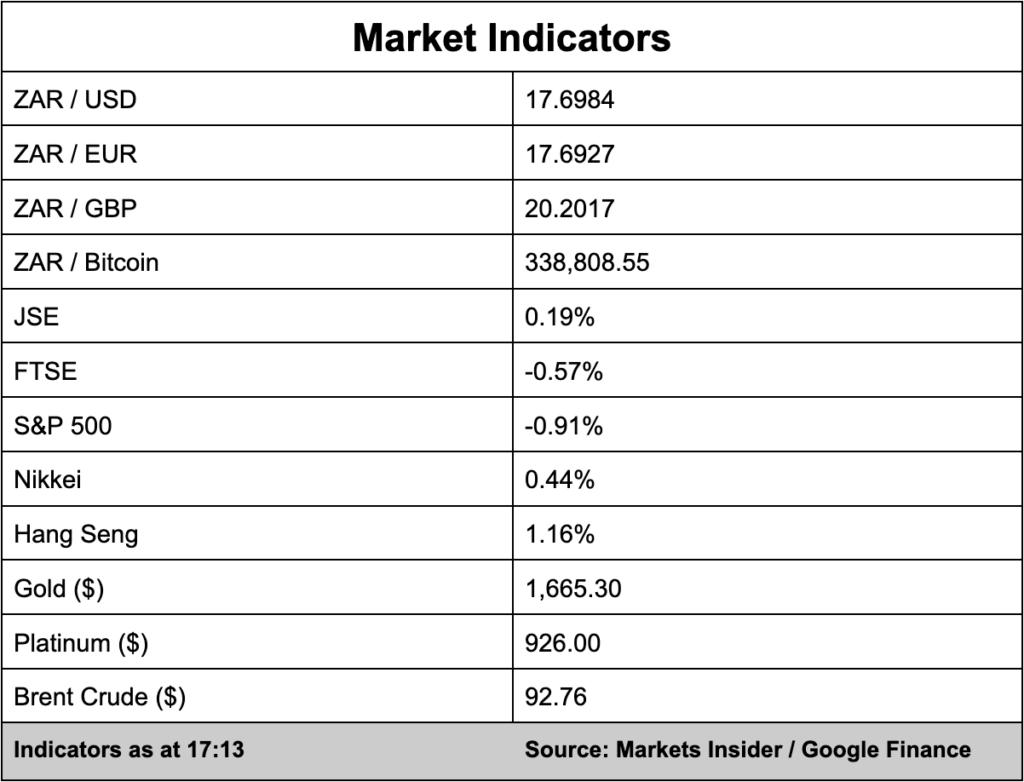

The local bourse added 0.19% to see the All Share Index close at 66,603 points. On Monday, the JSE closed at a two-week low.

Japan’s Nikkei closed 0.44% while Hong Kong’s Hang Seng and China’s Shanghai stock exchange both closed in the green. Tencent, which influences the JSE via Naspers, closed 1.52% up.

Sweden set the tone for a week of interest rate decisions from a host of central banks after it hiked rates by a greater than expected full percentage point with others expected to follow.

European stocks switched red following the news from Sweden.

On Wednesday the US Federal Reserve will make its decision while the Bank of England, Bank of Japan and the South African Reserve Bank will all announce their decisions on Thursday.

The Fed is widely expected to increase the interest rate by 75 bps.

Locally, the consensus is the SARB monetary policy committee will follow the Fed and hike by 75 bps while there has been limited fallout from stage 6 load shedding but the rand remains under pressure from a stronger US dollar.

The greenback is trading 0.21% stronger against the local unit with a current exchange rate of R17.70/$. Earlier in the day, the rand hit R17.80/$ for the first time since 2020.