Markets were muted Wednesday with investors mostly staying on the sidelines before another expected rate hike from the Federal Reserve. Treasuries and the dollar gained on haven flows after Russian President Vladimir Putin stepped up his war against Ukraine.

(Bloomberg) — Markets were muted Wednesday with investors mostly staying on the sidelines before another expected rate hike from the Federal Reserve. Treasuries and the dollar gained on haven flows after Russian President Vladimir Putin stepped up his war against Ukraine.

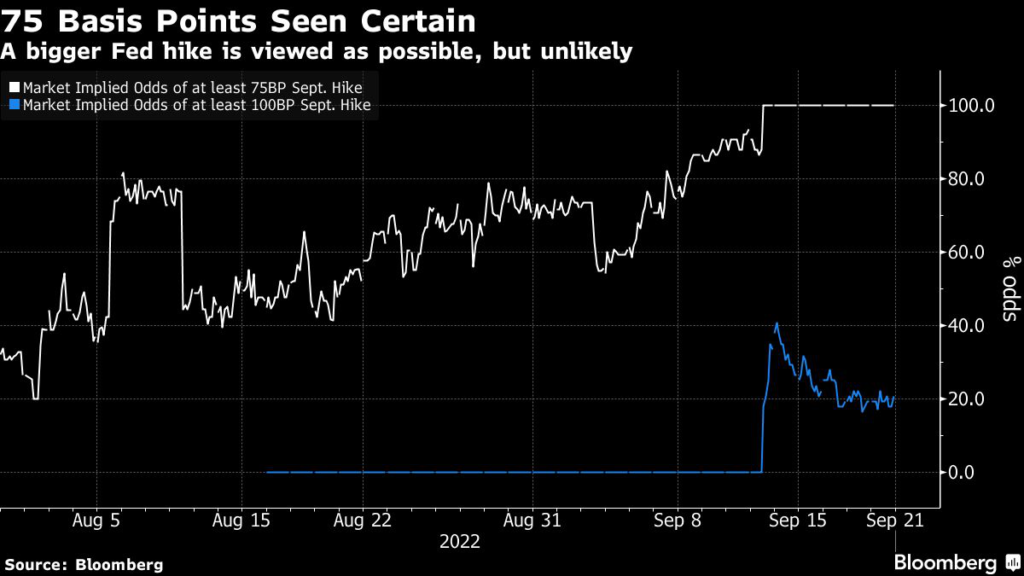

US equity futures pointed to a recovery from Tuesday’s slide in the S&P 500 on anxiety policy makers are risking recession in their zeal to subdue price pressures. Benchmark Treasury yields slipped four basis points to 3.53%. Officials are widely expected to boost rates by 75 basis points for the third time in a row, according to the vast majority of analysts surveyed by Bloomberg. Only two project a 100 basis points move.

European equities also swung higher after posting early losses in the run-up to the Fed meeting. Euro-area bonds advanced, with the German 10-year yield dropping four basis points to 1.9%.

“There’s been so much speculation about the Fed’s next step that finally having a decision should provide some much needed relief for investors,” said Danni Hewson, an analyst at AJ Bell Plc. “If it sticks to script and delivers another 75 basis point hike markets are likely to rally somewhat, partly because the specter of a full percentage point rise didn’t come to pass.”

The dollar headed for a fresh record while the euro fell as investors reacted to Putin’s announcement of a “partial mobilization” as he pledged to annex the territories his forces have already occupied, vowing to use all means necessary to defend Russia. Crude oil rallied.

Putin’s land grab and military escalation comes after a Ukrainian counteroffensive in the last few weeks dealt his troops their worst defeats since the early months of the conflict, retaking more than 10% of the territory that Russia held.

“We believe the USD will continue to benefit as the US is isolated from a geographic perspective and more resilient due to the make-up of its economy,” said Ales Koutny, portfolio manager at Janus Henderson Investors.

History suggests US markets may be due a relief rally after the Fed decision, following retreats in the S&P 500 and the Nasdaq 100 Indexes of 6.2% and 7% respectively over the past six days.

Read more: S&P 500 History Points to a Sharp Bounce After Fed Meeting

“It is a case of ‘travel and arrive’ or ‘buy the rumor sell the fact,”’ said Victoria Scholar, head of investment at Interactive Investor. “Traders have been bearishly positioned in anticipation of tonight’s announcement from the Fed and today those short positions are being unwound to avoid any event risk tonight.”

Key events this week:

- Federal Reserve decision, followed by a news conference with Chair Jerome Powell, Wednesday

- Big-bank CEOs testify before US Congress in a pair of hearings on Wednesday and Thursday

- US existing home sales, Wednesday

- EIA crude oil inventory report, Wednesday

- Bank of Japan monetary policy decision, Thursday

- The Bank of England interest rate decision, Thursday

- US Conference Board leading index, initial jobless claims, Thursday

Will the Nasdaq 100 Stock Index hit 10,000 or 14,000 first? This week’s MLIV Pulse survey focuses on technology. It’s brief and we don’t collect your name or any contact information. Please click here to share your views.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.3% as of 8:21 a.m. New York time

- Futures on the Nasdaq 100 rose 0.1%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.7% to $0.9901

- The British pound fell 0.4% to $1.1335

- The Japanese yen fell 0.2% to 144.04 per dollar

Bonds

- The yield on 10-year Treasuries declined four basis points to 3.53%

- Germany’s 10-year yield declined four basis points to 1.89%

- Britain’s 10-year yield advanced four basis points to 3.33%

Commodities

- West Texas Intermediate crude rose 1.8% to $85.49 a barrel

- Gold futures rose 0.7% to $1,682.70 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.